Read through the blog here, or skip to our Q1 2026 Market Update Video below

Key Takeaways

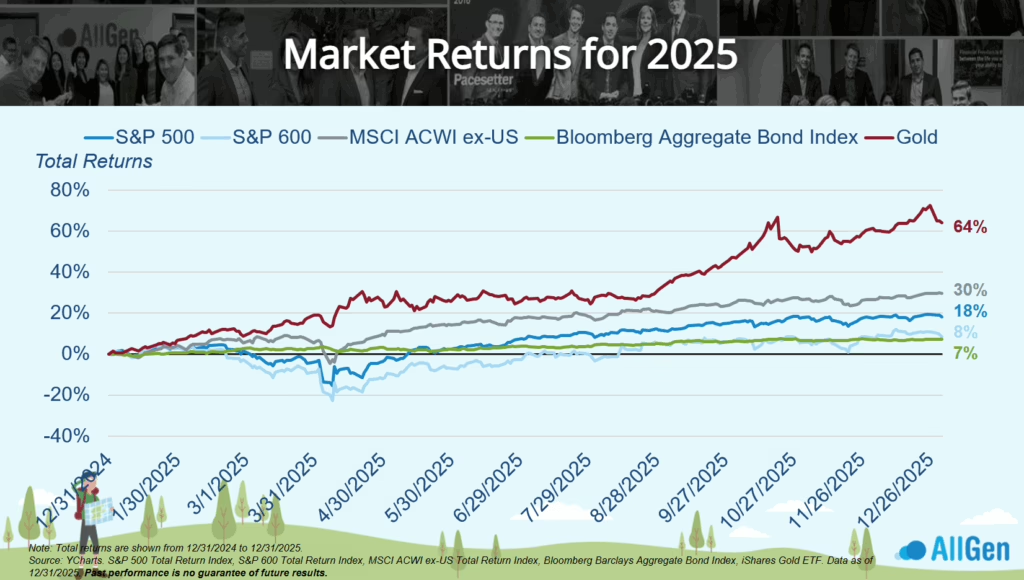

- 2025 delivered strong returns with gold up 64%, international stocks up 30%, U.S. large cap stocks up 18%, U.S. small cap stocks up 8%, and bonds up 7%.

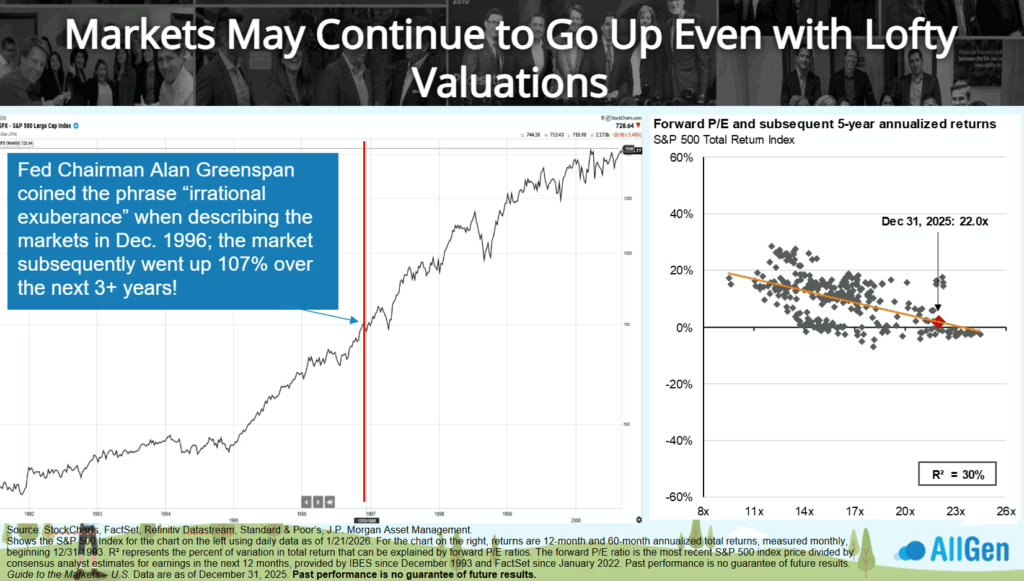

- U.S. stock valuations remain elevated, but history shows markets can continue rising over the short term even at lofty levels

- Leadership may be shifting away from large-cap growth toward international, value, and smaller companies

- Bonds are once again providing income and diversification benefits

Market Performance Recap: A Strong but Volatile 2025

2025 was a year where most major asset classes finished higher, even though volatility was high. Gold posted its highest returns since 1979; its 64% returns made the S&P 500 stock market returns look tiny at 18% (albeit still strong). Bonds also had a great year – up 7% – with credit and international bonds being some bright spots there.

