The Long and Short of It:

- Increased volatility is

causing extreme pessimism, which may be a good thing

- Trade war fears may be overblown

- FED is suggesting faster economic growth and higher interest rates

1st Quarter Review

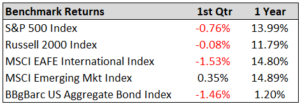

Stocks started the year strong in January, but then pulled back sharply from their recent highs in February and March. Essentially all major areas of the stock market declined in the quarter except emerging markets that had a small gain. Bonds declined as interest rates rose. In this quarter’s market commentary, we discuss how increased volatility and fear may be a good thing, talks of trade wars, and an upgrade by the Fed in their interest rate and economic growth outlook.

Increased Volatility Causing Extreme Pessimism…Which Could Be a Good Thing

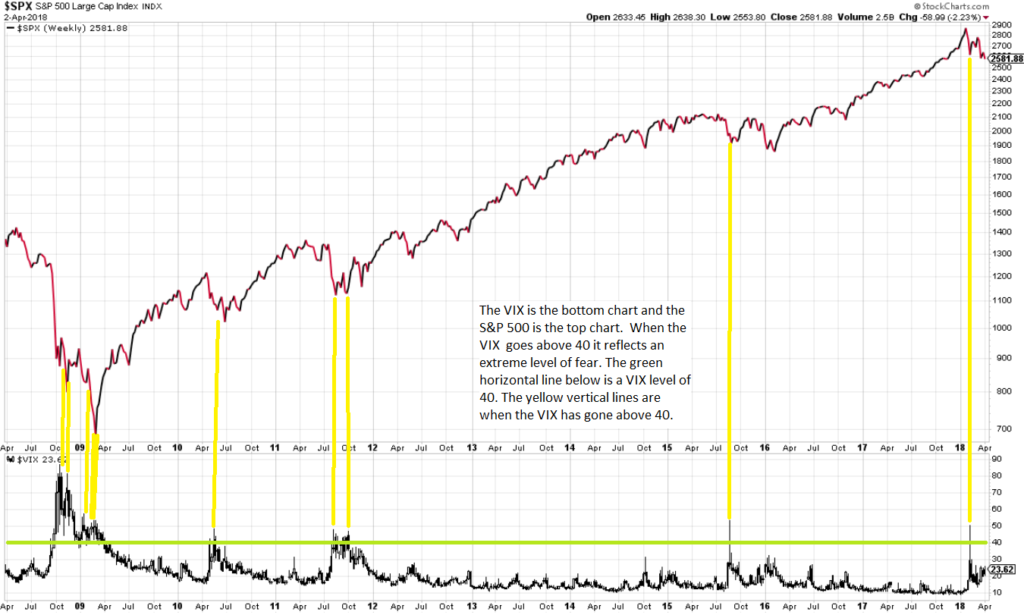

Last year the market did not have a pullback greater than 3%. In the last 100 years there has only been one other year (1995) that had volatility that low. In fact, in the last 5 years, the market’s volatility has been extremely low from a historical standard. In general, people have been conditioned to believe low volatility is normal. However, over the past 20 years the average intra-year decline is over 15%.1 The most recent pull back from the January high to the April low is just over 10%. Since people have not been exposed to high volatility over the last 5 years, the recent pull back has caused some extreme pessimism and fear. Times of extreme fear and pessimism have historically been good buying opportunities for long-term investors. Warren Buffet once said, “The stock market is the only place where, when everything goes on sale people run for the exits.” One indicator that we track to measure fear is the CBOE S&P 500 Volatility Index (VIX). As you can see below, in Feb. when the market initially dropped, the VIX rose above 40 (an extreme level of fear). Historically, when the VIX has exceeded a level of 40 (the yellow vertical lines below), it has been an excellent buying area for long-term investors. Other sentiment indicators have also confirmed high levels of pessimism.

