Disclaimer: Due to the large variety of health insurance options available and extensive scope of this topic, we encourage you to consult with a health insurance professional to assess your unique circumstances and health care needs.

What Is Health Insurance?

Health insurance is a form of insurance that covers a percentage of your healthcare costs beyond a certain amount. In addition to paying for routine well visits to the doctor, health insurance protects you from high medical expenses that could result from major illness or injury. Health insurance absorbs some of the financial impact caused by unexpected medical care.

Why Is Health Insurance Important?

Sickness is a fact of life and as such, it is important to be prepared in case a major illness or injury occurs in your life.

The reality is that healthcare costs are rising faster than inflation. This means that even routine or elective healthcare can be quite costly, let alone unexpected illnesses or injuries that can be financially catastrophic.

Here are some sobering statistics on the negative effects of medical costs:

- 62% of bankruptcies are caused by medical issues₁

- Average debt for households filing medical bankruptcy is $44,622₂

- 59% of Americans with medical debt use up most or all of their savings₃

- Average hospital stay in the U.S. costs $5,220 per day₄

Having adequate health insurance is a critical piece of managing your risks and helps you maintain financial stability even during unexpected health events.

Read through this post on health insurance here, or skip to our AllGen Academy health insurance video below.

How to Acquire Health Insurance

There are two major factors to consider when choosing health insurance:

- Cost of premiums

- Level of coverage

Cost of Health Insurance Premiums

The cost of health insurance premiums (what you pay each month for coverage) ranges widely depending on type of plan and deductible. You can expect to pay anywhere from $100 a month to upwards of $2,000 a month.

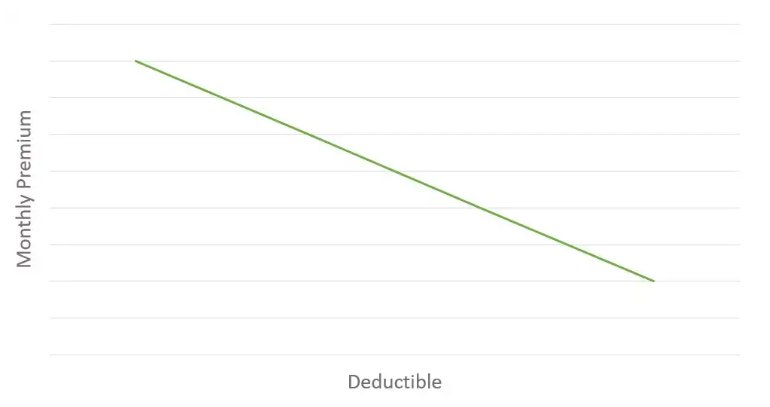

One way to lower your monthly premium is to raise your deductible. This is the amount you have to pay out of pocket before your policy kicks in. This chart illustrates the inverse relationship between monthly premiums and deductible amount.

High Deductible Health Plans (HDHP) are a certain type of health insurance plan specifically designed to offer lower monthly premiums in exchange for higher deductibles. You will need to meet the deductible amount in any given year before your policy starts paying. Because you pay more out of pocket initially, the premiums are usually lower.

What Level of Coverage Do I Need?

The level of coverage you choose also impacts your monthly premium cost. Plans typically come in different tiers of coverage (Bronze, Silver, Gold, and Platinum).

Lower tier plans cost less but they also provide less coverage. This means you’re responsible for a higher percentage of medical costs, called co-insurance. Different plans also include different types of medical care and services, with higher tier plans offering more comprehensive care.

How much coverage you need depends on your personal circumstances and health care needs. Because these could vary from one year to the next, it’s important to review your coverage on an annual basis.

Other Medical Coverage Options

Medical Cost Sharing Programs offer an alternative to traditional health insurance plans. In these programs, participants pool their resources together (i.e. monthly premium) to cover medical expenses as they arise. Each member who needs medical services pays a “incident fee” similar to a co-pay and then the remainder of the expense is covered by the pooled fee.

Many cost sharing programs are from faith-based organizations that exclude some services such as birth control and substance abuse treatment. It is important to carefully read and fully understand what is covered and what is excluded with these programs. Yet, exclusions allow these programs to offer much lower monthly premiums than traditional health insurance.

Health Savings Accounts (HSAs) provide a tax-advantaged way to pay for medical care. Contributions into these accounts are made pre-tax and withdrawals used for medical expenses are tax-free. While there are limits to how much you can contribute to an HSA in a given year, any unused balance at the end of the year rolls over to the next year so the savings can accumulate over time.

One thing to note is that HSAs must be combined with a High Deductible Health Plan (HDHP) to cover catastrophic illness or injuries. HSAs are available through many employers but you can also set one up individually.

How Does Health Insurance Help Protect My Assets?

Having adequate health insurance protects you from major medical expenses so you can avoid medical debt and continue working towards Financial Freedom.

For more information on the types of health insurance, watch our AllGen Academy video below.

Sources:

₁ The American Journal of Medicine, Medical Bankruptcy in the United States, 2007

₂ The American Journal of Medicine, 2009

₃ Kaiser Family Foundation, 2016

₄ Kaiser Family Foundation, 2018

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.