3rd Quarter 2015 Market Commentary

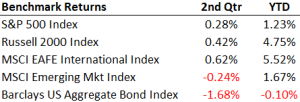

2nd Quarter Review

Should We Be Concerned About Greece, Puerto Rico and/or China?

Greece

To put things in perspective Greece’s GDP is approximately $238 billion. The world’s GDP is approximately $87 trillion. That puts Greece’s economy at about 0.27% of the World GDP. Greece National Debt is $379 Billion and the world’s total debt is approximately $56 trillion (give or take a few trillion!). So Greece’s debt to the world’s debt is less than 0.7%. While Greece has made financial headlines over the last few weeks it’s not a major issue from the stand point of Greece defaulting on its debt. It’s also important to note that while Greece has been an independent country for about 180 years they’ve been either in or on the verge of default 90 of those years. So the likelihood of Greece having troubles managing their debt is like a thunderstorm rolling in on a Florida afternoon in July (about a 50/50 chance). The Eurozone has had years to prepare for the possibility of Greece defaulting and the debt is mostly held by the International Monetary Fund (IMF), European Central Bank (ECB) and European Commission, rather than private institutions or investors. The biggest threat we see is if Germany and other Eurozone nations are soft on Greece and allow them to restructure their debt in turn encouraging other highly indebted countries like Spain, Portugal and Italy to default and try to get a better deal. At this point though there is no sign of that happening. While there has been increased uncertainty in the short-term, longer term, the crisis in Greece will most likely end up not being a major global market event.

Puerto Rico

Puerto Rico’s GDP is $103 billion or 0.12% of World GDP. Puerto Rico’s debt is $191 billion or about 0.3% of the world’s debt. Puerto Rico has problems similar to Greece: high unemployment, high budget deficits and unsustainable debt burdens. While we don’t believe Puerto Rico will affect the stock market there could be a small negative effect for some muni bond funds that hold a sizeable percentage in Puerto Rican munis. We have cautioned our clients not to buy Puerto Rican munis. While we know they pay a high tax free interest rate we don’t believe the risk is worth taking. We’ve also avoided Muni bond funds that hold a sizeable portion of Puerto Rican muni bonds.

China

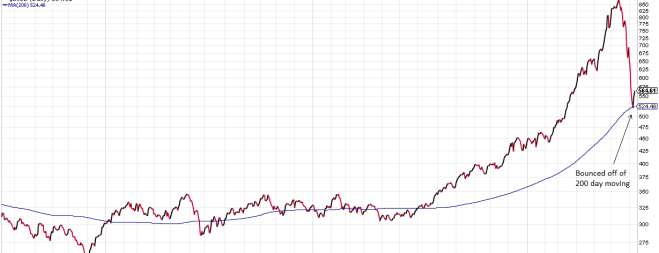

While we don’t see Greece and Puerto Rico as a significant risk we are keeping a close eye on China. China is the second largest economy trailing only the U.S. Interestingly, the fall in Chinese stocks is not receiving nearly the press coverage as Greece. Primarily there are two types of markets in China. The first is comprised of mainland stocks that are mostly driven by individual investors. And, the second is stocks that are traded in Hong Kong (Hang Seng) which are primarily driven by international institutions. The Hong Kong Hang Seng is 4-5 times larger than the mainland stock market and is much more significant in terms of the impact to the global markets. The mainland shares that are driven by your “mom-and-pop” investors have experienced a major bubble. One of China’s mainland indices, the Shenzhen, has gone up over 200% in the last two years

(Source: http://www.schwab.com/public/schwab/nn/articles/China-s-Stock-Plunge-What-You-Need-to-Know)

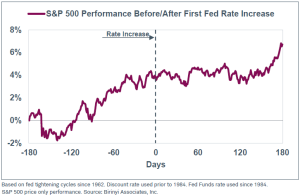

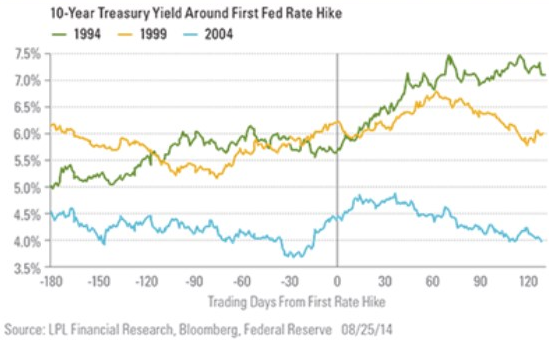

Ramifications of a Future Rate Hike

Recently Federal Reserve Chairwoman Janet Yelen stated that she feels it is appropriate to raise rates later this year.

Going Forward

While we will monitor Greece and Puerto Rico we do not feel they will have any significant negative impacts on the market long-term. China’s smaller mainland markets have recently experienced a bubble, but the more significant Hang Seng appears to be healthy. While we expect a rate hike in the latter part of this year the Fed has stated that future hikes will be slow and gradual which should not cause bond prices to decline suddenly. We also noted that historically stock markets are positive on average 6 months after the first rate hike. We constantly monitor market factors and adjust accordingly as our proactive money management style seeks to take advantage of pricing anomalies. We continue to manage risk first in all of our investments, while seeking to outpace our clients’ respective benchmark over the long-term net of our fees.

Written by:

Jason Martin, CFP®, CMT, Chief Investment Officer Allgen Financial Services, Inc.;Paul Roldan, Chief Executive Officer; Chris Damiano, Operation Specialist

Important Disclosures: Blogs, Collateral & Web Site Content: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. Allgen Financial Services, Inc. (Allgen) is an investment advisor registered with the SEC. Allgen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by Allgen. It is not intended to be a solicitation or offer to sell investment advisory services to residents of any state in which Allgen is not currently authorized to do so. The Disclosure Brochure, Form ADV Part II, which details the business practices, services offered, and related fees of Allgen, is available upon request.