Read through this post on dollar cost averaging here, or skip to the AllGen Academy dollar cost averaging video below.

When Markets Fall, What Should You Do?

Falling markets can be scary, especially when you see your life savings shrinking to lower and lower levels of red. The sickening feeling can get worse when the media covers the downtrend and new fears of “doom and gloom” set in, magnifying your urge to “act before it’s too late.” Research shows that the average person feels the pain of a loss twice as hard as the pleasure of an equal gain. So when markets fall, we are already at an emotional disadvantage. This phenomenon is known as loss aversion in behavioral economics. What should an investor do in a falling market? The answer isn’t straightforward, but we can learn from an ironic phrase thought to have been coined by Warren Buffet: “Wall Street is the only place that when things go on sale, people run for the exits!”

Disciplined vs. Emotional Investing

The objective of investing is to buy low and sell high, which seems simple. But if we bring human emotion into the equation, it becomes much more difficult to invest in something after it’s fallen in price. A disciplined investor might be able to withstand market downturns by continuing to add to their portfolio periodically, even if the market is falling, whereas an emotional investor might become nervous and decide to sell everything, locking in a loss, potentially missing out on a market recovery. Adding to a portfolio periodically over time is an investment strategy called Dollar Cost Averaging (DCA) that can offer some benefits, especially during volatile times.

Dollar Cost Averaging in Practice

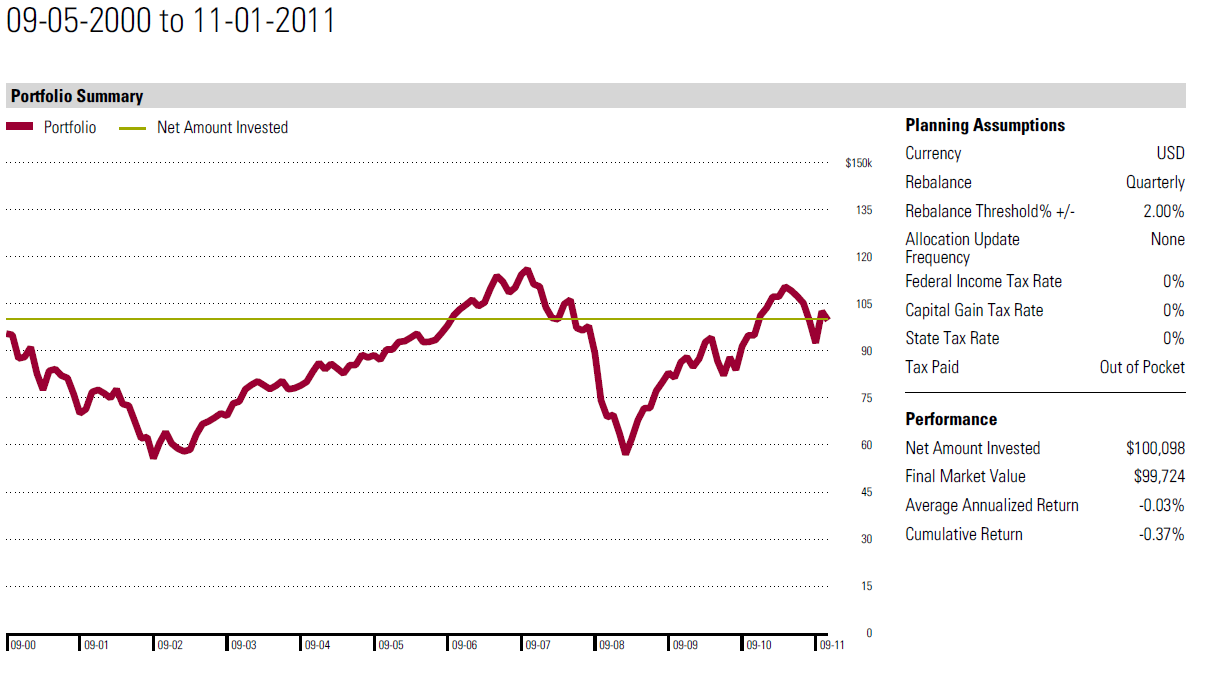

To elaborate further on dollar cost averaging, the illustration below charts the S&P 500 from 9/5/2000 to 11/1/2011; Nearly an eleven-year timeframe. Investors saw two major recessions, the “dot com bubble” of the early 2000s, and the Great Financial Crisis (GFC) of 2008, where the S&P 500 declined by -40% and -53% respectively but also recovered after each. From point to point, the S&P 500 traded flat, beginning and ending the period at roughly the same value.

