Key Takeaways:

- Market opportunities rarely present themselves in obvious ways but can typically be found when nobody else is looking for them.

- Historically, when investors pile cash into extreme rates, markets tend to do well one year later, as well as two years later.

- Research in behavioral economics shows that the average person feels the pain of an investment loss twice as hard as the pleasure of an equal gain.

If you’ve ridden a roller coaster, you probably remember your very first; mine was the Incredible Hulk at Islands of Adventure. The ride begins by shooting up the ramp with nothing but the sky as the limit, accelerating upward where excitement and adrenaline take hold. The car pitches as the ramp tops out, followed by an anxious turn of events – and your stomach – as the drop begins. The sickening feeling of fear takes control as the downward trajectory accelerates towards the earth which, for a moment, feels like the track is no longer connected to the car! Fear turns to panic, then followed by the eventual whiplash of the car catching the track and pulling upward again. Sometimes, investing can cause these very same feelings, except the difference is you’re sitting on the couch!

The Roller Coaster of Emotions

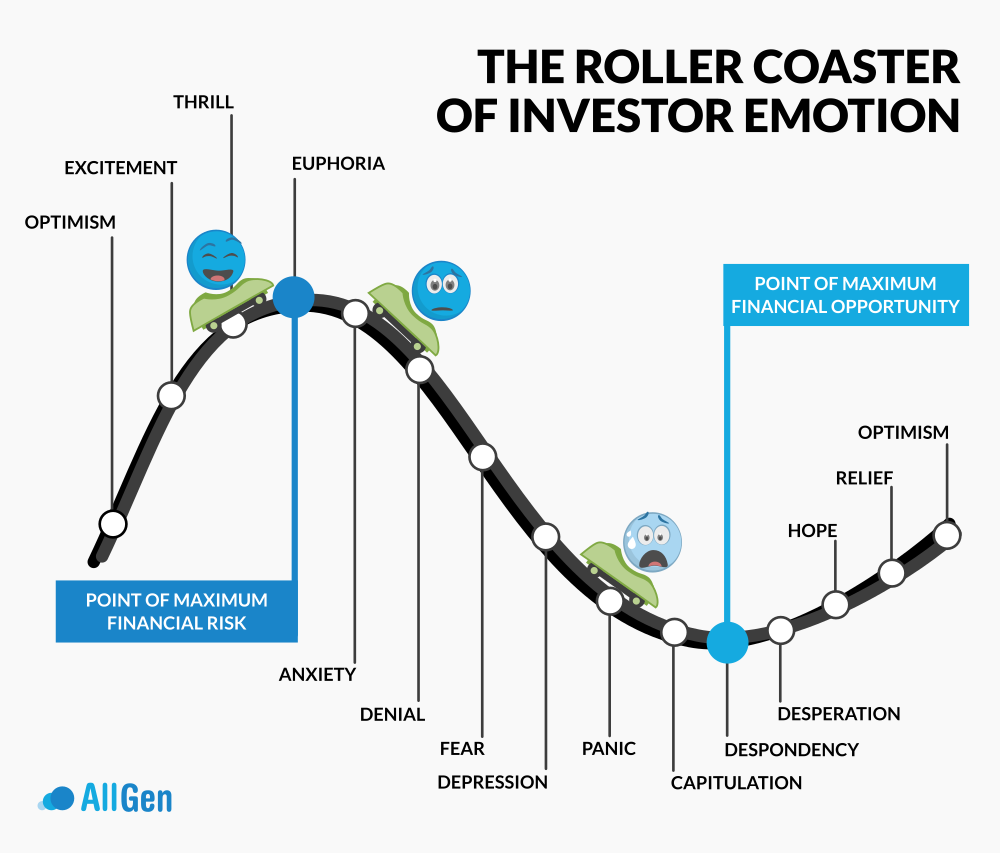

The chart below illustrates what we have coined as “The Roller Coaster of Investor Emotion.” As markets climb to higher highs, more investors experience FOMO (Fear of Missing Out) and enter the market to seek the thrill. Investors’ optimism turns into excitement, success stories seem to be everywhere, and eventually, euphoria sets in where it feels like nothing will stop the climb!

