Read through this post on compound interest or skip to the AllGen Academy time value of money video below. Don’t forget to download our time value of money calculator to help you determine how much you need to save to be financially free.

Perhaps the single most fundamental concept to understand in investing is the Time Value of Money (TVM), the idea that one dollar today is worth more than one dollar tomorrow. Because money can be invested and earn interest, there is value in having money now so that it can be put to work. This is a core principle in finance that underpins everything else you’ll learn in this chapter.

Compound Interest

Albert Einstein said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

The principle of TVM allows your money to compound over time. Simple interest is the growth of your principal (initial deposit) over one year. Simple interest grows your portfolio linearly over time.

On the other hand, compound interest is interest earned on your principal and the interest accumulated in the previous year(s). Because the cumulative sum of your principal and interest earned increases each year, compound interest grows exponentially over time.

Interest = (Initial Deposit + Previous Interest Earned) x Interest Rate

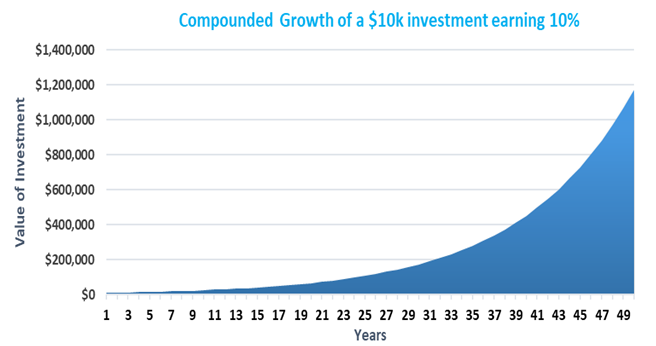

Example: An initial deposit of $10,000 earning 10% annually grows into:

- $25,937 after 10 years

- $67,275 after 20 years

- $174,494 after 30 years

- $452,593 after 40 years

- $1,173,909 after 50 years!

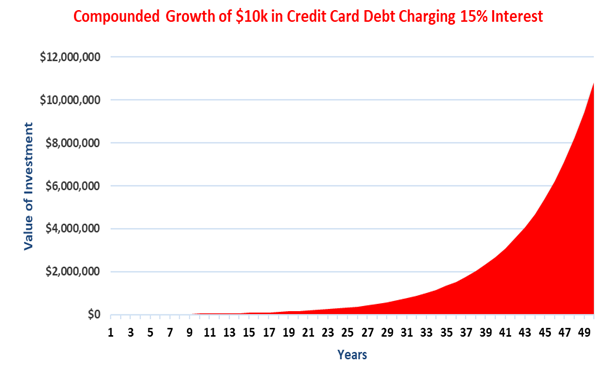

Just as compound interest can work in your favor and grow your wealth exponentially over time, it can also work against you. For example, the average credit card interest rate in America in 2020 is 15%1. If you owe $10,000 in credit card debt and don’t make any payments, your balance would grow to:

- $40,456 in 10 years

- $163,665 in 20 years

- $662,118 in 30 years

- $2,678 in 40 years

- $10,836,574 in 50 years!

Timing the Market

The key to long-term success in investing is the ability to consistently “buy low and sell high.” Very few people can do this successfully over time.

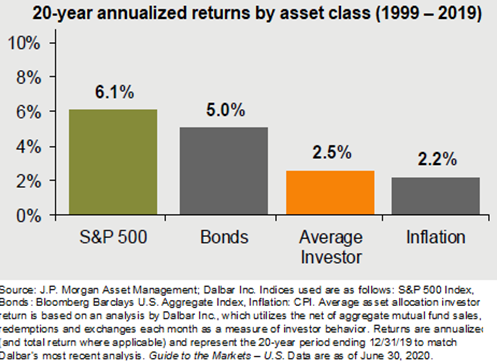

When amateur investors attempt to ‘time’ the market, the opposite usually happens: they end up buying high when the market is going up (greed) and selling low when the market is going down (fear). Their investing decisions are largely based on hype and emotion. Because of this, the average investor significantly underperforms over the long term.

As you can see from this chart, the average investor barely outperforms inflation over a 20-year period.

Time In the Market

Instead of attempting to time the market, a better, more sustainable approach to building long-term wealth is making sure you have sufficient time in the market. This means sticking with investments over the long run as opposed to constantly getting in and out of the market. By doing so, you can allow compound interest to work its magic to positively impact your financial picture.

Time Value of Money Calculator

The first tab, “How Much to Be Financially Free,” helps you define how much you need to reach Financial Freedom.

The second tab, “How Much to Save,” tells you how much you need to save annually to achieve the amount defined in the first tab.

We invite you to play around with these calculators! There are various inputs that you can change to get different results. This will help you visualize how compounding works.

Click to download our Time Value of Money calculator.

For more information on how to pay off your mortgage, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.