Read through this post on consumer debt and how to eliminate it or skip to the AllGen Academy debt elimination video below.

With the proper risk management strategies in place, you are well on your way to financial health and independence. However, one of the biggest obstacles to building long-term wealth is debt. Before you can move on to the Formation stage on the Path to Financial Freedom, you need to eliminate all consumer debt from your Net Worth Statement.

What Is Consumer Debt?

Consumer debt consists of debts that are owed as a result of purchasing goods used for personal consumption. These include credit card debt, student loans, and auto loans. While home mortgages can be placed in this category, we don’t include them as consumer debt as these loans are backed by your home—a potentially appreciating asset.

Why It Is Important

Financial success requires the elimination of “bad” money in your portfolio and the growth of “good” money. Bad money is money that is working against you, most often in the form of consumer debt. While it’s possible to make some financial progress while carrying consumer debt, you face the odds of never making it to the next stage because you have too much bad money working against you.

According to Debt.org, the average household in the U.S. has over $30,000 in consumer debt between credit cards, auto loans, and student loans. At these levels, most households are spending 1-2 weekly paychecks just to pay the interest on this debt each month. This is a huge obstacle to overcome when trying to build wealth. Consumer debt should be eliminated as quickly as possible to allow you to grow your wealth exponentially.

How to Avoid Taking on New Debt

In addition to paying off existing debt, debt elimination also requires you to prevent new debt from accumulating. Here are some strategies for avoiding new debt.

- Have an emergency fund. When unexpected expenses come up, you can use your reserves to absorb the cost instead of reaching for the credit card.

- Adopt a spending plan. This helps you live within your means and prevents overspending so you don’t incur more debt.

- Have adequate insurance. Insurance protects your assets and minimizes the amount you have to pay out of pocket when unexpected things come up. At a minimum, you need insurance to protect against catastrophic losses that could result in large amounts of debt. Basic types of insurance coverage include health insurance, auto insurance, homeowners or renter’s insurance, disability insurance, and life insurance.

- Save up and pay for things in cash. When you use credit cards or take out loans to pay for large purchases, you inflate the cost of that purchase over time through interest payments. Even if it seems like a good deal (i.e. Black Friday sales), financing a purchase will most likely cancel out any cost savings by the time you pay off the loan.

Ways to Accelerate Debt Payoff

By accelerating your debt payoff time horizon, you’ll save more money on interest and get to the next stage on the Path to Financial Freedom more quickly. Here are some strategies to expedite your way out of debt.

- Sell some of your possessions. Earn extra money from selling used items on online marketplaces or classifieds websites (i.e. Facebook Marketplace, Craigslist, etc.).

- Work extra hours/overtime or get a side job. There are many ways to earn extra income on the side with the modern gig economy (i.e. ride-sharing, food delivery, running errands, tutoring, etc.)

- Reduce unnecessary expenses. Review your spending plan to cut out subscriptions, memberships, and other expenses that you don’t need (or have but don’t use).

- Change spending habits. Consider adopting a cash envelope system or other behavioral changes to manage your spending. The leaner you can be with your spending, the quicker you can pay off your debt.

The Goal of Eliminating Consumer Debt

Consumer debt is one of the largest obstacles to financial growth. The goal of eliminating debt is to ‘get the monkey off of your back’ in terms of your finances. Even Warren Buffet has been known to warn shareholders about staying away from debt in his annual shareholder reports.

To accumulate a positive net worth and build long-term wealth, you need to stop paying interest to someone else and start earning interest on your own money. Only then will you progress down the Path to Financial Freedom.

How to Eliminate Consumer Debt

There are several approaches to go about eliminating consumer debt. Mathematically, you should pay off the highest interest rate debt first and work your way down to the lowest interest rate debt.

However, we believe another approach is more effective. It’s called the Debt Snowball. Here are the steps to implementing the Debt Snowball:

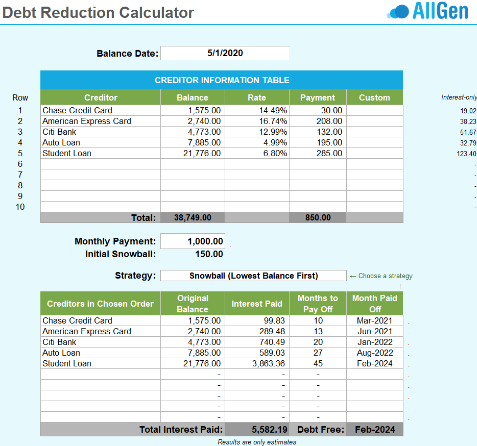

- Make a list of all of your debt including balances, interest rates, and minimum monthly payments.

- Pay off the lowest balance debt as quickly as possible with any surplus you have in your spending plan while paying the minimums on the other debts.

- Once the lowest balance debt is paid off, add that monthly payment to the next smallest debt (minimum payment plus any surplus). This is in addition to the minimum monthly payment on that second debt.

- Repeat this process until all of your debt is paid off.

By redirecting your monthly payments each time a balance is paid off to the next smallest debt balance, you quickly gain momentum and ‘snowball’ your way out of debt. Debt elimination takes a lot of focus and discipline so you need all the momentum you can get to keep going.

Not only will you pay off your debt much sooner using the Debt Snowball method, but you will also save a substantial amount of money in interest payments!

We recommend using a tool like this one to calculate and track your debt elimination plan.

Sample Debt Reduction Calculator

For more information on how consumer debt and how to eliminate it, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.