Key Takeaways:

- Investing in gold is pure speculation as there are no cash flows backing it nor does it earn a yield.

- Although it may be tempting, it is usually never a good idea to sell more than 10% of your portfolio to invest in gold.

- In small percentages, investing in gold through an exchange-traded fund (ETF) or a trust may diversify a portfolio and improve portfolio performance through recessions and inflation, which is why we hold it for our clients.

- We do not recommend investing in gold as a replacement for the dollar – especially physical gold coins that involve up to 20% trading commissions, shipping and handling costs, and storage costs.

A common question we have received as of late from clients concerned about inflation, the mid-size banking crisis, and the dollar potentially losing its global dominance is, “Should I invest in gold?” The short answer is yes, it may make sense to invest a small portion of your portfolio in a liquid exchange-traded gold fund or trust for diversification, but not physical gold coins.

Can Gold Be a Good Investment?

The long answer is more nuanced – gold has no cash flows, earnings from products or services rendered, or dividends to provide returns like stocks do. Gold also doesn’t earn a yield or pay a coupon payment backed by cash flows like bonds do. As such, gold typically performs worse than stocks and corporate bonds over longer periods of time – it mostly functions as a speculative asset for investors. Yet, in a low percentage, a liquid exchange-traded gold fund or trust may further diversify a portfolio to help protect against recessions, falling interest rates, inflation, and a falling dollar. That is why we hold a very small percentage of gold through an exchange-traded fund in our clients’ portfolios.

Are Gold Coins a Good Investment?

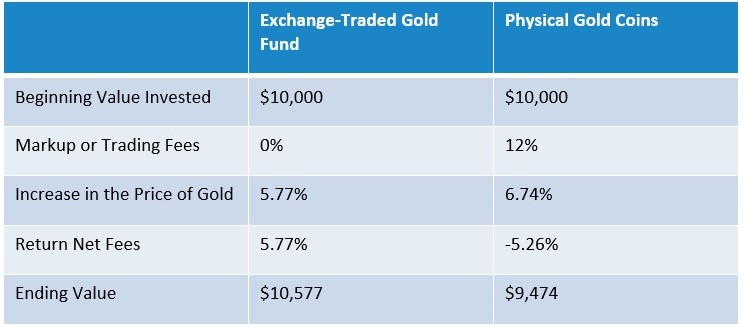

As for physical gold coins, we do not recommend investing in them. There can be markups or trading costs as high as 10-20%, shipping and handling costs, and storage costs. This means that an investment in physical gold coins must appreciate 10-20% just to break even, excluding any other costs we mentioned. This is why we do not recommend clients purchase physical gold coins. We ran the numbers below (based on real returns over a one-year time frame) to illustrate how high markups or trading fees can eat away at the money you had to invest when purchasing physical gold coins vs. an exchange-traded gold fund.

Source: YCharts and Various Gold Coin Dealers. Return data from 6/8/2022 to 6/8/2023. Past performance is not a guarantee of future results.

From here on out, when we mention investing in gold, we are referring to investing in exchange-traded gold funds and trusts, which we hold in our clients’ portfolios. Exchange-traded gold funds and trusts hold physical gold, but the investor does not have to pay the high trading commissions/markup and can easily trade in and out of the fund or trust on an exchange.

What Is Gold?

Getting back to the basics, gold is a type of commodity called a precious metal. Precious metals are usually mined and include other commodities many have heard of like silver and platinum. Gold is most often used for jewelry but can also be found as a component in industrial and electrical devices.

Pre-World War I, gold used to back most currencies because it can be a store of value – the change in a country’s holding of gold would directly impact the amount of money in circulation and indirectly impact economic activity. Today, all the major currencies around the world are no longer backed by gold or any physical assets, making them fiat currencies. This plays into concerns many have over inflation and the dollar – but more on that later.

Should I Invest in Gold?

