It is no wonder that as our credit card statements begin rolling in, we are motivated to make personal finances our New Year’s Resolution. For many of us, the New Year represents a clean slate – it is a time to reimagine our life.

However, amid all the “New Year, New You” talk, Allgen is taking a stand! We want you to take a holiday from New Year resolutions. Why would we suggest that? According to a recent Huffington Post article, resolutions have a 92% failure rate, 80% of which occurs by February. Now, you do not have to be a financial planner to see that those numbers are bad.

We spend a lot of time thinking about what we want, and we fail to plan to overcome the obstacles that will interfere. As a result, we typically fail before we begin. So, what should you do?

WHIP Your Finances into Shape

WHIP is an acronym that focuses on the psychological side of accomplishing your goal. Most people fail to attain their goals because they focus on what they want to accomplish as opposed to why they want to accomplish it. At Allgen we are big believers of getting out of debt because we have seen how debt destroys people’s financial dreams, strains relationships, and causes immense stress. In the chart below, we explain how to apply WHIP to getting out of debt.

What do you want to accomplish?

How will it improve your life?

Identify the obstacles.

Plan to overcome the obstacles.

W-Pay off my consumer debt

H-Reduce stress, improve my relationship, and allow us to build wealth quickly

I-I will be tempted to go out to eat, take a vacation, and buy things I do not need

P-I will bring my lunch, cook at home, and take a staycation.

We want you to really focus on how achieving your goal will improve your life. The plan is important; however, the obstacles will come up. That is why focusing on how it will improve your life is so crucial. If the plan gives you the roadmap to success, then your how becomes the fuel that insures you will reach your destination.

Motivational speaker, Eric Thomas, shared a story to a group of students about the key to success. The story involves a young man that meets a guru on the street. The young man asks the guru, “which way is success?”

The guru replies, “why do you want success?” The young man states, “I work hard every day and still my life isn’t as good as everyone else’s. They have the cars, the homes, and the experiences that I want. I am tired of waiting.” The guru nodds, “I see, in that case meet me at the beach tomorrow at 4:00 AM.”

Confused, the young man asks, “I want to be successful, what does that have to do with the beach?” The guru answers, “If you want to be successful, I’ll meet you tomorrow at 4:00 AM” and walks off.

The young man arrives at 4:00 AM sharp ready to learn the secrets of success. The guru grabs the young man’s hands asking, “how bad do you want to be successful?” The young man replies, “really bad.”

The guru responds, “good, walk into the water.” So, he walks out into the water, perplexed, but excited to discover the secrets of success. The guru walks up beside him, “do you see?” The young man waist-deep, looks back at him with a look of confusion. The guru recognizes that look and says, “let’s go out a little further.”

Now shoulder deep the guru asks, “now, do you see?” The young man frustrated replies “no, I don’t see what any of this has to do with success!” The guru responds, “the answer is just a little further.”

The water is now up to the young man’s chin, “how much further do I have to go before you will tell me your secrets?” At that moment, the guru jumps on the young man, dunking his head in the water. The young man flails while the guru fights to keep him under.

Just as the young man is about to pass out, the guru releases the man and asks, “what were you thinking about while I held you under?” The young man still trying to catch his breath says “breathing, all I wanted was to breathe.” The guru looks directly into the young man’s eyes and states, “when you want success, as badly as you want to breathe, then you’ll be successful.”

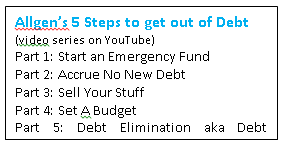

Debt is a crushing force, it causes stress, ruins marriages, and robs people of joy. Sadly, many people cannot imagine a life without debt. However, we have seen the transformation that occurs when you employ WHIP and follow Allgen’s path to Financial Freedom. Our clients, who follow the plan, become empowered and stop at nothing to break free from debt – just as badly as they want air to fill their lungs. It is not if they will get out of debt it is when.So, those of you clawing your way out of debt will now have a plan to overcome psychological hurdles. On the right, you will see Allgen’s 5 steps to get out of debt. We encourage you to go to Youtube and watch these 5 short videos, which will give you a step-by-step plan to get out of consumer debt. With the right mindset and practical steps, you will be successful and we are here for you every step of the way!

Summary

We look forward to assisting you with any questions you may have. We also invite you to stay connected with Allgen’s market viewpoints and financial education. Our weekly “Money Minute” video series answers your financial questions, and it helps guide you on your path to financial freedom. You can find us via www.allgenfinancial.com, Facebook, LinkedIn, Twitter, and YouTube.

Written by Paul Roldan, Robert Cortes, Ana Fernandez, CFP® and Teresa Talton, CFP®, with Allgen Financial Advisors, Inc.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.