Key Takeaways:

- The student loan payment pause from the pandemic will end on September 1st – meaning payments will be due October 2023.

- We want to make sure that all of our clients with student loans are prepared and have adjusted their spending plans to account for the restarting of their student loan payments.

- We recommend focusing on paying off your student loan (rather than making the minimum payments) to have more cash in your pocket when you are older so you can live life to the fullest – plus, you will spend less money in interest over the life of the loan.

Millions of people across the US have student loan debt in varying amounts. Those with graduate degrees or who went to med or law school may have even more debt than everyone else. Even for those who were able to secure careers as doctors, lawyers, or in other higher-paying positions, paying off their student loans is still a significant financial concern.

Continue reading this post on student loan debt repayments or skip to our student loan video below.

Student Loan Debt Legislation

Student loans have been featured in the news lately as politicians fight either to forgive a certain amount of debt or to force an immediate repayment of paused loans. It’s important to understand how this legislation may impact you as well as understand how paying off your loans can impact your future finances.

COVID-19 Student Loan Debt Pause

Because the COVID-19 pandemic saw so many people lose their jobs to layoffs or furlough, one of the relief measures enacted by the government was student loan forbearance. This paused any federally-backed student loans with a 0% interest rate. Private student loans were not affected. This pause is ending on September 1st, 2023.

Student Loan Forgiveness

The Biden Administration has been trying to implement student loan forgiveness for up to $20,000 for Pell Grant recipients and up to $10,000 for non-Pell Grant loan holders. However, this legislation has faced some opposition and its status isn’t certain. Anyone with loan debt from law school, med school, or a graduate degree wouldn’t have their full loans forgiven and it would only have applied to those with federal student loans.

It’s a good idea to have a financial plan that doesn’t rely on the forgiveness of any amount of your student loan debt.

Student Loan Repayment Matching

The SECURE 2.0 Act allows employees of companies that offer 401(k) matching to match an employee’s student loan payments instead of their retirement contributions. This helps those who can’t afford to put money toward retirement because of high student loan payments. It also gives others the option to pay more toward student loans without sacrificing having some retirement savings.

Companies that offer 401(k) matching can choose whether to match a percentage of student loan payments starting on December 31st, 2023.

Planning for Student Loan Repayment

The overhang of student loan debt can negatively impact your ability to build wealth and live your life to its fullest. Your discretionary spending is reduced with so much of your income going toward student loan repayment. For this reason, the COVID-19 student loan repayment pause was a reprieve not just from payments but also from the negative effects of those payments.

Some people may need to significantly change their budgeting as repayment resumes.

When Does the Student Loan Repayment Pause End?

The COVID-19 pandemic paused student loan repayments at 0% interest for around three years. However, due to an agreement as part of the new debt ceiling legislation, that pause is set to end on September 1st, 2023.

How Did the COVID-19 Pause Impact Spending?

Many may have altered their spending habits to reflect the lack of student loan payments. Some have purchased homes, bought cars, paid off other debts, or just saved money, but otherwise stopped budgeting for student loan repayments. Others caught up on other debts and financial obligations.

How Should You Prepare for Student Loan Repayment?

If you’ve adjusted your spending habits around not having student loan payments, it’s time to reassess your budget. You’ll have to determine where you can afford to pull back in order to budget for those payments.

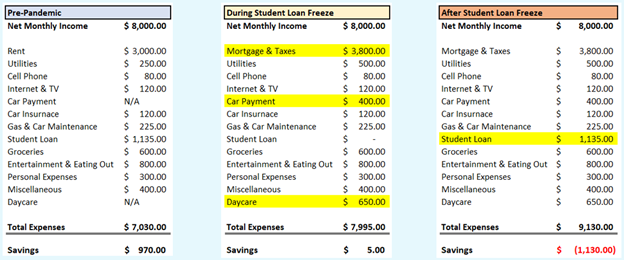

Below is an example of a household’s budget pre-pandemic, during the student loan freeze (enacted during the pandemic), and after the student loan freeze. The items highlighted in yellow are items that are added to the budget in each time period. While many were used to budgeting for student loan payments before the pandemic, the freeze that was placed on those payments during the pandemic led to a reversal of that behavior. From houses to cars to having children, many had life-changing events that changed their financial picture and were funded by the extra cash that was no longer going toward student loans. Fast forward to the present and student loan payments are coming back. Now the additional $1,135 in student loan payments below puts the household’s savings in the red. In other words, this household would have to pull from savings to pay their student loan payment. That is why we suggest revisiting your budget now, adding the student loan payment back in, and determining what areas of spending you will cut back if need be.

Revisit your spending plan.

If you need help creating a spending plan, reach out to your financial advisor. Another option is to seek out a free online course like AllGen Academy to learn about the foundation you need in place to build wealth.

What Happens if You Don’t Start Repayment by October 2023?

