What Is Disability Insurance?

Disability insurance is a type of insurance policy that pays you a portion of your income if you become disabled and unable to work.

Why Is Disability Insurance Important?

Most people insure their assets (i.e. house, car, etc.) against the possible loss of some or all of these assets. However, many fail to insure one of their largest assets: their future earnings.

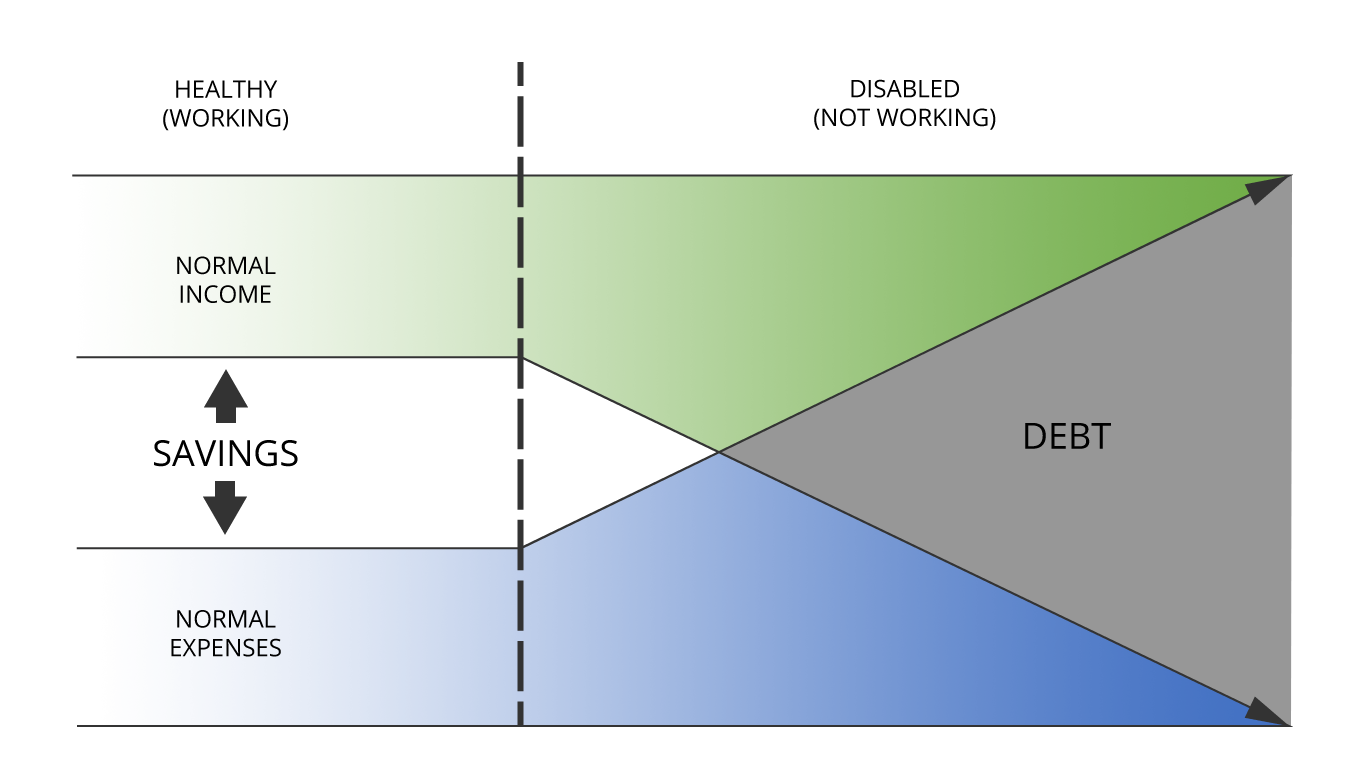

As we discussed earlier, having positive cash flow is critical towards financial progress. But if you or your spouse gets hurt and cannot go to work for an extended period of time, you’ll likely experience a loss of income that could be financially devastating.

Read through this post on disability insurance here, or skip to our AllGen Academy types of disability Insurance video below.

Statistics on Disability

- Nearly 3 in 10 working adults will suffer an accident or illness of 90 days or longer at some point during their career (Life Health Pro, 2015)₁

- The average duration of long-term disability is 2.1 – 3.2 years₂

- For someone in their 30’s, a serious disability is 6.5 times more likely than death₂

- 48% of mortgage foreclosures are caused by disability while only 3% are caused by death₂

You can protect your future income and your family’s standard of living by having adequate disability insurance.

