Key Takeaways:

- FedNow is kicking off in July 2023 and will allow cash transfers to settle 24/7 between bank accounts at different institutions, bringing the U.S. up to speed with similar payment systems used in other countries like the UK, Germany, France, and Australia.

- FedNow is not the start of the digital dollar as it doesn’t rely on a blockchain and is not a digital currency.

- The primary motivation of the Federal Reserve for researching a digital dollar is to protect the dollar’s market share from riskier cryptocurrencies, increase consumer access to the financial system, speed up international payment transactions, and protect the dollar’s dominance in global trade.

- A digital dollar could still be a few years out as the Federal Reserve would need authorization from Congress to issue one.

With the launch of FedNow by the Federal Reserve in July 2023, we are receiving more questions than ever about FedNow, the payment systems in the U.S., and the digital dollar. As such, we want to take some time to answer your most frequently asked questions about the topics. The overarching theme in the FAQs is that these initiatives and research are to modernize our payment systems in the U.S. as its technology has fallen behind many other major countries over the past few years. In both FedNow and any research into the digital dollar, privacy and protection for the consumer is a key area the Federal Reserve wishes to safeguard. Without further ado, check out the top questions we have received (and our answers).

What Is FedNow?

FedNow is a new payment system that is set to launch in July 2023 by the Federal Reserve and will help modernize our current payment systems in the US. It allows for instant payments and settling between bank accounts at different financial institutions 24 hours a day, 7 days a week, 365 days a year. FedNow is not a cryptocurrency, not a digital dollar, and not built on a blockchain. The Federal Reserve started building this new payment system back in 2019 and conducted pilot programs with various banks – it’s not something that is untested or just appeared overnight. To put the launch into context: America’s payment system was falling significantly behind many other major countries and needed to catch up. Central banks in Germany, the UK, France, Australia, and many other countries launched their own instant payment systems years ago.

What Was US Payment Processing Like Before FedNow?

So, let’s consider the payment processing landscape in the U.S. before FedNow. Payment processing options in the U.S. include wires that transfer within a few hours and usually cost the consumer $25-$30 per wire, ACH payments that transfer the next day, and peer-to-peer payment systems like Zelle or Venmo. Of the options that are free (Zelle, Venmo, and ACH payments), your bank normally puts holds on those dollars received, meaning the bank will not allow you to withdraw those exact dollars for up to 5 business days. We often just don’t see or experience that because we live in a mostly cashless society and would rather use credit cards for merchant transactions. These options will still exist going forward, however, the Federal Reserve is adding FedNow as an additional option. You can think of it as an instant version of wires that are free or cheaper.

What Are the Goals of FedNow?

The goals of FedNow are:

- To improve service quality for bank and credit union customers by providing instant payment processing.

- To lower transaction costs for banks.

- To modernize the retail payments system in the U.S., which lagged many other nations.

Is FedNow a Cryptocurrency or Built on a Blockchain?

While people have been inundated with information about cryptocurrencies and the concept of blockchains in the media, it can be hard to wrap your mind around exactly how the Federal Reserve is providing instant payments without being a cryptocurrency or being on a blockchain. The reality is that other systems exist besides blockchains or cryptocurrencies that can provide instant payment settlement. FedNow is not built on a blockchain, isn’t a cryptocurrency, nor is it creating a digital dollar. It Is built on the ISO 20022 standard, which is a payment system utilizing messaging, models, and a data dictionary, not a blockchain.

Will FedNow Invade My Privacy or Expand the Federal Reserve’s Oversight?

No, FedNow does not invade your privacy nor does it expand the oversight of the Federal Reserve. FedNow adheres to the same anti-money laundering laws and privacy laws as existing payment systems, so there will be no additional layer of oversight or invasion of your privacy. FedNow is just a payment processing platform that financial institutions will use to settle your transactions with other bank accounts instantaneously. It also won’t create a direct link between your bank account and another bank account, as it is a multi-step process that does afford you privacy as it relates to the other bank account you are transacting with.

How Does FedNow Impact Me?

You should start seeing transactions settle instantaneously on the weekends and holidays by the end of July 2023. Pre-FedNow: if you were to send money from your bank account to a family member’s bank account at another institution on a Sunday, you wouldn’t see the transaction go through until Monday or sometimes even Tuesday. Likewise, your family receiving the money wouldn’t be able to pull those exact dollars out of their account until up to 5 days later. Post-FedNow: you should see the transaction go through in real time on Sunday. No more waiting until the next business day or potentially longer for the funds to transfer and no more waiting for up to 5 days to be able to pull the money out in the form of cash.

Some things won’t change, however: you should still have the same login and user experience for your bank account, with the same privacy and anti-money laundering laws your account already adheres to.

