Modern investing technology has put the power of investing into the hands of the masses, giving nearly any individual with an internet connection access to global markets at their fingertips. With almost zero investment experience or industry knowledge, a person can open a brokerage or cryptocurrency account online and begin trading all by themselves. While this sounds exhilarating and empowering, the initial process does come with plenty of disclosures about risk, should one care to read them, warning people that investing can be extremely risky. Benjamin Graham writes in his book The Intelligent Investor: “The investor’s chief problem – and even his worst enemy – is likely to be himself.”

Understanding Risk

Investments will fluctuate in price and while the objective is to generate a “return on investment” (ROI), investors should count on bear markets from time to time. Investing comes with risk, and your investment choices will determine the level of risk, or potential downside, in your portfolio.

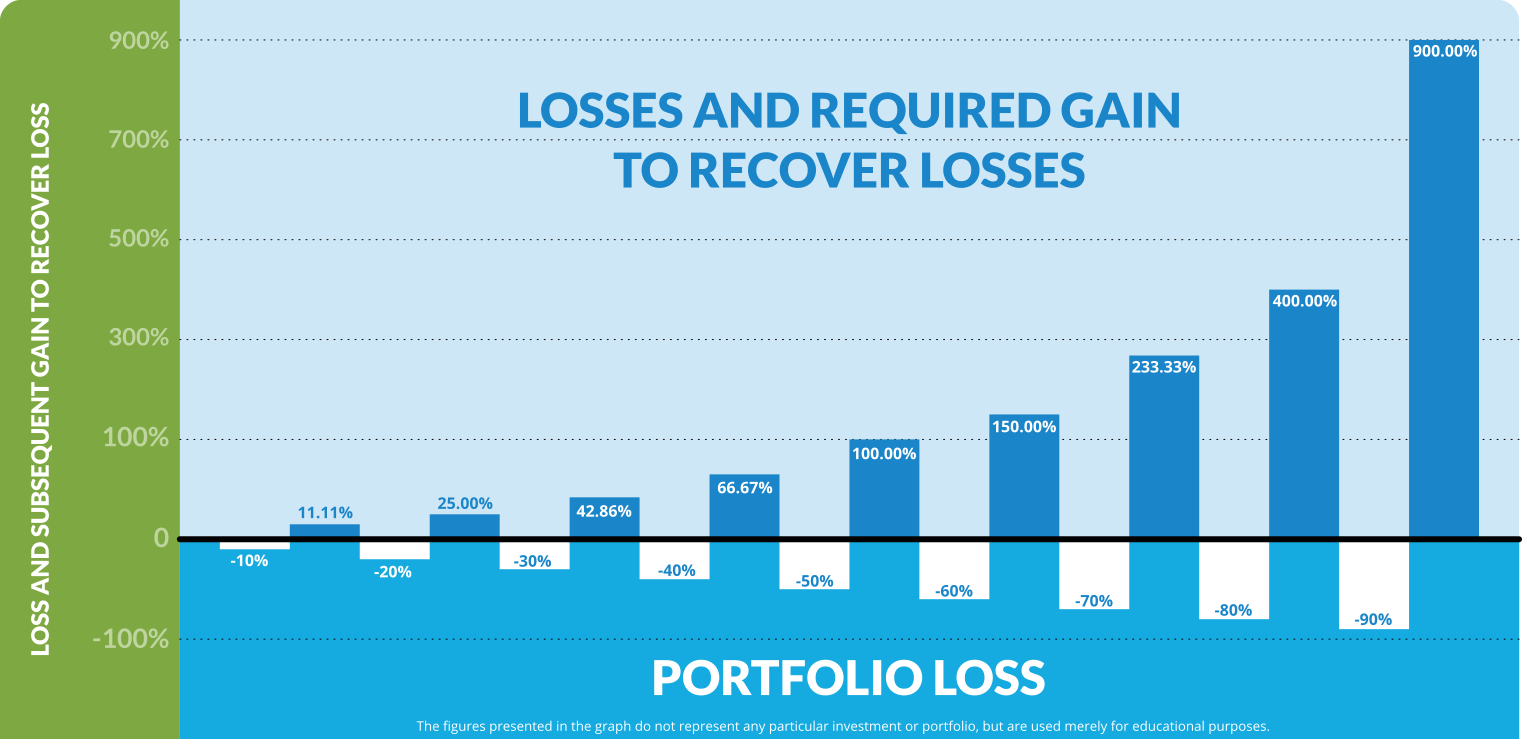

The chart below represents the relationship between a particular loss and the required return to recuperate that loss (break-even). A portfolio that declines by -10% will need an 11.11% return to recover losses, whereas a portfolio that is down by -50% will need a 100% return to recover losses. This magnifies exponentially as the loss increases, visible at the far right, a portfolio down -90% needs a 900% recovery just to make the money back! By reducing the downside, investors need less upside to recover.