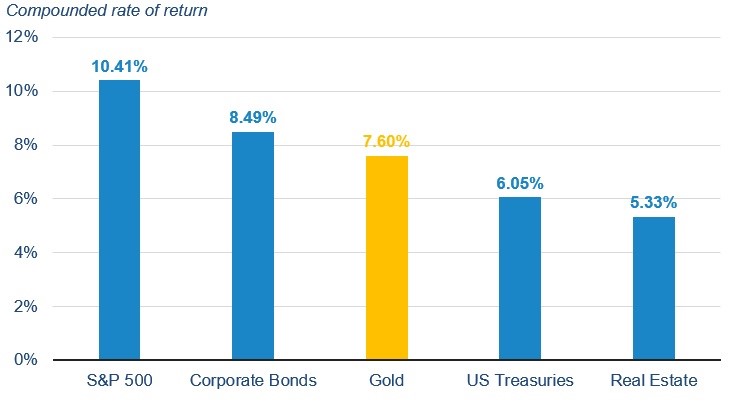

There are many reasons to hold a small amount of gold through an exchange-traded fund or trust, but not many reasons to invest a significant portion of your portfolio into it when other assets may have better and less volatile historical returns. Remember, gold is speculative and does not provide earnings or cash flows to support returns like stocks and bonds do. We looked at the historical returns of a broad set of assets from 1971 to 2022 to compare them to gold. The compounded returns for stocks (the S&P 500) and high-quality corporate bonds were 10.4% and 8.5% respectively, which were higher than gold at 7.6%. This is why we do not recommend our clients hold more than 10% of their investable assets in gold.

Gold has underperformed stocks and corporate bonds over the long run.

Source: NYU Stearns. Historical Returns on Stocks, Bonds, and Bills: 1928-2022. Compounded returns using annual data from 1971-2022 as of January 2023. Past performance is no guarantee of future results.

How Can Gold Diversify a Portfolio?

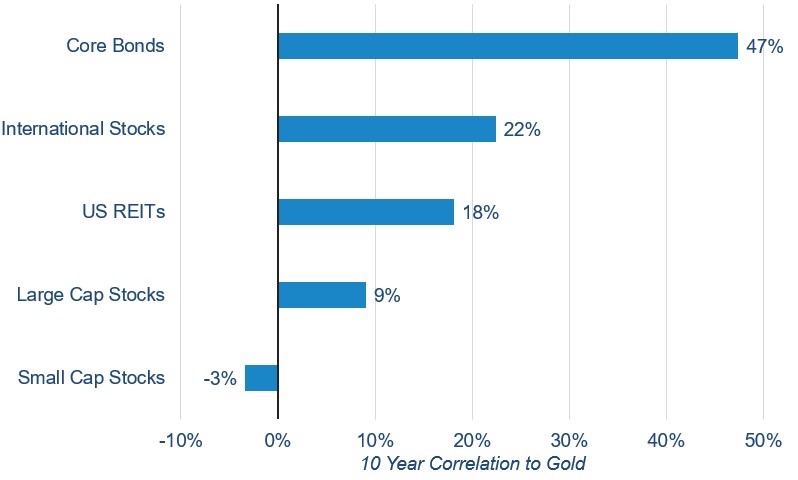

We do, however, usually hold a small portion of your assets in gold for diversification benefits. Over the last ten years, gold has provided diversification benefits to portfolios that hold stocks and bonds. One way to measure the diversification benefits of gold is through correlations. Correlation refers to the relationship between two assets – specifically, how one asset’s price moves relative to another asset’s price. Assets can be positively correlated, not correlated, or negatively correlated, and investing in assets in the latter two categories provides the best diversification to a portfolio. As you can see below, small-cap stocks, large-cap stocks, US REITs, and international stocks tend to have no correlation with gold, while core bonds tend to have a low positive correlation with gold.

Gold has little to no correlation with many commonly held assets.

Source: YCharts. Correlations over 10 years relative to gold shown for the Bloomberg US Aggregate Bond Index (Core Bonds), MSCI ACWI Ex USA (International Stocks), S&P US REIT Index (US REITs), S&P 500 Index (Large Cap Stocks), and S&P 600 Index (Small Cap Stocks). Monthly data as of May 2023.

Why Is Diversification Important?

Diversification matters because it is the building block of well-constructed portfolios. We could easily go out and buy only large-cap stocks tomorrow, like the S&P 500, but the reason we hold small-cap stocks, international stocks, bonds, gold, or any other asset is that they may decrease drastic moves in your overall portfolio and smooth out the ride without sacrificing returns.

