A lot of entrepreneurs and small business owners are focused on growing their business (as they should be). However, sometimes business owners are so preoccupied with growing their business that they forget to save for their retirement. Consider a small business retirement plan designed to save for your future and potentially help your tax bill.

Advantages of Small Business Retirement Plans:

- Save for your future faster – small business plans give you the ability to put more money away than traditional IRAs and Roth IRAs

- Saving on taxes – company contributions for employees are deductible to the company

- Way to divest from the business – Sometimes business owners invest the majority of profits into the business and nothing into traditional retirement planning

- Attracting and retaining top talent

- Offers asset protection

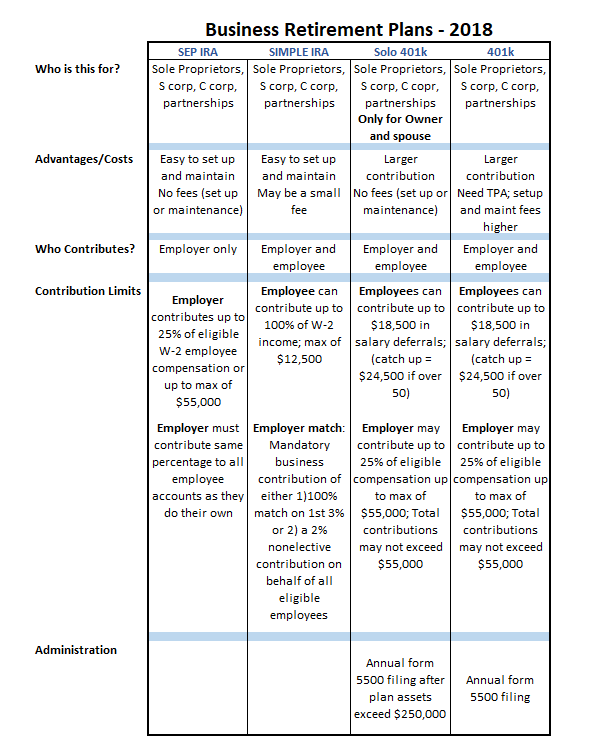

Common small business retirement plans are Solo 401k, 401k, SIMPLE IRA, and SEP IRA.

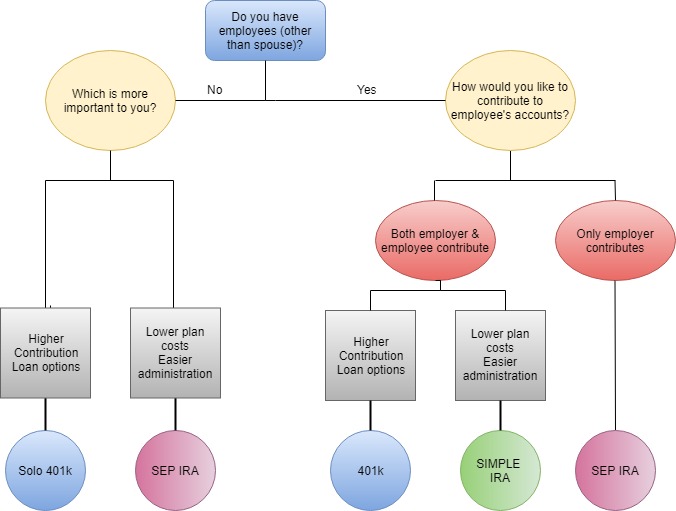

Which one is right for you?

This flow chart along with the following details can help you decide which plan may work best for you. There are other factors to consider than are listed here, so please speak with an Allgen advisor before finalizing the right choice for your business.

At Allgen we have helped many clients strategize and implement these plans. We welcome the opportunity to find the right design for you. Contact us at advisors@allgenfinancial.com.

Written by Teresa Talton with Allgen Financial Advisors, Inc.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.