Read through this post on how your desired lifestyle impacts retirement planning or skip to the AllGen Academy retirement lifestyle video below.

Lifestyle in Financial Freedom

One of the first steps in creating your Financial Freedom plan is to define how much you’ll need once you reach Financial Freedom. This may seem hard to quantify since it’s in the future, but the idea is to have a target number that you can start accumulating towards.

To arrive at that target, consider a general dollar amount that you’ll need to live off of each year in retirement (we use the term ‘retirement’ interchangeably with Financial Freedom in this course for simplicity. Refer to Chapter 1 for a deeper discussion on our approach to Financial Freedom). This annual dollar amount needed is called your quantified lifestyle in retirement.

If you’ve done financial planning with AllGen, you’ll see on your Trail Map the annual income needed in the Formation section. Note that we capture this number in today’s dollars on an after-tax basis. In other words, assuming you’ve already paid for taxes and this is the amount left over to spend, how much would you need per year in today’s dollars?

“In today’s dollars, I want to live on $_________ per year after I retire.”

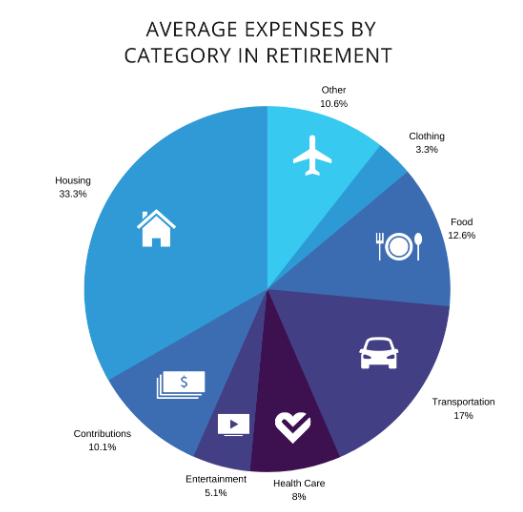

According to the Bureau of Labor Statistics in 2018, the average household spends about $51,000 yearly at age 65 and beyond. How much should you plan to spend each year? This chart shows a general breakdown of average household expenses by category.

There’s no right or wrong answer although you do need to arrive at a number at some point. It’s easier to come up with an amount if you already keep a monthly budget which is why we encourage everyone to track their expenses monthly. This will give you a good starting point on how much you might spend in retirement, making adjustments for expenses that may change once you reach Financial Freedom (i.e. no more mortgage payments, no childcare expenses, etc.).

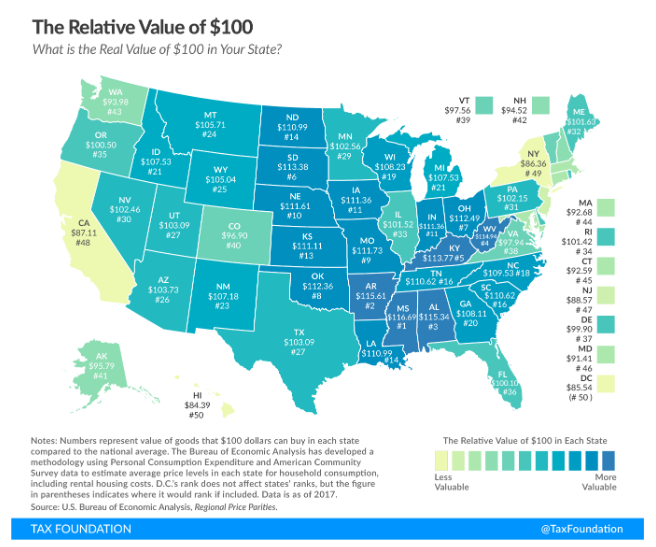

The cost of living also varies by region and locality. This map shows the variations among different states.

Two other factors that impact that annual number are inflation and taxes. We’ll cover these in the upcoming lessons.

Once you have a good estimate of how much you’ll need each year, you can calculate your Financial Freedom Number, the total amount you need to save to accommodate your desired lifestyle in Financial Freedom.

Getting to a specific amount requires nuanced calculations that take into account various factors like how much your invested assets grow each year, whether you’ll have other sources of income, etc. We’ll also cover those in upcoming lessons. For now, you can use this formula as a general rule of thumb:

Annual Income Needed in Freedom Stage x 25 = Financial Freedom Number

For example, if you want to live a $75,000 per year lifestyle in Financial Freedom, the amount you need to accumulate is $1,875,000.

Your Financial Freedom Number may seem daunting or unattainable, but don’t let that discourage you. Planning and starting today will give you the best shot at reaching your goal. Ultimately this exercise will help you ballpark the cost of your desired lifestyle in Financial Freedom and how much you need to accumulate in order to fund that lifestyle.

Reflect on your current spending habits and projected expenses to set a realistic target. The remainder of this course will equip you so that you can plan properly to reach that target.

For more information on how your desired retirement lifestyle impacts how much you’ll need to save, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.