Trade Wars and Tariff Fears May Be Overblown

The recent news of steel and aluminum tariffs along with the Trump administration announcing a list of trade restrictions and large amounts of tariffs on China has caused investors a lot of anxiety. While we believe a trade war would be bad for the global economy, we also see the probabilities of an outright trade war occurring to be very low. President Trump tends to use a strategy in which he comes out extremely strong to gain leverage, then he backs off to negotiate a deal. For example, initially when President Trump announced that there would be tariffs on steel and aluminum imports with “no exceptions” he ended up backing off and exempted Canada and Mexico and offered the possibility of exempting other allies.2 We view the recent announcement of tariffs and trade restrictions with China as a negotiating tactic to try and improve trade policies with China. While headlines around the subject of trade wars can lead to investor anxiety we see it as a tactic to negotiate a better deal.

The FED is Predicting Higher Rates and Higher Growth

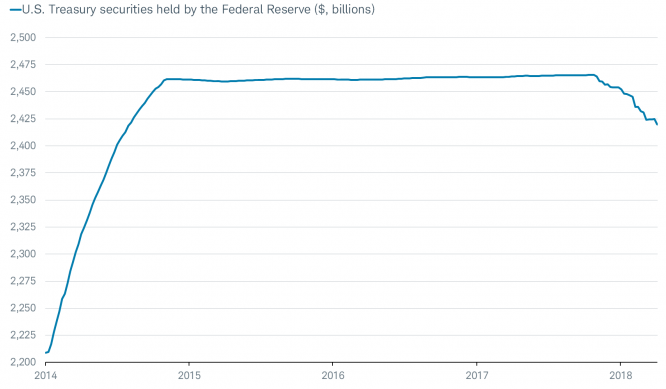

The Federal Reserve (FED) started the year predicting that it will raise rates 3 times in 2018, totaling an increase of 0.75%. At their recent March meeting they stuck with their forecast of 3 rate hikes this year. The central bank, however, raised its forecast for the number rate hikes over the coming few years implying that they will raise rates 3 times for the next two consecutive years ending 2020 at approximately 3.4% (currently the rate is between 1.5%-1.75%). The FED also upgraded its estimates for economic growth. The median estimate for GDP growth for 2018 was raised to 2.7% versus 2.5% previously, while the 2019 estimate was increased to 2.4% from 2.1%.3 Also noteworthy the FED has accelerated (as planned) its quantitative tightening program, decreasing the amount of bonds on its balance sheet by around $18 billion a month (see chart below).4 These factors should continue to put upward pressure on interest rates and downward pressure on bond prices. As active money managers, we try to overweight areas that we believe will perform well and underweight weaker areas. As such, on the stock side of our portfolios, we are underweight interest rate sensitive areas like REIT’s, utilities, telecoms, and overweight sectors that tend to do better in a rising interest rate environment like financials. On the bond side of our portfolios, we hold a smaller overall percentage of bonds and a shorter duration than their respective benchmarks.

Source: Charles Schwab, FactSet, as of April 6, 2018

Going Forward

We believe the recent volatility in the market may prove to be a good opportunity to invest as historically extreme levels of fear and pessimism has resulted good entry points. While recent news over potential trade wars has caused investor anxiety, we believe that the proposed trade tariffs by the US is a negotiating tactic and the risk of an outright trade war is low. Finally, we believe interest rates will continue to rise, possibly at a faster pace in the future. As such, we have positioned our portfolios for a rising rate environment. We constantly monitor the markets, economies, interest rates, currencies, sentiment, and many other indicators to try to stay ahead of the markets as we look to preserve and grow our client’s wealth. Our investment philosophy is to manage risk first in efforts to avoid a major loss, as we seek to outperform markets over a full market cycle net of our management fee. We appreciate your trust and confidence in us!

1: Source: https://intelligent.schwab.com/public/intelligent/insights/blog/stock-market-corrections-not-uncommon.html

2: Source: https://www.reuters.com/article/us-china-usa-trade/trump-sets-steel-and-aluminum-tariffs-but-exempts-canada-mexico-idUSKCN1GK09C

3: Source: https://www.schwab.com/resource-center/insights/content/fed-rate-hike-what-does-it-mean

4: Source: https://www.schwab.com/resource-center/insights/content/gettin-tighter-financial-conditions-effect-on-stocks?cmp=em-QYD

Written by: Jason Martin, CFP®, CMT, Chief Investment Officer, Paul Roldan, Chief Executive Officer; Christina Shaffer, Junior Analyst Allgen Financial Advisors, Inc.;

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.

causing extreme pessimism, which may be a good thing

causing extreme pessimism, which may be a good thing