Allgen Update – October 2016

As we enter the last quarter of the 2016, much uncertainty is looming given the upcoming elections, the banking situation in Europe, the Feds potentially increasing interest rates, etc. In these uncertain economic times, it is tempting to blame your financial situation on the economy, especially when the news continually floods the airways with negativity. Although financial experts and the media would like us to believe otherwise, you can’t control the overall economy, and contrary to popular opinion, neither can politicians. What you can control, however, is what I like to call your personal economy – that is, your own financial situation and its overall health, direction, and vitality. Controlling your own personal economy means no longer being at the mercy of the swings of the external economy, the rate of unemployment, or which party is in office. It means having a plan in place that lets you adjust for unforeseen circumstances while building towards a certain, defined goal. A starting point for taking control of your personal economy is understanding and optimizing your cash flow.

Financial Planning – Cash Flow

Your Journey Starts Here

Creating a Balanced Budget

Creating a Balanced Budget

Tracking monthly cash flow, when combined with tracking your net worth, empowers you with your money. Moreover, it keeps you on track to reach your goals and gives you a full view of your financial picture. While the net worth statement provides you with the macro view, the cash flow statement provides you with the micro view of your financial well-being. Essentially, tracking monthly cash flow is knowing how much money comes in and how much money goes out on a monthly basis.

of your financial well-being. Essentially, tracking monthly cash flow is knowing how much money comes in and how much money goes out on a monthly basis.

A zero based budget is the ideal budget; this is where all of your income minus all your expenses equals zero. This isn’t suggesting you should spend all of your money, but rather assign every dollar into a category. Arriving at the zero-based budget (a balanced budget) is you telling your money where to go rather than your money being spent willy-nilly without focus. When trying to initially build a zero based budget you will need to make adjustments depending on if you have a surplus or deficit. If you have surplus, assign the surplus to pay off consumer debts, build up your cash reserves, maximize your retirement savings, save for big ticket purchase items, or give to charity. Where you allocate your surplus depends on what life stage you are in on your “Path to Financial Freedom”. If you have a deficit, then you need tweak your budget until you arrive at zero. That is done by increasing your income and/or cutting your expenses.

Getting Started

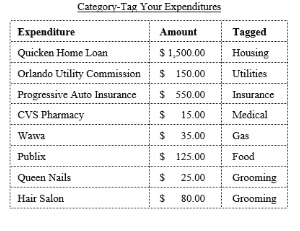

To get started, use the most recent past 1-to-3 months’ numbers to determine an average for your household’s various spending categories. Gather your checkbook and your monthly bank statements. If your household uses a charge card rather than a debit card, then gather your monthly charge card statements. Identify your spending categories and beside each expenditure, tag it with the most appropriate spending category (see example below).

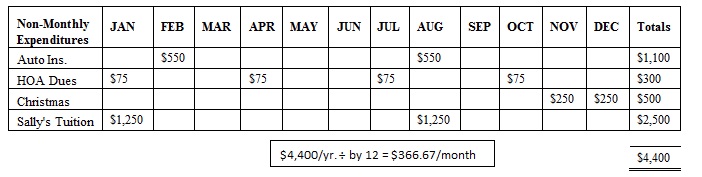

Below you can list out all your non-monthly expenditures for the year and divide the total by 12 and you save this monthly average amount in a savings account every month. When a non-monthly bill comes due, you transfer it to your checking account and pay it. This is your own “escrow” account. Your mortgage service company does this with your property taxes and homeowner’s insurance premium.

Once you have your average monthly budget done it is your blueprint for each subsequent month. Creating the budget ahead of the month can be an empowering experience. You pre-spend the money in the categories that you designate, including for fun and miscellaneous spending. Just be sure you don’t overspend which can happen with the use of charge cards if not closely monitored.

You can’t manage what you don’t measure

Periodically throughout the month you need to track your actual spending against your budget. You can make adjustments as long as you are able to adhere to living within your means. This is accountability. The budget is your benchmark by which you measure your performance. Generally speaking, most of us feel fulfilled when our financial resources are used for giving, saving, investing, and spending. Is your spending activity in alignment with your values and goals? If you are new to budgeting anticipate messing up for the first few months, don’t give up though as you will get the hang of it.

“After just 3-months of budgeting, 84% of people say they feel more in control of their money.” – www.daveramsey.com

Working Together with your Spouse

Budgets often get a bad rap because one spouse uses the budget to control the other. The phrase, “it’s not in the budget!”, can sound like nails being scraped along a chalk board to some. Others may be thinking “I do the budget but my spouse doesn’t follow it”. The proper way to get on the same page is to do the budget together. One person can make the budget, but then present it to the other and allow them to make suggestions and change things. Just make sure it stays balanced, if you add to one area you have to take from another. Once both spouses feel they have a say in the budget both are more likely to follow it. This eliminates a lot of the money fights and does wonders for your marriage, trust me!

Use Technology to Track and Monitor

As a client of Allgen you are offered your own personal financial website called Wealth Tracker to help you aggregate and connect all your financial accounts in one place. You can create a budget on Wealth Tracker and keep track of your spending activity. With secure online access, you can log in from your computer and most mobile devices: laptops, tablet, or smartphone. In today’s app driven and cloud-storing environment, we have so many tools to help us succeed.

We invite you to stay connected with Allgen’s market viewpoints and financial education. Our weekly “Money Minute” video series answers your financial questions and helps guide you on your path to financial freedom. You can find us via www.allgenfinancial.com, Facebook, LinkedIn, Twitter and YouTube.

Written by Ana Fernandez, CFP®, with Allgen Financial Advisors, Inc. Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. Allgen Financial Advisors, Inc. (“Allgen”) is an investment advisor registered with the SEC. Allgen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by Allgen. It is not intended to be a solicitation or offer to sell investment advisory services to residents of any state in which Allgen is not currently authorized to do so. The Disclosure Brochure, Form ADV Part II, which details the business practices, services offered, and related fees of Allgen, is available upon request.