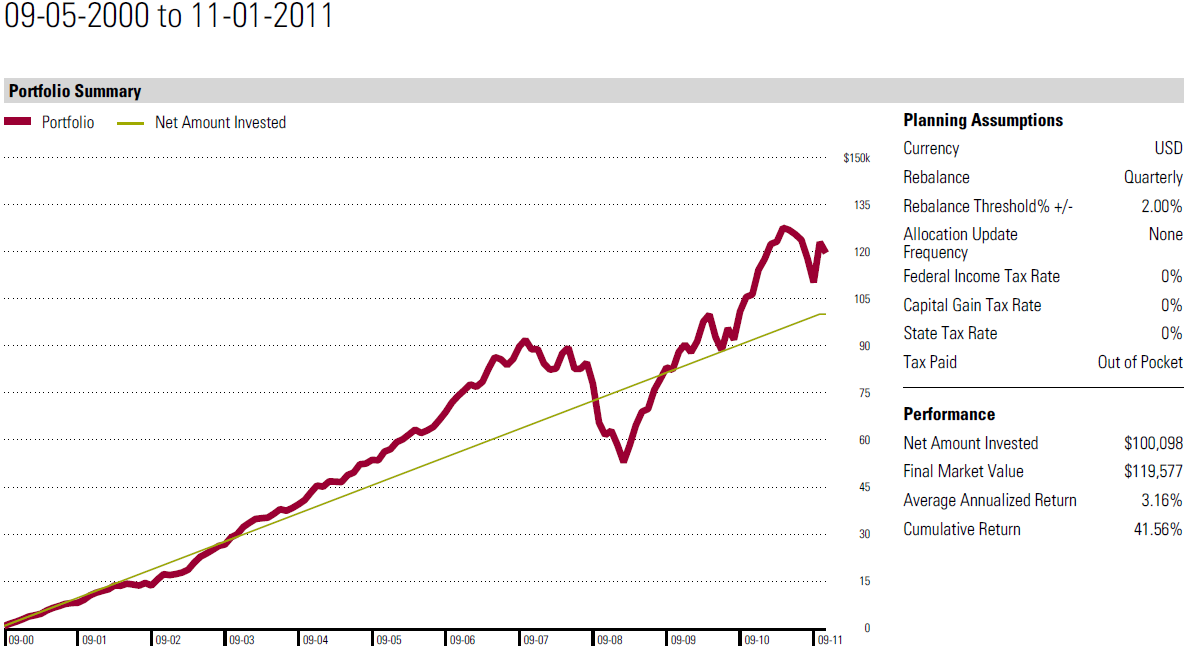

If an investor practicing dollar cost averaging invested $750 per month in the S&P 500 over the same time period, contributing a total of $100,000, they would finish with about $120,000; a gain of $20,000 (see chart below). Even though the index experienced two major recessions and finished flat from point to point, the investor using dollar cost averaging still returned a profit!

In this example, the disciplined investor who invested the same amount evenly over 133 months (about 11 years), outperformed the S&P 500. By periodically investing in a declining market, an investor continues to buy at cheaper and cheaper prices.

Let’s say the investor got scared after the 40% decline of the dot com crash in the early 2000s and sold everything, then remained in cash the rest of the period. They would have locked in a loss of $40,000 and the investor would hold a portfolio worth $60,000 while the market recovered.

How Dollar Cost Averaging Can Improve Returns

Dollar cost averaging in a declining or volatile market can offer an investor some additional returns along the way while reducing emotional stress. Many investors are already applying this strategy by contributing periodically to their employer retirement plans. One way to easily start dollar cost averaging is to automate a recurring deposit into your investment account.

Markets are no strangers to uncertainty and volatility, which is why staying disciplined and keeping your investment goals in mind can save you from making rash decisions. Always be sure to consult with your financial advisor about what investment strategy makes sense for your individual situation.

For more information on Dollar Cost Averaging, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.