Diversification Protects Portfolios During Recessions

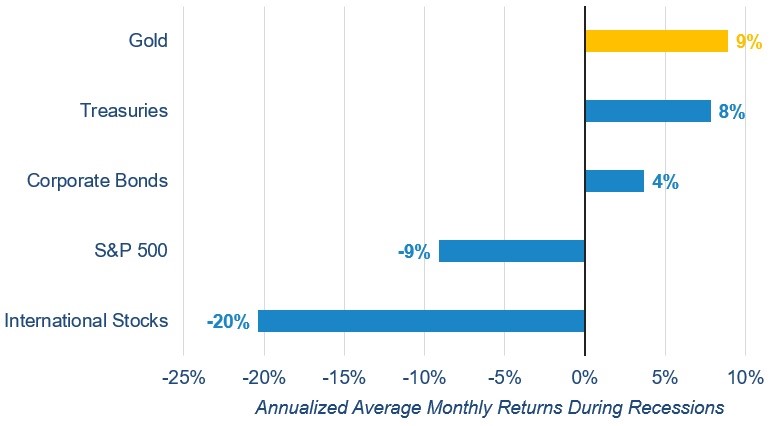

Similarly, different economic environments create different returns for each asset class. Gold and bonds tend to perform well during recessions, while stocks tend to perform well in non-recessionary times. Typically, during a recession, interest rates fall, stock prices fall, and investor fear rises – all of which generally support gold prices and drive up demand for gold from investors. The chart below shows the average annualized monthly returns during recessions for a variety of asset classes. Gold posts a solid 9% return on average during recessions vs. stocks which have negative returns on average, meaning gold can act like a buffer against recessions for your portfolio. This positive average performance during recessions is another reason why we typically hold a small percentage of an exchange-traded gold trust in your portfolio.

Gold tends to perform well during recessions.

Source: YCharts. Using the recession index, it shows the average annualized monthly returns during recessions for Gold, Bloomberg U.S. Treasury Index (Treasuries), Bloomberg U.S. Corporate Bond Index (Corporate Bonds), the S&P 500, and MSCI ACW ex USA Index (International Stocks). Monthly data from September 1989 to May 2023. Past performance is no guarantee of future results.

Will the Dollar Lose Its Global Dominance, Making Gold More Attractive?

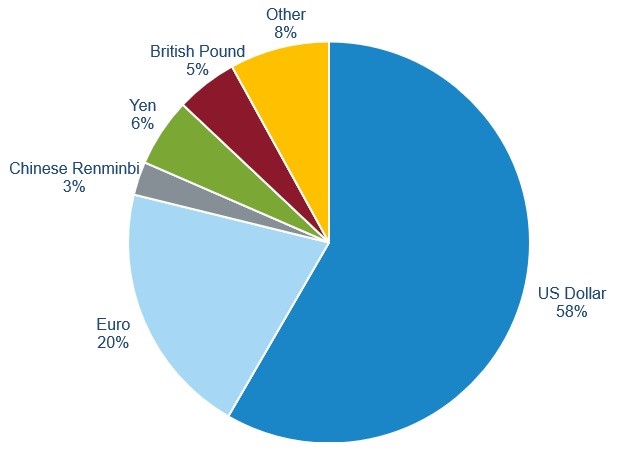

Many people are concerned about whether the dollar will lose its global dominance and wonder whether gold is a solid hedge against that possibility. This a very reasonable concern, as China has worked hard to become a global economic power and more heavily involved in trade over the last 30 years. Additionally, the high inflation within the U.S. over the last year and the mid-size banking crisis don’t help instill confidence in the dollar. It’s important to put these concerns into historical context though – the British pound was the last reserve currency and dominated for over 100 years until 1960 when U.S. dollar-denominated assets surpassed those in the pound. So, the dollar is a relatively young reserve currency. The dollar is also still the most heavily used currency for global trade and accounts for the largest portion of reserves held by global central banks. After the US dollar at 58%, the next largest currency in global reserves is the Euro at 20%, while the Chinese Renminbi is the lowest at 3%!

The US dollar accounts for 58% of reserves.

Source: IMF. World Currency Composition of Official Foreign Exchange Reserves. Quarterly data as of Q4 2022.

As to whether gold coins are a good alternative if you are concerned about the dollar’s dominance declining, then the answer would be no. Physical gold coins come with high trading fees and storage costs. Gold coins are not easily convertible and are not accepted as a form of payment for goods and services (similar to cryptocurrencies – but we will leave cryptocurrencies for another time).

Bringing It Home: Gold Can Help Diversify Portfolios in Small Amounts

Exchange-traded gold funds or trusts may provide diversification benefits to a portfolio, protection against a recession, protection against inflation, and perform well when rates fall, which is why we hold a small portion of gold for our clients.

That said, it is never a good idea to hold a large portion, or all, of your investable assets in an exchange-traded gold fund or trust. If you are interested in investing in physical gold coins, then we highly recommend you don’t. Investing in physical gold coins comes with high trading and storage costs. Gold is a speculative asset with no cash flows, earnings, or coupon payments to produce returns and it tends to underperform both stocks and corporate bonds over the long term.

How we invest for our clients is heavily dependent on their financial plans and risk profile (the ability and willingness to take risks). If you do not have a financial plan, please contact your advisor today to get one.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.