The Long and Short of It:

- Tax cuts are likely to produce greater after-tax earnings and increase disposable incomes

- Bitcoin is displaying bubble-like characteristics

- The FED is signaling 3 rate increases for 2018

4th Quarter Review

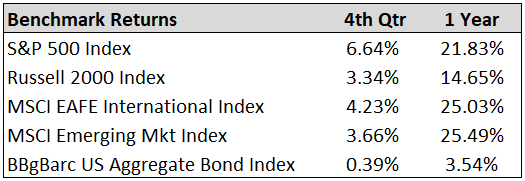

Stocks finished the year strong in the fourth quarter. Large US stocks led the way, but essentially all major areas of the stock market rose at a good pace. Bonds were nearly flat. In this quarter’s market commentary, we look at how the recent tax bill affects the markets, a potential bubble in cryptocurrencies, and the interest rate outlook for 2018.

How Will the Tax Cuts Affect the Markets?

Without going into all the changes of the tax reform, the two major benefits to the economy and the markets are an increase in after-tax profits to most corporations, and higher disposable income for most families. Under the new bill, the corporate tax rate will decline from 35% to 21%. This means corporations will most likely produce greater after-tax earnings. The likely results of greater after-tax earnings are increases in capital expenditures (buying buildings, equipment, etc.), stock-buybacks, wages, and dividends. These effects should be good for the economy and the stock markets. Ordinary income tax rates went down for most individuals. Some itemized deductions are being reduced or eliminated, and the personal exemption and dependent deduction are eliminated. However, the standard deduction and the child tax credit will double, which for most families, will make up for the reduced deductions and elimination of the personal exemption. The new bill also helps most small business owners since pass-through entities (i.e. S-corps, LLC’s, etc.) will be in slightly lower tax brackets, and most will be able to exclude a portion of their net income from taxation. All this to say that most families will pay less in taxes, which should lead to higher disposable income. If families and individuals have a higher disposable income, then they will have the ability to buy more things, invest more for their future, and travel more, all of which are good for the economy.

The two major cons of the recent tax bill are the potential for increased deficits and national debt. Initially, tax revenues are expected to decline from the tax cuts. If the government has lower tax revenues and does not decrease government spending, then it will have higher deficits, which will lead to more government debt. The current US government debt level is $20 trillion. An increase to government debt during strong economic times would not be ideal. This is a time where we could lower deficits and pay down debt. However, if the GDP grows more than 3% a year, and the government controls spending, then we could make progress on reducing deficits and potentially lower debt levels. I’m not holding my breath.

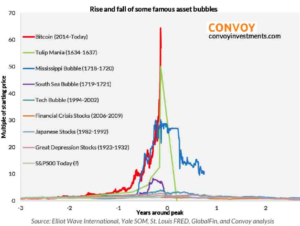

Bitcoin and Cryptocurrencies are Showing Signs of a Bubble

Since cryptocurrencies are such a hot topic, we thought it appropriate to discuss. First, what is cryptocurrency? Satosho Nakamoto, the unknown inventor of Bitcoin, defined it as “an electronic cash system that uses a peer-to-peer network to prevent double-spending. It’s completely decentralized with no server or central authority.” Since cryptocurrencies’ emergence in early 2009, they have seen an astronomical rise in their value. In the prior 3 years leading up to Bitcoin’s recent peak on 12/18/17 its price went up nearly 64 times! On 12/19/14 Bitcoin closed at $299 and its recent peak on 12/18/17 was $19,180! Pictured on the next page is a chart of Bitcoin compared to the largest bubbles in history. The price of Bitcoin in a 3-year period has gone up higher than all the prior bubbles, making it the largest bubble in history from that standpoint. While an astronomical price rise is one characteristic of a bubble, other signals that point to a bubble are: 1) Bitcoin and other cryptocurrencies are constantly discussed even in non-financial circles, 2) People who have never invested before are buying it with the expectations of huge gains, and 3) So-called “financial experts” are predicting price increases much higher than where the price currently stands. These are all characteristics typical of a bubble. While no one knows when the bubble will “pop,” as a general rule-of-thumb in investing, it is usually not a good idea to buy something after a rise of 6400%!

We strongly advise that you do not invest in Bitcoin at these current levels due to the amount of risk that you would incur. Or, if you do invest in Bitcoin or other cryptocurrencies, then only invest what you are willing to lose. One of my favorite Proverbs is: “Steady plodding brings prosperity; hasty speculation brings poverty.” This proverb has served me well, when I’ve applied its wisdom. Building wealth over long periods of time comes from disciplined saving, investing in proven long-term investments, and being properly diversified. Anytime I hastily speculated and tried to get rich quick, I usually ended up with a large loss.

Source: https://blockgeeks.com/guides/what-is-cryptocurrency/

Rates to Continue to Rise in 2018

The Federal Reserve (FED) is predicting that it will raise rates 3 times in 2018, totaling an increase of 0.75%. The market expects rates to go up 2-3 times or between 0.50%-0.75%. The FED has also commenced its quantitative tightening program, planning to incrementally decrease the amount of bonds on its balance sheet during the year. Globally speaking, last year was the first year that no major country around the world had interest rate cuts. This is due to the economies around the world strengthening and inflation finally starting to increase. These factors should put upward pressure on yields and downward pressure on bond prices. As active money managers, we try to overweight areas that we believe will perform well and underweight weaker areas. As such, on the stock side of our portfolios, we are underweight interest rate sensitive areas like REIT’s, utilities, telecoms, and overweight sectors that tend to do better in a rising interest rate environment like financials. On the bond side of our portfolios, we hold a smaller overall percentage of bonds and a shorter duration than their respective benchmarks.

Going Forward

We believe the recent tax bill is a net positive for the economy and the stock market. The positives being increased after-tax corporate earnings and increased disposable income for families, and the negatives being increased government deficits and debt if the economy does not grow at more than 3% a year. While cryptocurrencies have intrigued investors recently with their astronomical price returns, we caution against investing in anything that has shown multiple bubble-like tendencies. Finally, we believe interest rates will rise again this year. As such, we have positioned our portfolios for a rising rate environment. We constantly monitor the markets, economies, interest rates, currencies, sentiment, and many other indicators to try to stay ahead of the markets as we look to preserve and grow our client’s wealth. Our investment philosophy is to manage risk first in efforts to avoid a major loss, as we seek to outperform markets over a full market cycle net of our management fee. We appreciate your trust and confidence in us!

Written by: Jason Martin, CFP®, CMT, Chief Investment Officer, Paul Roldan, Chief Executive Officer; Christina Shaffer, Junior Analyst Allgen Financial Advisors, Inc.;

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.