How Diversification Can Reduce the Downside

Investing only in risky assets can significantly disadvantage a portfolio when markets fall. As evident above, a portfolio containing major downside risk can require unattainable returns to recover losses. Keeping a portfolio diversified, especially containing noncorrelated assets (assets that move in different directions to one another), can help cushion the blow of a bear market. But having different stocks of the same category isn’t the answer to keeping your eggs in different baskets; you wouldn’t want to hold your eggs in different baskets if the baskets are carried by the same horse!

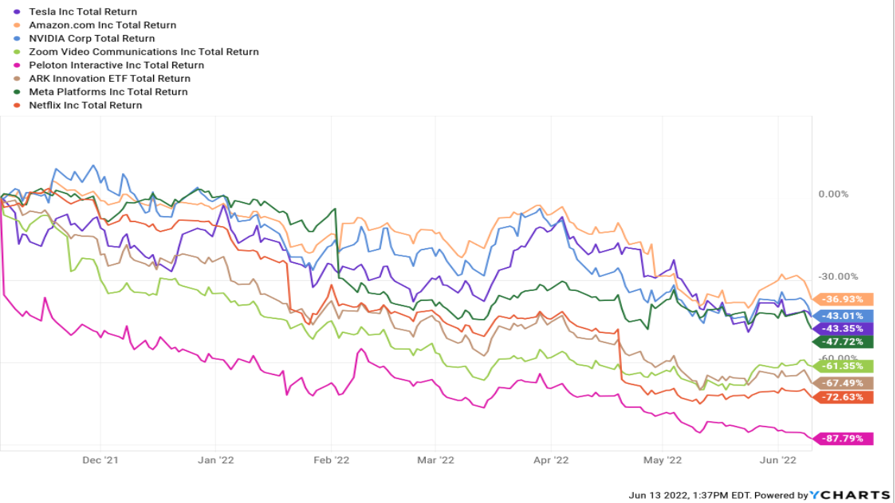

Through the 2020 recovery and over 2021, growth stocks like (Tesla, Amazon Zoom, Peloton, and Netflix to name a few) saw enormous gains, most of which were over 100%. The chart below plots their returns from December 2021 to 6/13/2022, most of which are down over -40% from their peaks. A portfolio containing only Zoom (-61.35%) Netflix (-72.63%) and Peloton (-87.79%) would have a steep path to recovering losses when considering the previous chart. In economic recessions, growth stocks like these typically move together and are hit the hardest. Read more about this relationship in AllGen’s Market Update 6/14/2022.

