Read through the blog here, or skip to our Florida Prepaid video below.

Many parents are wondering if they should get a Florida Prepaid Plan or another type of savings plan for their children’s college education. The enrollment period is from February 1 through April 30, so now is the time to consider planning ahead and deciding which type of college savings plan is best for you.

So, should you get a 529? Should you get Florida Prepaid? What are the major factors in funding your child’s education?

What Is the Florida Prepaid Plan?

The traditional Florida Prepaid Plan allows you to lock in tuition rates for any Florida public university or college and can be applied to a private college, a community college, a state school, or a state university. You can also choose a combination of two, as some students may start at a community college and then transfer to a university.

Protection for Increased College Tuition

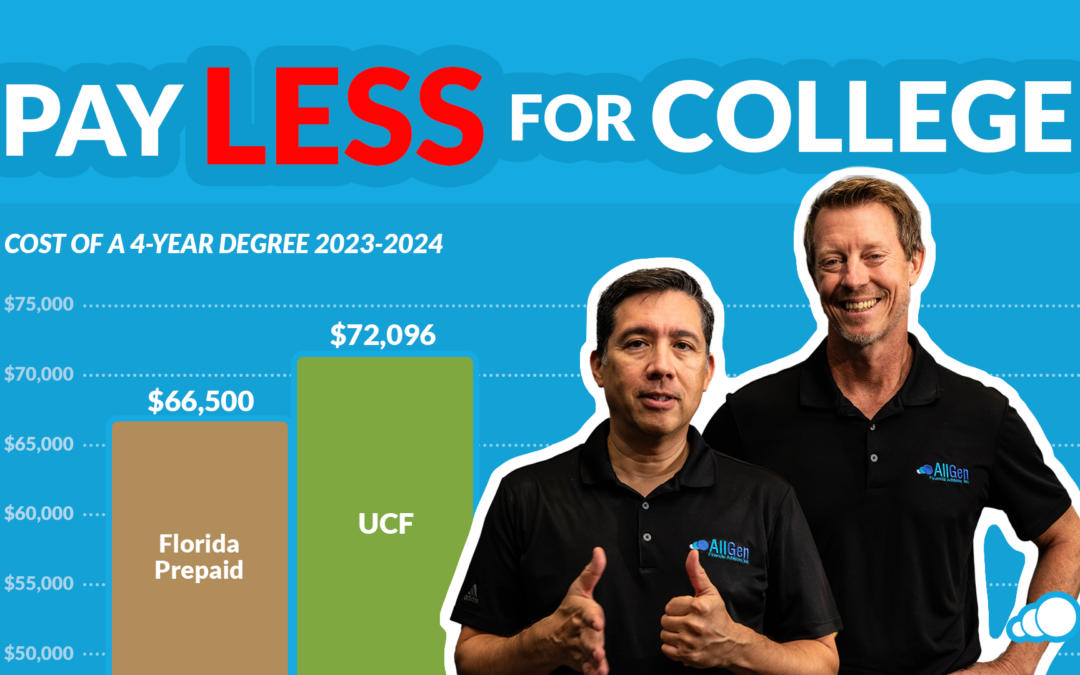

With the Florida Prepaid Plan, you’re prepaying your child’s college education at a presumably discounted rate (assuming tuition costs rise between now and the time your child attends college). This shields you from having to worry about college tuition rates going up, which have traditionally increased at a rate from 5-8% depending on the time period. The Florida Prepaid plan offers a “win-win” scenario–no matter what the cost of your child’s college is in the future, it guarantees you a refund if it costs less, or to cover the difference if it costs more.

What Are the Florida Prepaid Rates?

How much you pay into the plan is calculated every year before the enrollment window opens. In 2024, Florida Prepaid reduced its monthly prices by up to 25% for the program’s 35-year anniversary. This is the lowest Florida Prepaid prices have been in ten years.

Paying for the Florida Prepaid Plan

You can pay for a Florida Prepaid plan 1) in a lump sum, 2) over a 5-year period, or 3) in monthly installments through high school graduation. They offer the following plans, some of which also include the option to add a 1-Year Dormitory Plan:

- 2-Year Florida College Plan: Earn an associate’s degree (AA) or trade certificate from a state college.

- 4-Year Florida College Plan: Earn a bachelor’s degree (BA) from a state college.

- 2 + 2 Florida Plan: Earn an AA at a state college and guaranteed admission into a state university.

- 1-Year Florida University Plan: Pay for one year of state university at a time, for up to four years.

- 4-Year Florida University Plan: Earn a bachelor’s degree from a state university.

Florida Prepaid Refunds

For those who already have the Florida Prepaid program, it’s a good idea to keep an eye out on the Florida Prepaid website. Florida Prepaid is continually re-evaluating the cost of tuition and gives refunds when it finds that tuition hasn’t increased as much as the company had anticipated.

