What Is Rebalancing?

When you diversify your portfolio, you will arrive at your target asset allocation, a defined set of proportions for each asset class. The main asset classes that typically make up allocations are stocks and bonds but you may include other categories of assets in your portfolio.

Rebalancing is the practice of bringing your portfolio back in alignment with your target asset allocation. Another core strategy in investing, rebalancing is done by selling asset classes that went up in value and buying asset classes that went down in value.

Keep reading this blog or skip to our rebalancing video below from AllGen Academy.

How Do I Rebalance My Portfolio?

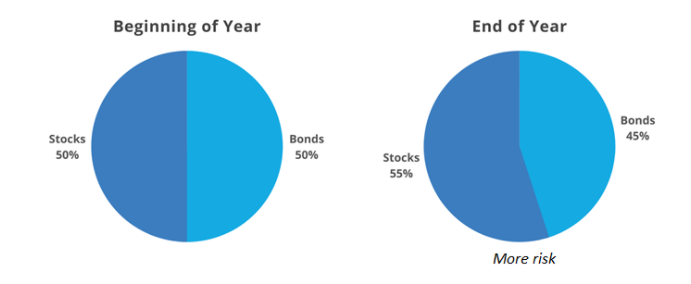

50/50 Stocks and Bonds Rebalancing Example 1

An investor starts with a balanced portfolio (50% stocks, 50% bonds). Throughout the year, stocks go up 20% and bonds stay flat (0% growth). At the end of the year, stocks will make up nearly 55% of the portfolio while bonds will be at approximately 45%.

The portfolio is riskier at the end of the year compared to where it started since stocks generally take on greater risk than bonds and now they make up a larger portion of the portfolio. It’s common for the stock market to decline after a big rise so if the portfolio stays more heavily invested in stocks, it could potentially experience bigger drops during a declining market.

To rebalance the end-of-year portfolio, the investor would sell about 5% of the stocks and buy more bonds to replace that 5%. This brings the portfolio back in alignment and reduces the risk exposure. If the market were to decline, the rebalanced portfolio would be better positioned to weather the storm.

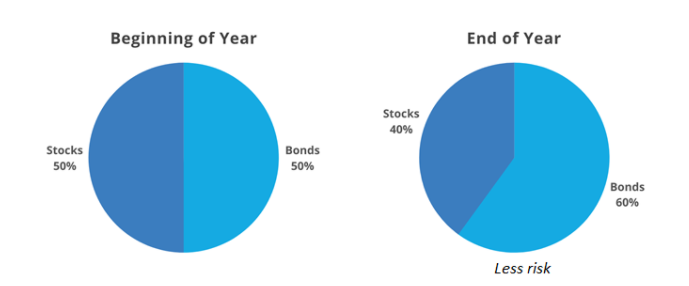

50/50 Stocks and Bonds Rebalancing Example 2

Again an investor starts with a balanced 50/50 portfolio. Throughout the year, stocks drop 25% and bonds go up 5%. The portfolio stands at 40% stocks and 60% bonds at the end of the year. To rebalance, the investor would sell 10% in bonds and buy 10% in stocks.

Typically after the stock market makes a big drop, it follows with a year of gains. By rebalancing, the investor would benefit from buying stocks when they are down (buying low) and enjoying a larger bounce back in their portfolio when the stock market rises again.

How Does Rebalancing Reduce Risk and Maximize Returns?

Rebalancing is a systematic way of selling assets that are high and buying assets that are low. Done properly over time, rebalancing produces less risk in a portfolio while potentially earning greater returns.

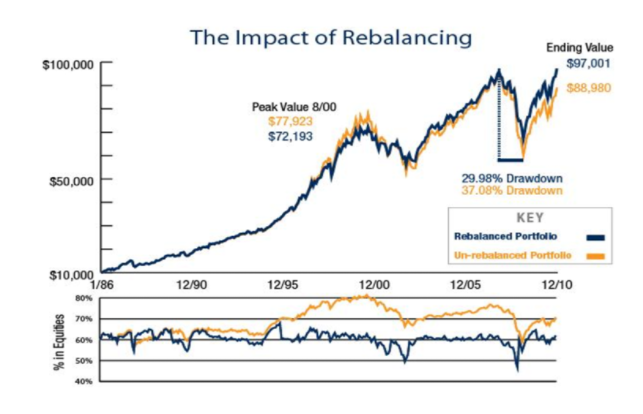

To further illustrate the impact of rebalancing, this chart tracks two different portfolios, each starting with a 60% stock 40% bond mix.

The blue line portfolio is rebalanced annually while the yellow line one is never rebalanced. While the yellow portfolio had stronger returns during strong markets, it took much bigger hits during difficult markets. The blue portfolio on the other hand didn’t catch as much of the upside but also held up better on the downside. In the end, the rebalanced portfolio had better returns while taking on less risk.

For more information on rebalancing, what our video from AllGen Academy below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.