If you fail to start making your student loan repayments by October 2023, you might face wage garnishment. This means that the payment amount might be withheld from your paycheck before you even receive it. If you’re retired, as may be the case for some parents who co-signed or took out loans for their children’s education, then your social security payment might be garnished.

Student Loan Repayment Strategies

Student loans of any size can have a negative impact on your ability to build wealth as well as to live your life to the fullest since they can significantly reduce your discretionary income. The only guaranteed way to get rid of your student loan debt is to pay it off. But what is the best way to do that? Here are some tips for paying down your student debt.

Tip 1: Don’t Rely on Debt Forgiveness

While President Biden has created a student debt forgiveness program, it’s important not to rely on this when creating your budget, for multiple reasons. First, it’s currently tied up in courts. Even if the challenges to the program aren’t successful, the maximum amount you could get forgiven is $20,000. Also, student loan forgiveness only applies to federal loans, not private ones.

Tip 2: Focus on Debt Elimination

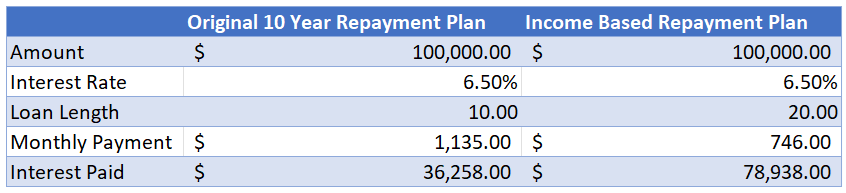

Federal student loans operate on an income payment system so that they’re tailored to what you’re making. However, paying only the smallest payment may result in interest compounding on interest, which could see you owing even more than what you’d started with. It’s therefore better to pay with a focus on eliminating the debt. Minimizing what you pay now will only maximize what you pay overall. The hypothetical below shows how making smaller payments on the same loan amount not only extends the life of your loan but can more than double the amount you pay in interest over the life of the loan. In the income-based repayment plan hypothetical, you could end up paying more than 75% of the original loan amount in interest!

Try to avoid the income-based payment route.

Tip 3: Start Student Loan Payments Early

The COVID-19 student loan pause didn’t just halt repayments, it also paused interest. A great way to pay down some of your debt would be to start paying again as soon as possible so that 100% of each payment goes toward the principal of the loan rather than to interest. Interest will restart again along with repayments on August 29th, but anything you paid before that date would help to make a dent in the loan’s principal.

Tip 4: Contact Your Financial Advisor

Your financial advisor can help you to budget for debt elimination. With their expertise, you can create a spending plan that focuses on your long-term financial health so that you can start building wealth sooner. Contact your financial advisor to discuss creating a financial plan to help pay off your student loans.

What To Do Next: Review Your Budget in Preparation for Student Loan Repayment

Don’t be caught off guard – be prepared for student loan repayments starting September 1st. It’s never a good feeling when you receive a large bill or payment you forgot you had. We suggest reviewing your budget to determine where you can afford to pull back spending, if needed, to pay your student loan payment. Likewise, if you can afford to do so now, then consider making principal-only payments to lower your loan amount and come out ahead when you start having to pay interest on the loan again.

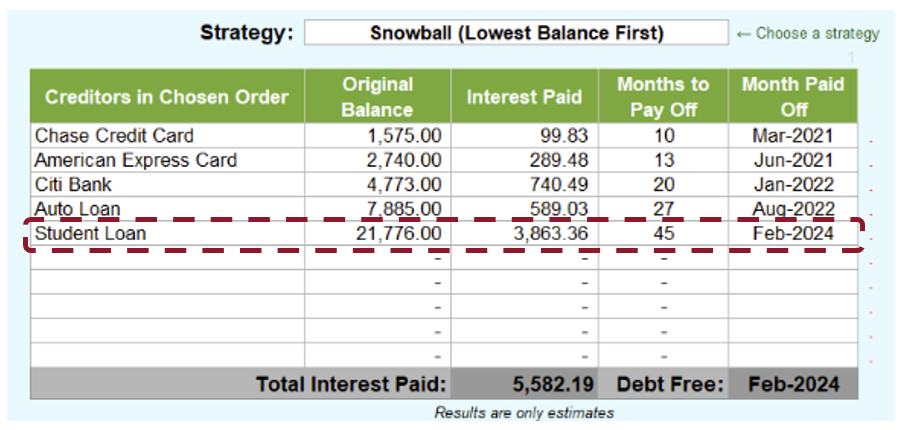

Getting out from under student loan debt requires a shift in your mindset. Be intentional and adopt the mindset of paying off the loan as soon as possible instead of simply paying the minimum possible payment based on income. The longer you take to pay off your loan, the more money you will throw down the drain on interest. If you have additional loans beyond student loans, then we usually recommend clients use a “debt snowball” approach, paying off the smallest loans first to gain momentum as the chart below shows. As always, feel free to reach out to your advisor with any questions!

Consider using a debt snowball approach to pay off your debt.

For more information on student loan payments and what you need to know before they restart, watch our student loan video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.