What Is the Digital Dollar?

The digital dollar is a commonly used name for the potential central bank digital currency the Federal Reserve is researching for the dollar. A central bank digital currency (CBDC), in theory, would allow for every consumer to have an account holding a digital form of physical dollars at the Federal Reserve, which could speed up transactions and the transmission of monetary policy. On the surface, this sounds a bit shocking and like a potential invasion of privacy, but as you dive below the surface, into the banking system in the U.S., you will find that your bank likely already has an account with the Federal Reserve that it uses to deposit reserves into. Your bank’s reserves are partly made up of money deposited by its customers, meaning you could already have cash that is sitting at the Federal Reserve without necessarily realizing it. That said, the Federal Reserve has already expressed a preference for an intermediated digital dollar. This means you would likely interface with your financial institution to open a digital dollar wallet/account and for any customer service needs you would have, not the Federal Reserve directly.

What Is a Central Bank Digital Currency?

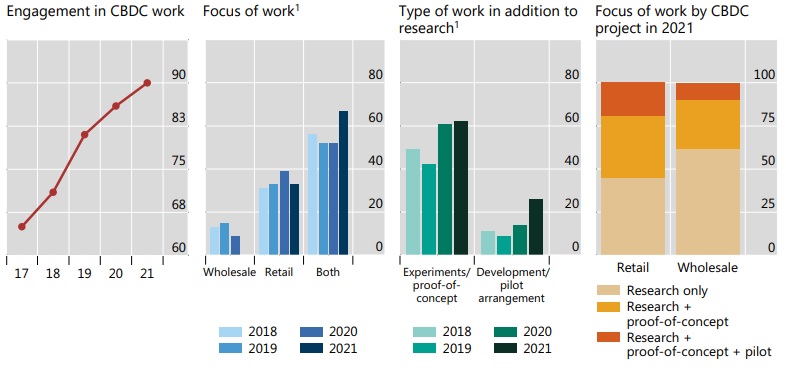

Central bank digital currencies, including the digital dollar, are most comparable to stablecoins within the cryptocurrency space. In the case of the digital dollar, it would be backed by the same thing as the physical dollar: the taxing authority and Treasury issuing ability/full faith and credit of the U.S. government. Part of the reasoning behind the Federal Reserve’s desire to issue the digital dollar is to simply stay competitive and maintain the global dominance of the dollar. Research into the digital dollar is part of a much larger global trend; roughly 90% of central banks are currently researching, piloting, or have already issued a digital currency.

Interest and research on central bank digital currencies is picking up.

Share of respondents conducting work on CBDCs from the 2021 BIS central bank survey on CBDCs and digital tokens. Source: Bank of International Settlements. Gaining Momentum – Results of the 2021 BIS Survey on Central Bank Digital Currencies. As of May 2022.

Emerging market economies are leading the way as the need for a digital currency is much greater when so much of their population does not have easy access to banks. China, for instance, has the largest pilot program for its digital currency (the digital yuan).

Why Would the Federal Reserve Want to Create a Digital Dollar?

As previously mentioned, the Federal Reserve has a strong interest in not falling behind in the central bank digital currency race. For instance, China is piloting its digital yuan in 23 cities, the Bahamas and Nigeria have both issued digital currencies, and many European countries are currently researching digital currencies. If the U.S. does not keep up with central bank digital currencies and the payment ecosystem, then the dollar’s global dominance in trade and assets could be threatened. The U.S. is used to certain economic and geopolitical liberties afforded by being the world’s most heavily used currency.

There are many additional reasons the Federal Reserve would want to create a digital dollar as well:

- To speed up international payments

- To lower the cost of international payments

- To increase access to the financial system for individuals that may not have bank accounts (i.e. if peer to peer payment based institutions were approved as digital dollar intermediaries)

- To protect the dollar’s market share to cryptocurrencies

- To provide a safer alternative to cryptocurrencies with the same speed, cost, and auditing benefits

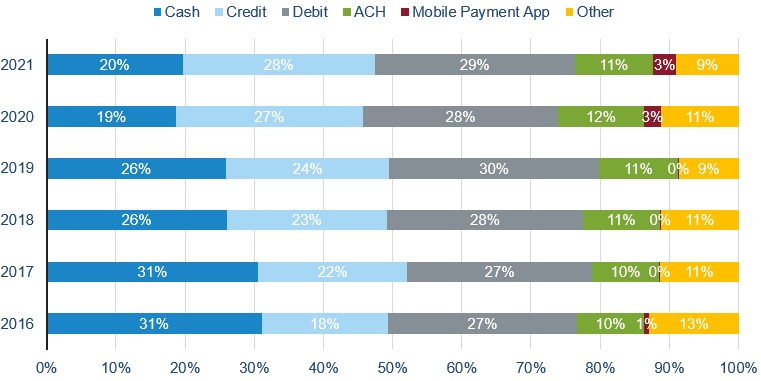

There is already a trend of consumers shifting away from using cash for transactions and towards digital payment methods. As you can see in the chart below, 71% of transactions occurred via credit card, debit card, ACH, or a mobile payment app in 2021 vs. roughly 55% in 2016. It’s important that the Federal Reserve keeps up with these changes in consumer preferences for transactions and currencies or risk consumers turning to unregulated and less structurally sound alternatives.

