Inflation Numbers from July 13, 2022

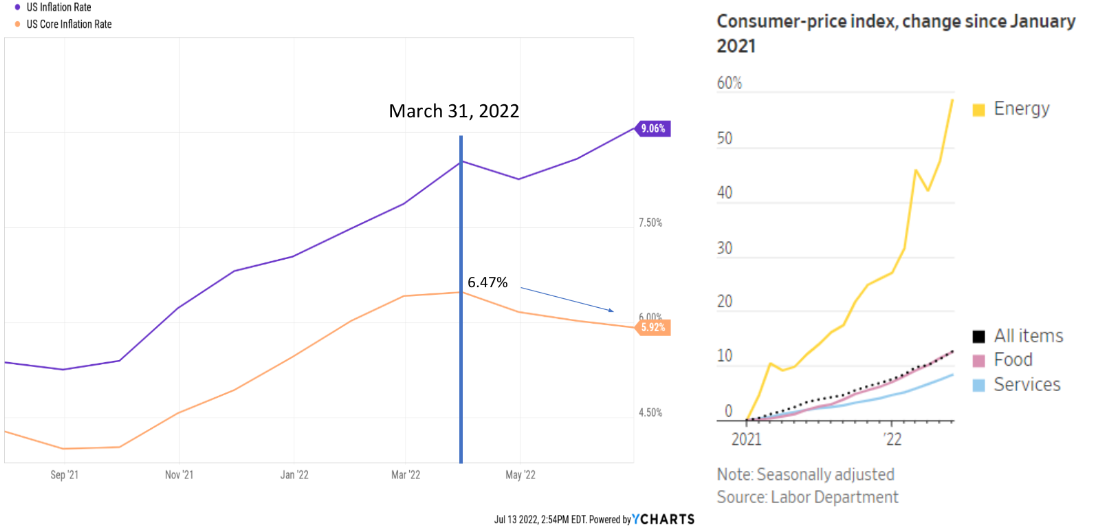

Higher than expected inflation numbers were published on July 13, 2022. US Inflation, which measures the price-change of a basket of goods and services in the US, increased by 9.06% over the 12 months prior to June 30, 2022; a four-decade high. US Core inflation, which excludes items such as food and energy appears to be cooling off from its peak of 6.47% in March to 5.92% this June (chart on left). This leaves food and energy, mostly energy, as the biggest culprits driving inflation upward. The cost of energy has increased tremendously, almost 60% since January of 2021; exacerbated by the recent conflict in Ukraine (chart on right).

How the Federal Reserve Fights Inflation

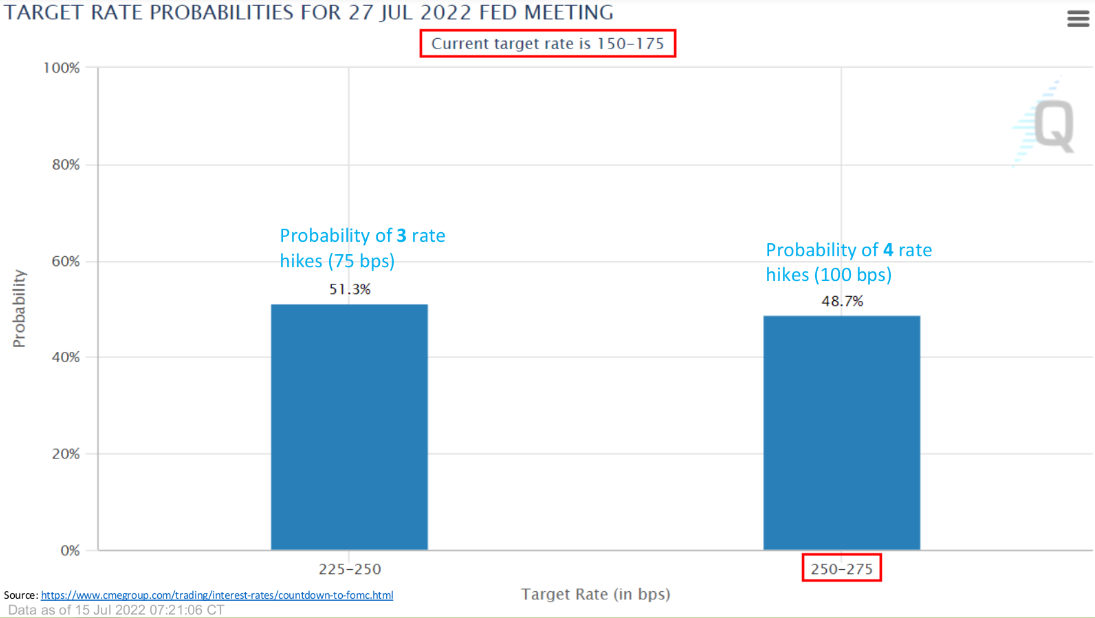

The Federal Reserve’s main tool to fight inflation is raising interest rates in efforts to reduce consumer demand. This can help cool inflation however, it can reduce economic growth, potentially causing recessions. The Fed has already acknowledged raising rates 75 bps at the next Fed meeting in July. With the recent inflation numbers touching four-decade highs, there’s an increasing probability the Fed will raise rates by a full percentage point (100bps) at that meeting (see chart). This would be one of the most aggressive Fed tightening schedules ever which could put solid pressure on economic growth.

How Diversification Can Help Manage Risk in a Recession

Managing risk effectively in a portfolio through proper diversification is extremely important when navigating recessions, which is how AllGen approaches investment management. We Incorporate different asset classes and sectors, while overweighting or underweighting areas based on our market research. As economic recession risks loom, remaining disciplined and incorporating safer assets in a portfolio that aren’t as correlated to stock markets can help a portfolio weather the storm.

Learn more about how AllGen is navigating inflation and recession risks while managing client portfolios in June’s market update.

Also, see earlier articles about Risk Management and Dollar Cost Averaging for more discussion on reducing risks and investing strategies.

Click here to talk to an AllGen Financial Advisor!

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.