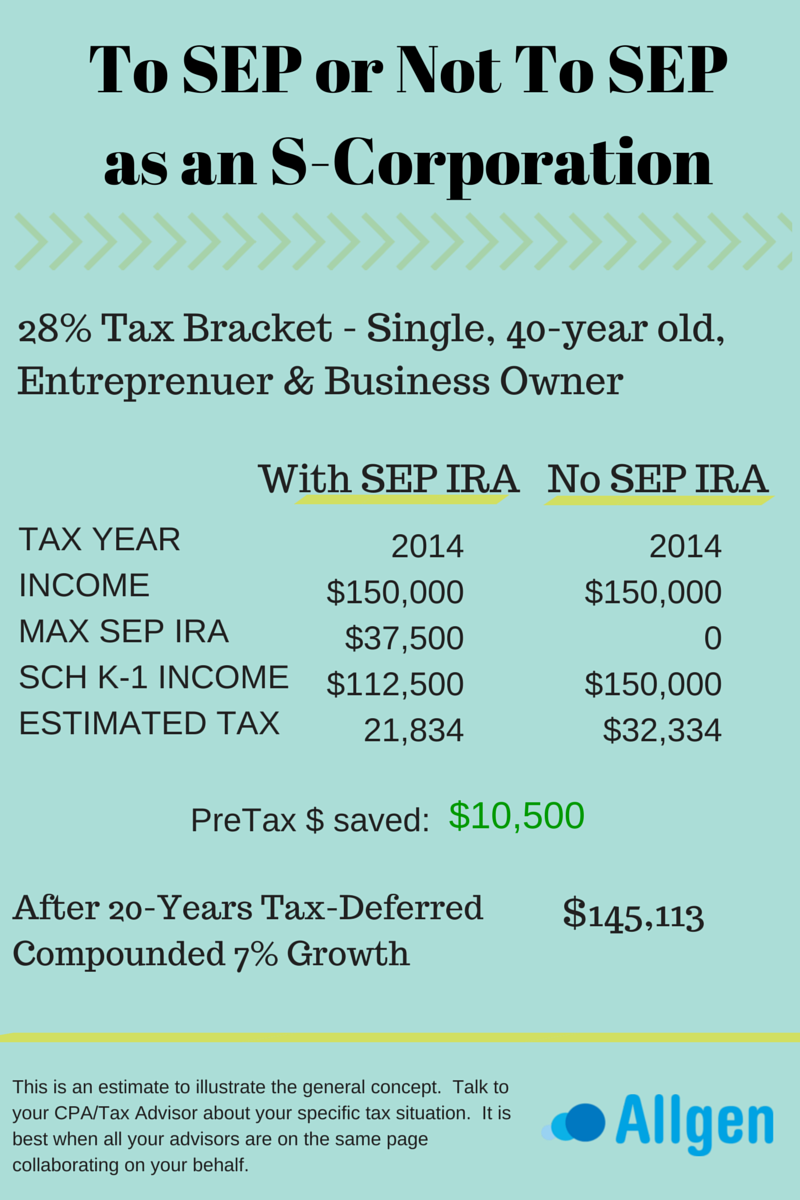

The corporate tax filing deadline is this Monday, March 16th. While most tax deduction opportunities for last year have expired, you might still be able to lessen your check to the IRS. If your company is an S-Corporation and you are looking for a tax deduction before your tax deadline, a SEP IRA might make sense for you.

A Simplified Employee Pension, more commonly known as a SEP IRA, is a type of traditional IRA for self-employed individuals or small business owners. A SEP follows the same investment, distribution and rollover rules as traditional IRAs.

In order to qualify, you must be a sole proprietor, a business owner, in a partnership, or earn self-employment income by providing a service.

Benefits:

- Tax-deferred compounding

All of the money contributed to a SEP IRA, as well as any dividends and/or capital gains on those holdings, grows tax deferred.

- Tax-deductible contributions

Contributions are by the employer and are deductible from federal income taxes.

- Take advantage of flexible funding

Employers can decide every year what amount to contribute, which can vary, or to skip contributing altogether.

- Contribution Limit

25% of compensation or up to $52,000 for 2014

- SEP contributions are not subject to FICA tax

- Minimal administrative costs

How we can help?

Allgen can help you determine if a SEP IRA is right for you. If it is, we can help you open a SEP IRA account by Monday or your filing extension deadline of September 15th.

Most importantly do not forget to file your taxes this Monday!