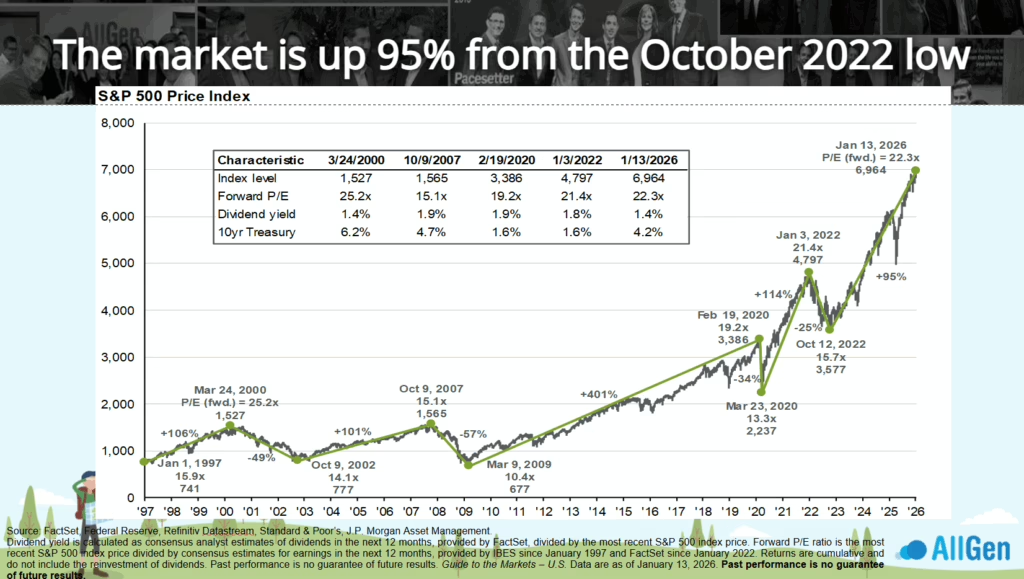

Markets Are Up Nearly 95% Since the 2022 Low

From the October 2022 market low, the S&P 500 gained roughly 95%. That strong recovery naturally raises questions about sustainability and risk.

Although Valuations are High, Markets May Continue to Rise

When markets appear expensive, history shows they can continue rising for extended periods. In 1996, Fed Chair Alan Greenspan famously warned about “irrational exuberance” due to how much the stock market had gone up at that point in time. Then stocks went on to rise another 107% over the next three years. The lesson: elevated valuations alone are rarely a reason to exit markets and valuations only explain about 30% of a stock’s price movement over a five-year period. Trends around corporate profit margins often matter more.

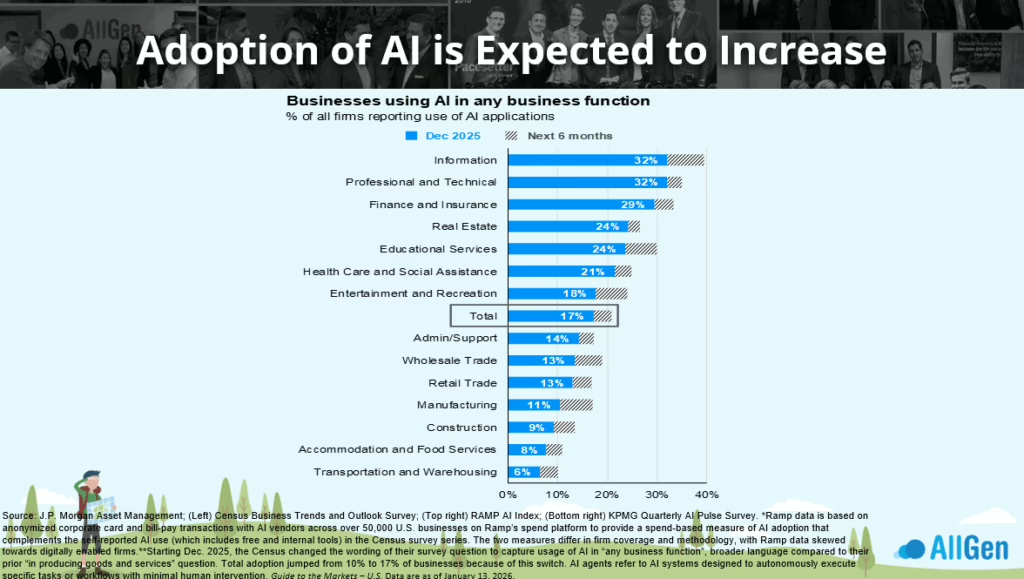

Earnings, Margins, and Sentiment

Corporate profit margins remain near all-time highs, helped in part by productivity gains and early AI adoption. Strong earnings growth can support markets even when prices appear elevated, which is what we saw for much of 2025. The good news for 2026 is, AI adoption across businesses still remains relatively low, suggesting that AI-based productivity gains may still have more runway, and earnings and margins alike may be supported.