What About the Florida 529 Savings Plan?

An alternative to the 529 Prepaid plan is the 529 savings plan. This plan allows you to invest in a tax-favored manner for education funding. The plans are offered by various mutual funds or insurance companies in conjunction with participating states. Residents in a state that has a state tax typically are lured to their own state-sponsored plan for the potential to get tax-favored investments at the state tax level as well. In Florida, where there is no state tax, residents have merely picked the plan of any state they feel is the best plan. While historically Florida did not have a very competitive plan relative to other states, the Board of Education and Florida leadership has revamped the Florida 529 Savings Plan, making it competitive with other state plans.

What 529 Savings Plan Does AllGen Recommend?

AllGen’s financial advisors historically recommended 529 savings plans from out-of-state instead of the Florida savings plan to Florida residents. However, with the recent improvements, the Florida 529 savings plan is now very competitive and has low fees, good fund choices, and good flexibility. It’s important to point out that you can have both a Florida Prepaid Plan and a Florida 529 Savings Plan.

What Happens If My Child Has a Florida Prepaid Plan and Bright Futures Scholarship?

Most universities will use the Florida Prepaid Plan funding first, for tuition expenses. Florida Prepaid doesn’t cover things like transportation, lab fees, or books, but those expenses can be paid for with a student’s Bright Futures Scholarship. If there is anything left over from the scholarship, it can be deposited into the student’s account for housing or other living expenses.

What Are The Differences Between Florida Prepaid Plans and Bright Futures Scholarships?

Florida Prepaid Plans are applicable to most colleges, both in-state and out-of-state, whereas Bright Futures Scholarship is only applicable to in-state colleges. Bright Futures works with both public and private Florida universities; however, the amount paid for private universities will be calculated based on credit hours so it is unlikely to cover private college tuition in full.

Does My Child Need To Be a Florida Resident?

If you open a Florida Prepaid Plan and then move out of state, you can keep your Florida Prepaid Plan. You only have to live in the state of Florida when you open the plan. However, a student must be a Florida resident to receive a Bright Futures Scholarship and can only use the scholarship by attending a Florida college.

What Is Covered by the Florida Prepaid Plans and Bright Futures Scholarships?

Most Florida Prepaid Plans don’t cover much other than tuition. There are add-ons that do cover basic housing costs as well. Depending on the year that you signed up, you can find more information about what your plan covers here. In contrast, Bright Futures Scholarships can be used for a variety of college expenses, including housing, books, and lab fees. Both Florida Prepaid and Bright Futures can be used during summer semesters.

What Happens If My Child Doesn’t Go to College?

If your child doesn’t go to college, you still have several different options. You can transfer the funds to a different family member and keep those rates going. Also, if they don’t go to school immediately, they have ten years to use it from the expected high school graduation date. The last recourse is to actually cancel the plan. You can cancel the plan and get a full refund of everything that you put in, except for a $50 administrative fee.

Keep in mind that your refund is only for the amount you put in, there’s no growth. This is why it may be better to leave the funds in the Florida Prepaid account and see if the child goes to college later. Alternatively, you can transfer it to another family member.

Should I Choose Florida Prepaid?

The real answer is that it depends.

It depends on the age of your child and your risk tolerance, among many other factors. Developing the right strategy is very important as there are multiple variables to consider. The younger your child, the more the 529 savings may make sense, as the longer time period can mitigate some of the associated market volatility. You must also consider your personal risk tolerance as well, as there is a big difference between locking in a rate guaranteed by the state of Florida rather than looking for greater returns, not guaranteed, via equity investments.

If you cannot choose and your budget allows, you can also do both. Primarily, you must be in the appropriate financial stage of life to increase the odds of this or any savings plan succeeding.

Financial Life Stages

Parents have an innate desire to care for their children and support them by doing things like paying for college, which is a great thing. However, sometimes things get out of order when you’re doing your finances.

At AllGen, we teach three financial life stages: Foundation, Formation, and Freedom.

The Foundation Stage

In the Foundation stage, you might be working to get your consumer debt paid off. You’re also building up critical emergency reserves. You need to have a strong Foundation before you can get into the Formation stage and take the next financial steps.

The Formation Stage

Saving for your child’s college education is something that should be done in the Formation stage. Although parents want to start paying for their children’s education, it’s important to prioritize your Financial Foundation before you start a college fund. If you already have your consumer debt paid off and an emergency fund in place, you are free to use any additional funds to start saving for a college education.

We hope this helps you think about how to fund college education for your children. We invite you to come in and speak with one of our Financial Advisors. Our aim is to assist you in understanding your available options and to discuss what would be most beneficial for you and your circumstances. Reach out to us any time; we’re here to serve.

For more information, watch our full Florida Prepaid video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.