Consumers are using cash less often than before.

Source: The Federal Reserve. 2022 Findings from the Diary of Consumer Payment Choice. As of May 2022.

What Are the Federal Reserve’s Digital Dollar Guiding Principles?

To increase transparency around its digital dollar research, the Federal Reserve has published its guiding principles for its research:

- The benefits to households, businesses, and the economy must exceed the costs and the risks.

- The potential for the digital dollar to be more effective than alternative methods of currency.

- To protect consumer privacy.

- To protect against money laundering and other criminal activity.

- For the digital dollar to complement other forms of money and payment transactions, not replace them.

As you can see, privacy, regulation, stability, and efficacy are all top of mind for the Federal Reserve. The digital dollar would need to meet these guiding principles for the Federal Reserve to want to proceed and issue a digital dollar.

How Soon Should I Expect to See a Digital Dollar?

Although the Federal government issued a mandate for the Federal Reserve to research a digital dollar in a timely fashion and research is ongoing, a potential digital dollar won’t happen overnight. We don’t even expect the digital dollar to be issued in the next two years. The Federal Reserve has already stressed the importance of issuing and executing the digital dollar correctly vs. quickly – it would want to go through an extensive testing and piloting program before rolling something like a digital dollar out full-scale to every consumer. Likewise, the Federal Reserve would need the authority to issue a digital dollar, which is something only Congress can grant. If you want to dig deeper into the major labs and ongoing projects exploring what hands-on experience with a potential digital dollar, please see the list below:

- Project Hamilton (Federal Reserve Bank of Boston and MIT)

- Innovation Center (Federal Reserve Bank of New York and the Bank of International Settlements)

- Technology Lab (Federal Reserve Board of Governors)

Will the Digital Dollar Lead to a Dollar Crash?

The digital dollar should not lead to a crash in the dollar. The value of the digital dollar would be equivalent to the value of a physical dollar – they would be complementary as outlined by the Federal Reserve in its guiding principles for its digital dollar research. In fact, the digital dollar would likely support the global dominance of the dollar, allowing the U.S. to continue to enjoy certain economic and geopolitical privileges it has grown used to.

Is the Digital Yuan a Threat to the Dollar?

The short answer is yes, it could be. As for the long answer, some additional context is useful before we unpack the question further. As mentioned above, the digital yuan is China’s central bank digital currency. The digital yuan was launched in 2020 and piloted in 11 cities but has since grown to 23 cities. This is the largest-scale central bank digital currency pilot program running today. According to PricewaterhouseCoopers’ Global CBDC Index and Stablecoin Overview report published in 2022, the digital yuan stats are as follows:

- Accepted by 3.6m merchants in China

- There are roughly 261m wallets holding the digital yuan

- Total transactions are about $13.7b

- During the 2022 Winter Olympics in Beijing when foreigners were allowed to use the digital yuan, there was an average of $300k in daily transactions

As you can see from the stats above, the digital yuan pilot program is gaining ground. China states that the goal of the digital yuan is to increase the resilience, convenience, and efficiencies within the retail payment system, and could strengthen the yuan’s globalization. While the comment on the yuan’s globalization is stated often as a side note, it is likely a key consideration within China and is something the U.S. should be aware of. If the U.S. does not create a digital dollar in a timely fashion, it could contribute to the digital yuan or another currency overtaking the dollar. However, fundamental to achieving global dominance in the digital or physical yuan, China would need to adjust many policies when it comes to its financial markets. For the digital yuan to overtake the dollar, at a minimum China would have to:

- Maintain consistent open access to digital yuan wallets to foreigners and companies.

- Maintain consistent, uncapped open access to its financial markets, like its government bonds, which isn’t always the case.

- Allow the yuan exchange rate with other major currencies to be free of government intervention, which it is not currently.

China has a long way to go to evoke enough confidence in its financial markets for investors and companies to become more reliant on the yuan. Nonetheless, the U.S. needs to remain cognizant of this when considering whether to issue a digital dollar.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.