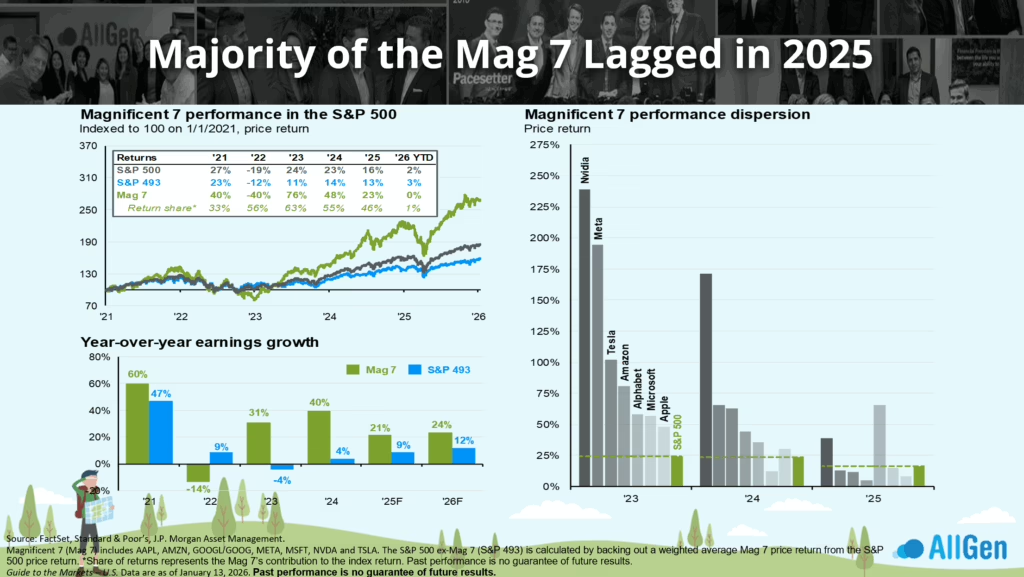

The Magnificent 7: No Longer Carrying the Whole Market

While the “Magnificent 7” tech stocks dominated returns in prior years, most lagged the broader market in 2025. This shift reinforces the importance of diversification beyond a handful of large companies. Caption: Market leadership is broadening beyond mega-cap tech.

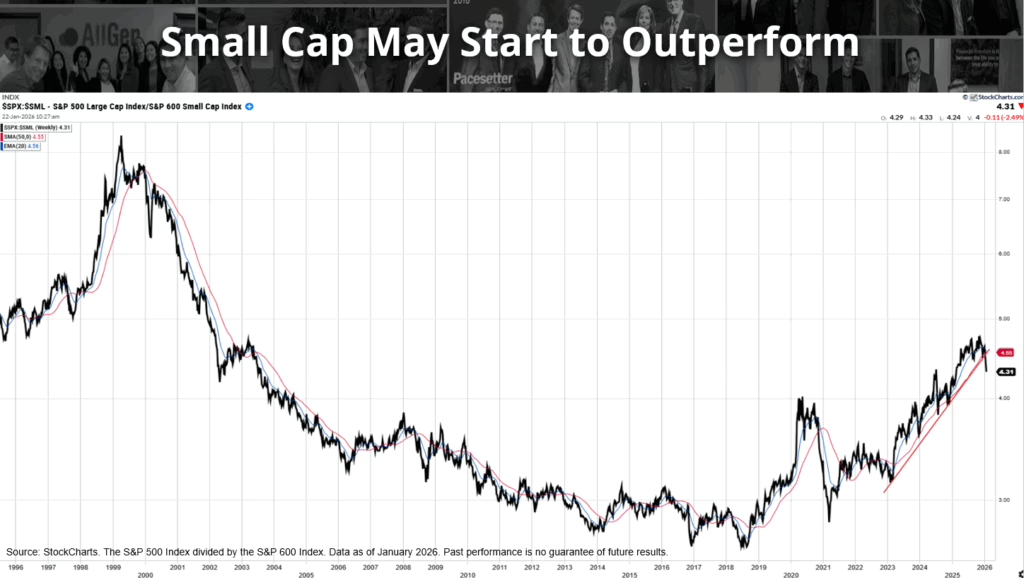

Small Caps and Market Leadership

After years of large-cap dominance, technical signals suggest smaller companies may be positioned for a resurgence. The economic cycle is also supportive of small cap stocks given their sensitivity to economic growth and the expected fiscal and monetary stimulus in 2026. While not a guarantee, this shift is something AllGen is actively monitoring.

