Read through this post on how longevity impacts retirement planning and Financial Freedom or skip to the AllGen Academy video below.

The Top 4 Reasons Why People Fail to Reach Financial Freedom

Even with good intentions, there are some common mistakes that people make which prevent them from reaching Financial Freedom.

1. Not Saving Enough

In the US, the average household savings rate is only 6.6% of income. This is not enough to replace and sustain your current lifestyle in Financial Freedom.

Instead, aim to save 10% – 20% of your income annually in a long-term account that is invested according to your risk tolerance. You can automate your savings through automatic transfers or deductions from your paycheck into a 401(k) or similar vehicle. Whatever your method, the goal is to develop the discipline to save and pay your future self first.

2. Procrastination

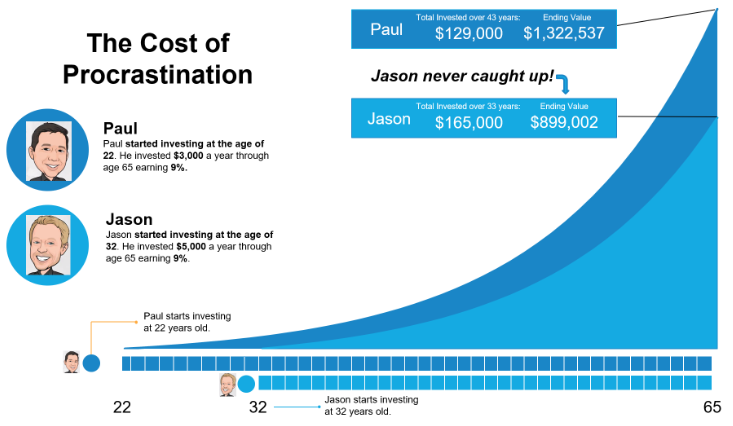

In the investing world, time can be your ally or your enemy. Leverage the power of compounding by starting early and being consistent with your contributions throughout your earning years.

The opportunity cost of waiting is that for each year you delay investing, you not only lose the interest earned that year but also its compounded value over the remainder of your time horizon.

Don’t wait to start building wealth to maximize the impact of your contributions.

3. Not Having a Plan

“If you don’t know where you’re going, you’ll get there every time—which could mean nowhere.”

According to a recent study by Fidelity Investments, only 18% of Americans have a financial plan. This means most people don’t have a clear idea of how they will reach Financial Freedom and the steps they need to take to get there.

As you can see from what we’ve covered so far, there are many components to planning for Financial Freedom. It’s necessary to have a plan that incorporates all the components of Financial Freedom and ultimately defines:

- How much you need to save

- What vehicles to save in

- How investments might grow over time

Create a financial plan with a professional financial planner who can help guide you toward Financial Freedom.

4. Not Monitoring the Plan

Even the most well-designed financial plan is prone to change as life happens. You must monitor your plan to make sure you’re still on track as your circumstances change and evolve.

Examples of life events that could affect your financial freedom plan include:

- Illness or injury resulting in disability or death

- Marriage or divorce

- Having more children and/or dependents

- Overspending and/or under-saving

- Receiving an inheritance

- Job loss or promotion

As your circumstances change, you may need to adjust your plan and make it dynamic, incorporating new variables to ensure you can still reach Financial Freedom in a timely manner.

Many people fail to reach financial freedom because of these common mistakes. Avoid these pitfalls by establishing a plan that incorporates the various components of financial freedom, starting saving as soon as possible, and monitoring your plan to make sure you’re staying on track.

For more information on how taxes impact how much you’ll need to save for retirement, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.