What Are Active & Passive Investing?

There are two approaches or schools of thought when it comes to investing:

- Active investing – the portfolio manager attempts to outperform a standard index or benchmark by making proactive investment decisions

- Index investing – passive strategy where a fund attempts to replicate a stock market index (unmanaged basket of similar securities)

Keep reading this blog or skip to our active vs. passive investing video below from AllGen Academy.

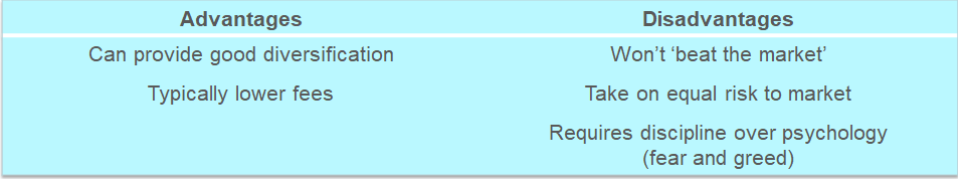

Index Investing

Index investing has become increasingly popular over the past 15 years as more index mutual funds and ETFs are created. It offers a way for an average investor to ‘own the market’ with lower fees.

It’s important to be aware of investment psychology that may jeopardize positive performance in the long run. Many investors get scared and sell when the market goes down then get excited and buy after the market goes up. This is the opposite of “buy low, sell high.” Succumbing to bad investment psychology can cause your approach to backfire.

In order to be successful with index investing, investors need to weather volatility during difficult times in the market and avoid selling out. Investors should also avoid the temptation to be overly aggressive after a big market run.

Robo Advisors

Robo advisors are investment advisory firms that offer index-driven portfolios to individuals through a website or app. They have grown in popularity over the past decade and continue to be a simple and accessible way to invest.

However, investors also run the risk of underperforming using these technologies as they have the ability to become more aggressive or conservative in their portfolio as the market changes. Investment psychology can cause investors to take a more active approach and try to time the market using robo advising solutions. This may inadvertently hurt their investment returns in the long run as many time it wrong.

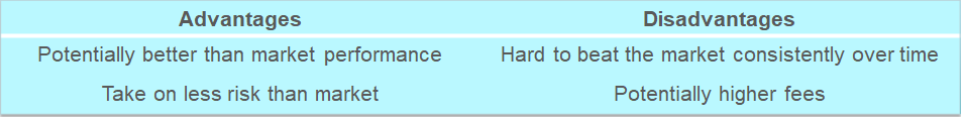

Active Investing

On the other hand, active investors proactively choose investments in a portfolio with the intention to ‘beat the market’ with reduced risk. Lower risk can reduce volatility in the portfolio which helps investors psychologically through market downturns.

However, it’s difficult for active money managers to consistently outperform the market in the long run. One study shows that only 20% of mutual funds beat their benchmarks net of fees over a 10-year period1. With over 10,000 mutual funds available on the market, investors still have many options among the 2,000 funds that do outperform over the long run. The trick is finding good funds by doing market research. Investors can take on this task themselves or hire a money manager to choose the appropriate funds for their portfolio.

Another disadvantage to active investing is that it comes with potentially higher fees. ETFs or mutual funds that replicate an index such as the S&P 500 require less work to manage so they may have lower fees. Actively managed funds aim to boost returns through extensive market research in order to find the most promising stocks, bonds, winning sectors, etc. Because of this, many actively managed funds charge higher fees to compensate for the additional work and skill needed to produce potentially higher returns.

It’s important to note that the main objective is not to have the lowest fees but rather to achieve better returns net of fees with less risk. While passive funds may emphasize low fees, that is just one part of overall performance, not the whole picture. The focus should be on returns after all fees relative to the amount of risk taken to achieve those returns.

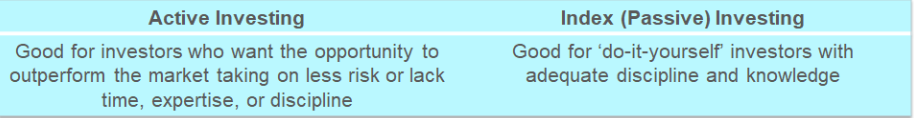

Which Approach Is Best?

All investing approaches have pros and cons. The right approach for you depends on your personality and the type of investor that you are.

If you’re a do-it-yourself investor, you may be better suited for passive or index investing. Aim for lower fees with a well-diversified portfolio (including more than just one index such as the S&P 500) and stick to it over time.

If you’re a delegator, you may prefer to work with a fee-based advisor with a strong track record in active money management. The advisor can help you build a solid portfolio that you are comfortable with and monitor the portfolio going forward. The advisor can also help dissuade you from making bad investment decisions driven by investment psychology. The added benefit of behavioral coaching from working with an advisor can potentially increase returns by as much as 3% annually over time 2.

Make sure you understand the pros and cons of active versus passive investing so you can choose the approach that is right for you.

For more information on active vs. passive investing, what our video from AllGen Academy below.

Sources:

- Staff, I. B. D. (2021, June 17). 877 Best Mutual Funds Topped Their Categories And Beat Benchmarks Over 1, 3, 5 & 10 Years. Investor’s Business Daily. https://www.investors.com/etfs-and-funds/mutual-funds/best-mutual-funds-beating-sp-500-over-last-1-3-5-10-years/#:~:text=Among%20funds%20at%20least%2010,index%20in%20those%20four%20periods.

- Kinniry, F. M., Jaconneti, C. M., DiJoseph, M. A., Zilbering, Y., & Bennyhoff, D. G. (2019, August 16). Putting a Value on Your Value: Quantifying Advisor’s Alpha . Vanguard. https://advisors.vanguard.com/insights/article/IWE_ResPuttingAValueOnValue.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.