At this point, most investors have bought in and have borrowed at extreme levels to buy stocks or bonds. Here, the stock market could be at the point of maximum financial risk as there are likely more potential sellers than there are buyers.

The next stage begins with market volatility followed by investor anxiety and denial. Headlines turn from positive to overwhelmingly negative, further fueling market fears. The cycle ends with panic, extreme pessimism, and, ultimately, capitulation and despondency, at which point investors quit and sell. At this stage, there are likely more potential buyers than sellers in the market, which indicates the point of maximum financial opportunity for investors. Typically, contrary to popular opinion, this occurs when investors are most scared.

The Roller Coaster of Investor Emotion

Behavioral Economics and Investment Losses

Investors feel the pain of losses twice as much as the pleasure of equal gains

Research in behavioral economics shows that the average person feels the pain of an investment loss twice as hard as the pleasure of an equal gain, meaning that when markets fall, we are already at an emotional disadvantage – it’s human nature!

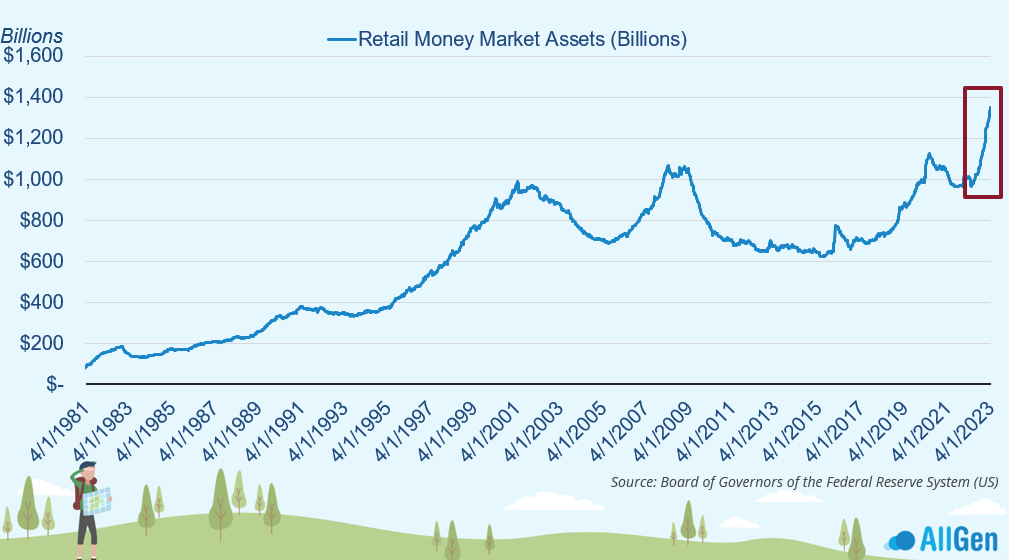

As more investors panic and exit the market, it typically means that they’ve given up and sold to cash or money market investments. The chart below plots money market balances since the1980s where we clearly see that as markets were falling in 2022, cash levels were piling up quickly, surpassing record highs.