How Do I Get Disability Insurance?

There are multiple factors to consider when choosing disability insurance:

- Type of policy

- Length of coverage

- Amount of benefits

- Taxation of benefits

Types of Disability Insurance

There are two basic types of disability insurance: Short Term and Long Term.

Most employers offer Short Term disability as a benefit at inexpensive rates (usually a few dollars a month). This in addition to a full emergency fund should be enough to cover a short term disability for 3 – 6 months.

After 6 months, you will need a Long Term disability policy to kick in and start paying you a portion of your lost income. It is most critical to have this type of coverage.

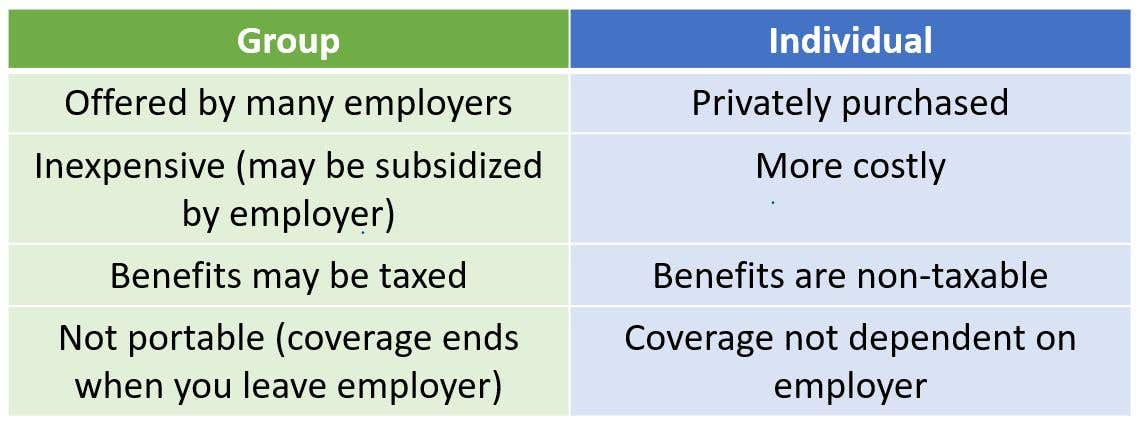

Disability insurance may be offered by your employer (called Group Disability Insurance) or purchased individually. If it is acquired through your employer, the benefits may be taxable and the policy isn’t portable from one employer to another.

Disability Insurance Vocabulary

Here are a few terms that are helpful to learn while selecting your disability insurance policy.

Waiting or Elimination Period

This is the amount of time that must elapse before you can start receiving benefits. When buying a Long Term disability policy, you choose a certain elimination period—usually in 30 day increments up to 180 days. The longer the elimination period, the lower the premium.

Income Replacement Percentage

This is the portion of your income that you’ll receive if disabled. Ideally you would want to replace 100% of your income but most disability insurance policies will only cover 50% – 80% of your gross income. This is important to remember when considering your monthly cash flow in such an event. For example, can you and your household be financially sustainable if your income drops to just 60% of its current level?

Definition of Disability

For insurance companies to assess and apply benefits, disability has to be defined. A disability insurance policy pays out benefits based on what it considers a ‘disability’. The following are examples of how this works:

-

- Any Occupation (“any-occ”) – this type of policy will only pay you a benefit if you cannot work at all.

- Own Occupation (“own-occ”) – this type of policy will pay you a benefit if you cannot continue to work in your current occupation as a result of the disability.Own-occ policies are more expensive as they will pay even if you find work in another industry but cannot continue to work in your specific profession. Typically, highly skilled professionals such as doctors should consider an own-occ policy.

Inflation Rider

This is an optional rider that increases your benefits periodically to maintain purchasing power over time.

How Long Should I Keep Disability Insurance Coverage For?

It depends on how long you plan to continue working and whether you have others who are dependent on your income. Long Term policies typically provide coverage through age 65 (retirement age).

Why Do People Have Disability Insurance?

The goal of having disability insurance is to protect your household income in case of an injury that prevents you from going to work for an extended period of time. This adds financial stability so that your progress towards financial freedom is not disrupted.

As there are many considerations when choosing the proper coverage, it is important to consult a disability insurance specialist for your specific situation.

For more information on types of disability insurance, watch our AllGen Academy video below.

Sources:

₁ Life Health Pro, 2015

₂ Disability Insurance Resource Center, 2017

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.