by | | AllGen Academy, Foundation, Homebuying, Uncategorized

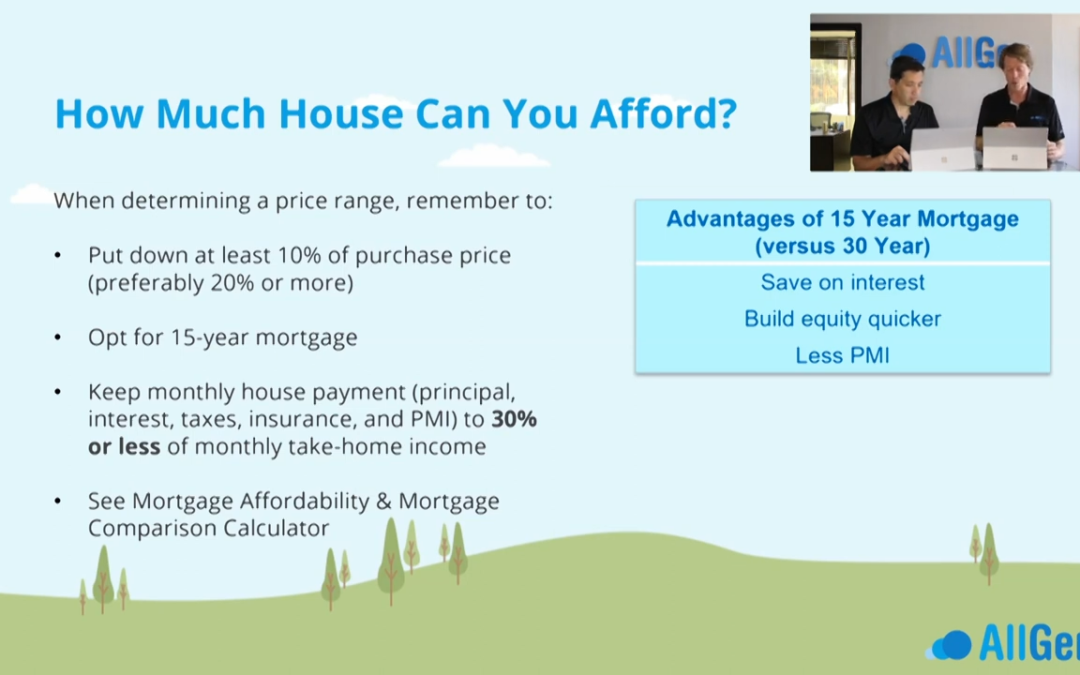

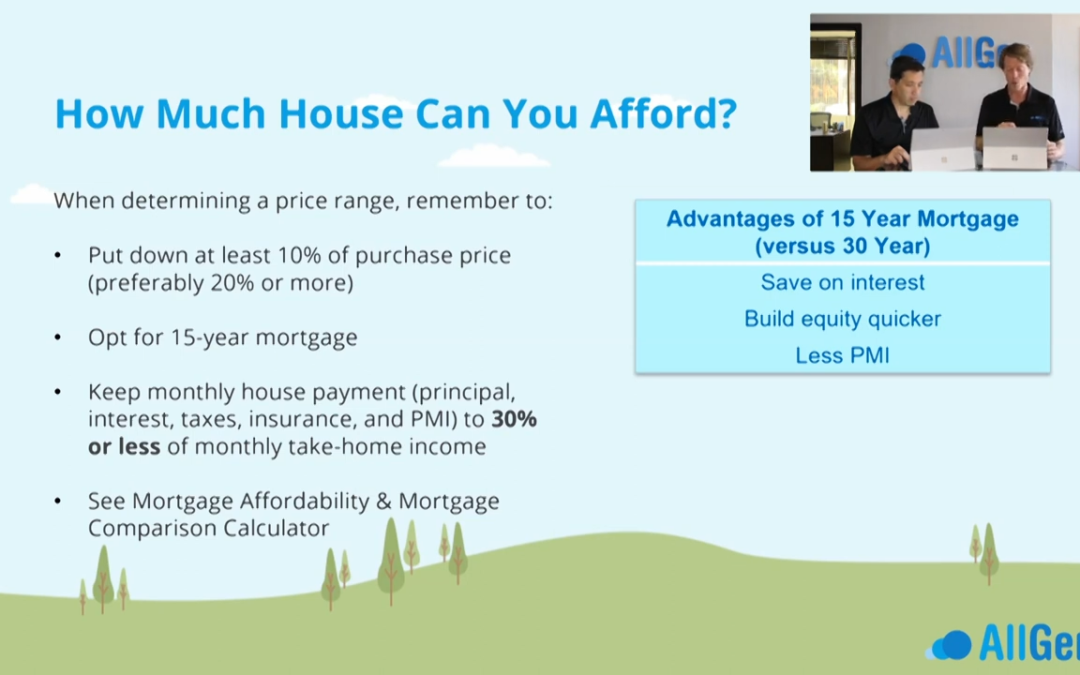

Determining exactly how much home you can afford is an important step in the home-buying process. Before you buy a house, you’ll need to figure out how much mortgage you can afford each month as well as how much of a downpayment you would need to avoid having to...

by | | AllGen Academy, Foundation, Homebuying

Before you buy a home, it’s important to determine just how much home you can afford. You’ll need to figure out both how much of a down payment you’ll need to avoid PMI as well as how much you can afford per month to pay off the mortgage. Our...

by | | Allgen, Featured Posts, From the Trade Desk, Market Commentary, Market Updates

Read through our market commentary here, or skip to Jason’s October 2022 Market Update video below. 2022 has continued to be a very difficult year for investors as the Fed continues to aggressively raise interest rates in efforts to slow down the economy and...

by | | AllGen Academy, Financial Planning, Foundation, Homebuying

What Is Private Mortgage Insurance (PMI)? Private mortgage insurance, or PMI, is a type of insurance for your mortgage. If you put down less than 20% on your home when you buy it, you’ll most likely be required to purchase PMI. Although you’re paying for the PMI, it...

by | | AllGen Academy, Financial Planning, Foundation, Homebuying

When it comes to buying a home, afford is a relative term. You may be able to afford the monthly payment on a house, but at what cost? Before the 2008 housing crash, many homebuyers who were making minimum wage were assured that they could afford half-million dollar...