Increases in Retail Money Market Assets

Retail Money Market Funds

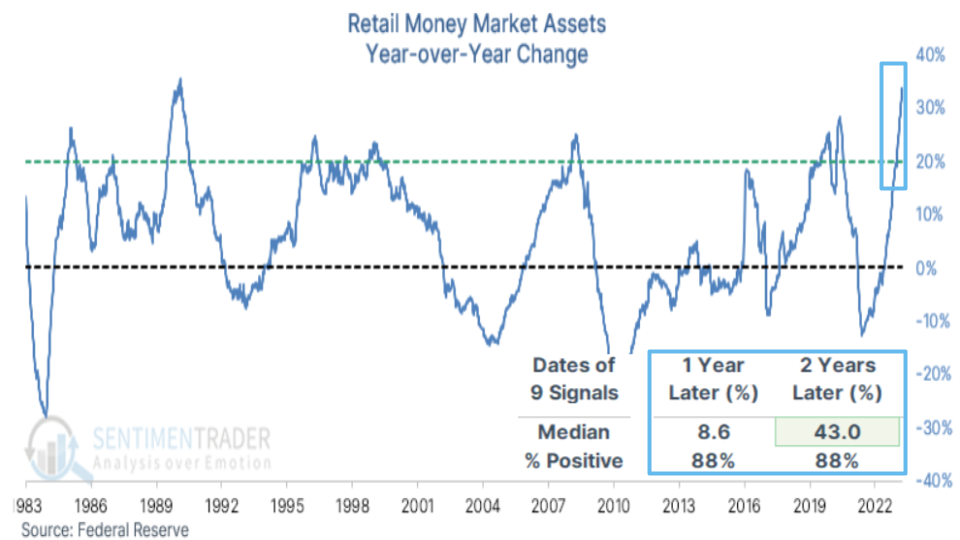

Retail Money Market Balances Increased Over 30% Year-Over-Year

For 2022, retail money market balances (cash alternatives) have increased over 30% year-over-year – the largest increase in any 12-month period since the late 1980s (see chart below)! Since then, over a rolling 12-month period retail money market assets increased by at least 20%, nine times. Eight of those times, over the subsequent 1-year and 2-year periods, the S&P 500 was positive with a median return of 43% two years following!

Changes in Retail Money Market Assets Year-over-Year Change

Bringing It All Together: How Do Emotions Impact Investing?

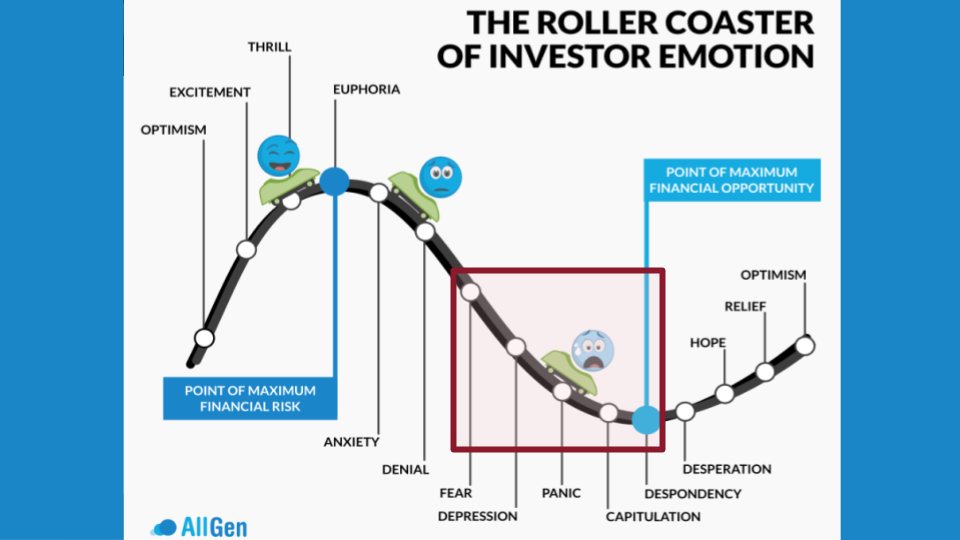

Now, refer to the roller coaster of investor emotions chart and try to find which point investors might be located at as they exit markets and rush to cash. If you answered somewhere between fear and despondency (shaded red box), you might be right! As investors pile into cash, they are simultaneously selling out of the market. This exacerbates selling pressure in stocks and causes an extreme influx into cash investments. In this area, the number of potential buyers is increasing, eventually surpassing the number of potential sellers.

It might have been easy to find where investors might be when cash levels are piling up and when fear and panic seem to be everywhere. However, when it’s your life savings on the line, it becomes personal, and you might find it to be much more difficult to remain on track! Incorporating diversification in portfolios with a touch of discipline can separate the winners from the losers in situations when fear is tearing through markets.

What should an investor do in a falling market? The answer isn’t straightforward and might depend on your specific situation, but we can learn from an ironic phrase coined by the billionaire investor, Warren Buffet: “Wall Street is the only place, that when things go on sale, people run for the exits!”

For more information about how AllGen can help you stay invested while being properly diversified, talk to your advisor here!

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.