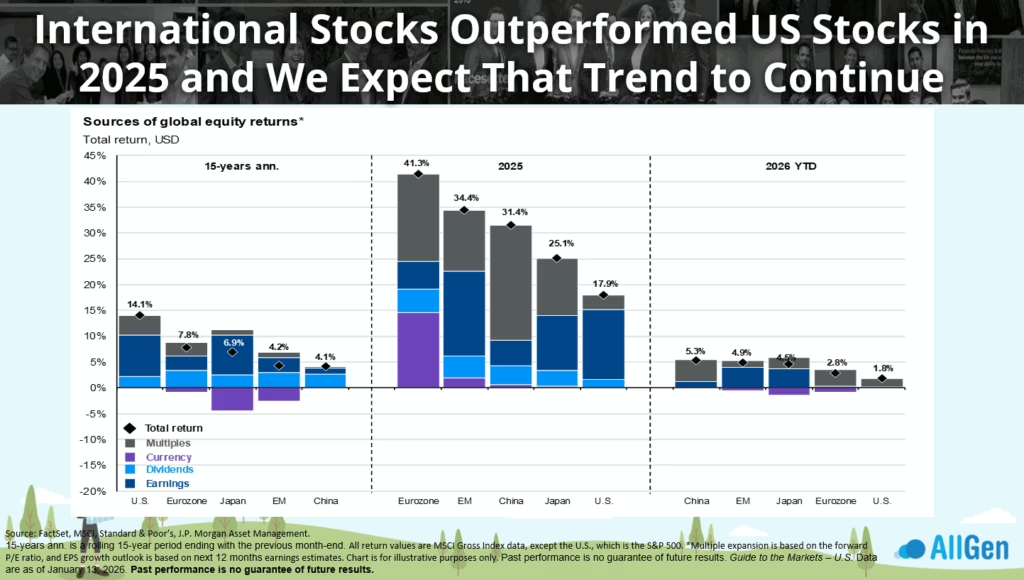

International Stocks and the Dollar

International stocks outperformed U.S. stocks in 2025, and early 2026 data suggests that trend may continue. A weakening U.S. dollar has historically supported international returns.

Gold’s Role in a Diversified Portfolio

Gold has been one of the strongest performing assets recently. Central bank purchases, geopolitical uncertainty, and concerns around currency stability continue to support demand. While gold carries its own risks after a strong run, it remains an important diversifier in small amounts.

Caption: Gold moves in long-term cycles.

Current Bond Yields Remain Supportive of Future Returns

Bonds delivered positive returns in 2025, particularly in higher-risk segments. More importantly, current yields suggest bonds may provide reasonable income and diversification over the next several years.

2026 Market Outlook Summary

The S&P 500 is no longer the only game in town.

While U.S. large-cap stocks have dominated returns for much of the past decade, leadership has begun to broaden out to small cap stocks and international stocks. Gold has been one of the best-performing assets year to date, and ongoing policy uncertainty, geopolitical instability, and the potential for a weaker U.S. dollar might continue supporting gold in the second half of the year.

This environment reinforces the importance of diversification beyond U.S. large-cap growth. International stocks, small cap stocks, and value stocks currently trade at more attractive valuations and have outperformed recently, highlighting the benefits of a more balanced approach.

Bonds should also play a meaningful role moving forward. With higher starting yields, bonds are positioned to provide a reasonable return while adding stability and diversification to portfolios, especially during periods of market volatility.

The most successful investors maintain a long-term mindset with a well-diversified portfolio. This includes a mix of non-correlated assets and prioritizes a strong approach to risk management with the goal of generating positive returns over the long run. Of course we always suggest tailoring your specific asset allocation to your financial plan and risk tolerance.

Contact Your Financial Advisor

A well-diversified, disciplined strategy that manages risk first is what we strive to build for our clients. Contact your advisor to learn more about how AllGen can help manage risk in your portfolio!

For more information, watch the full October 2025 Market Update video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.