Diversified Portfolios

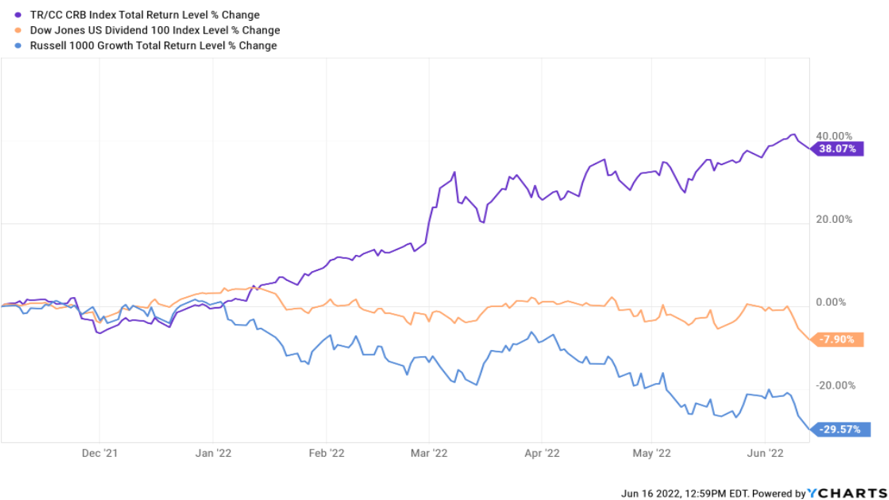

There are many other asset classes that are not as correlated to growth stocks and typically hold up better in bear markets such as commodities (hard assets, including gold) and value-oriented companies (companies with strong balance sheets and profits). Here is where true diversification comes into play. Over the same time, from December 2021 to mid-June 2022 while growth stocks were getting crushed, commodities and value stocks outperformed, see chart below.

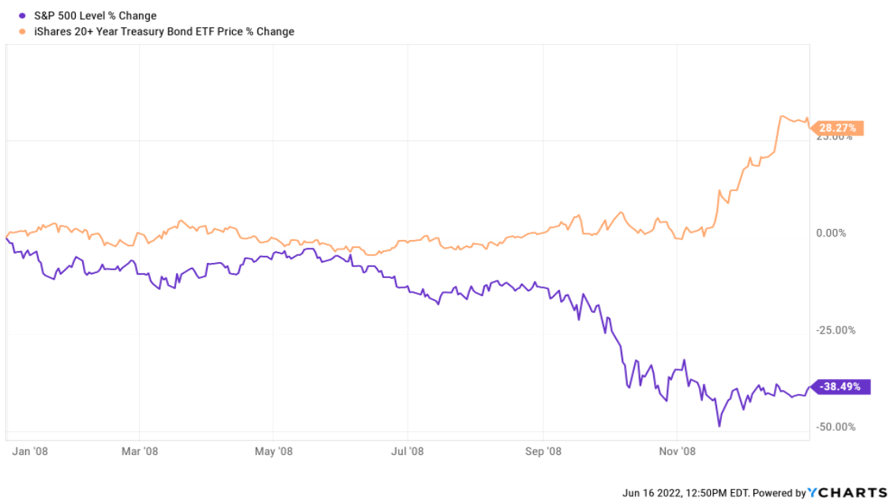

Many investors do not understand this level of diversification which can come in handy when you need it, but realizing you need it after it’s too late can wreak havoc on a portfolio. Another example of a non-co-related asset is US Govt bonds. While bonds are down significantly in 2022, over-time US Govt bonds can be a great diversifier. See the chart below how US bonds performed versus stocks during the financial crisis in 2008. Diversifying across different asset classes is a great step in keeping your investment risk spread out; when one asset class is struggling, another could begin working for you.

Summary

Diversification doesn’t stop at simply keeping a few different companies in your portfolio. If these companies are in the same line of business and of similar size, odds are they will move together when volatility comes. Incorporating assets that do not move together in your portfolio can offer advantages when things get bad. As visible in the first chart at the beginning of this article, by managing downside risk responsibly, your required return to recover losses can be exponentially less!

Building a truly diversified portfolio can be challenging and time-consuming. Contact an advisor today to learn more about diversifying your portfolio!

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.