When it comes to buying a home, afford is a relative term. You may be able to afford the monthly payment on a house, but at what cost? Before the 2008 housing crash, many homebuyers who were making minimum wage were assured that they could afford half-million dollar houses.

Many prospective homebuyers may receive mixed messages about how much house they can actually afford. Realtors typically make a percentage based on the cost of homes they sell. This means that they may encourage you to spend more on a home because the higher the price of your home, the more money they make. Not every realtor operates that way, but homebuyers should be aware of the realtor’s perspective when making decisions about how much home they can afford so that they don’t end up house poor.

What Is House Poor?

Someone who is house-poor spends a large portion of their income on the costs of owning and maintaining a home. It’s sometimes also called house rich, or cash poor, because all of your money is tied up in the house and you have little to spend or save. If you’re house poor, it’s difficult to build wealth over time and you may end up paying more in interest than you would otherwise.

Guidelines for How Much House You Can Afford

Put down at least 10% of the purchase price. It’s even better if you can put down 20% or more. The less you put down on the purchase price of the house, the more expensive private mortgage insurance can be.

Choose a 15-year fixed-rate mortgage. Stay away from adjustable-rate mortgages (ARMs) or interest-only mortgages. Many people may try to convince you to choose a 30-year mortgage so your monthly payments are lower. However, you will ultimately be able to build wealth faster with a 15-year mortgage. You may not be able to afford as much house early on, but that can be a good thing as you can avoid becoming house poor. You’ll have more equity in your first home so when you sell it, you can invest in a larger second home.

Keep your total monthly house payment to 30% of your income. Your total monthly house payment, including the principal, interest, taxes, insurance, and private mortgage insurance (PMI) should be no more than 30% of your monthly take-home income.

Reference our Mortgage Affordability & Mortgage Comparison Calculators. These are coming up in the following lessons. The Mortgage Affordability Calculator helps you calculate how much mortgage you can afford. The Mortgage Comparison Calculator compares a 15-year mortgage to a 30-year mortgage.

Advantages of a 15-Year Mortgage

1. Save money on interest. We prefer the 15-year mortgage over the 30-year mortgage because it saves you a lot of money on interest. Depending on the cost of your home, you could save up to hundreds of thousands of dollars on interest alone.

2. Build equity faster. If you want to sell your home after a few years, you’ll have paid more of it off with a 15-year mortgage. This means that you can get more money back when you sell.

3. Less PMI. A 15-year mortgage can also help lower the cost of PMI. This is advantageous if you can’t afford to put 20% down on the home when you first buy.

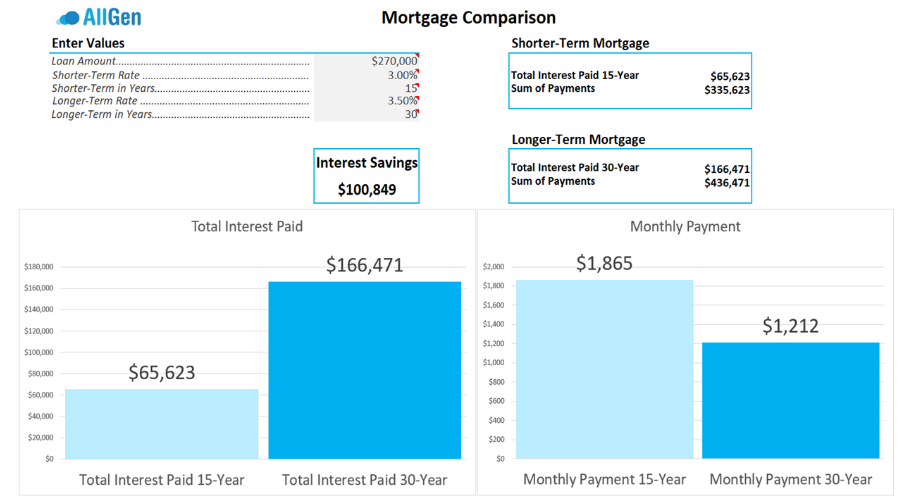

In the example below, the 15-year mortgage saves the homeowner about $100,000 in interest payments over the cost of the 30-year mortgage, even though the monthly payment isn’t very different. The goal is not to have the lowest monthly payment, but to pay the least amount of interest and build wealth over time.

For more information on the types of mortgages, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.