Read through the blog here, or skip to Christina’s Rising Interest Rates video below.

Key Takeaways:

- Expect bond market volatility to remain high as markets wrestle with an economy that isn’t in a broad-based recession yet and is still dealing with lingering inflation.

- The labor market is a key area to watch – it needs to materially weaken before inflation cools and the Fed finishes hiking rates.

- The broad bond market may experience its third straight year of negative returns in 2023.

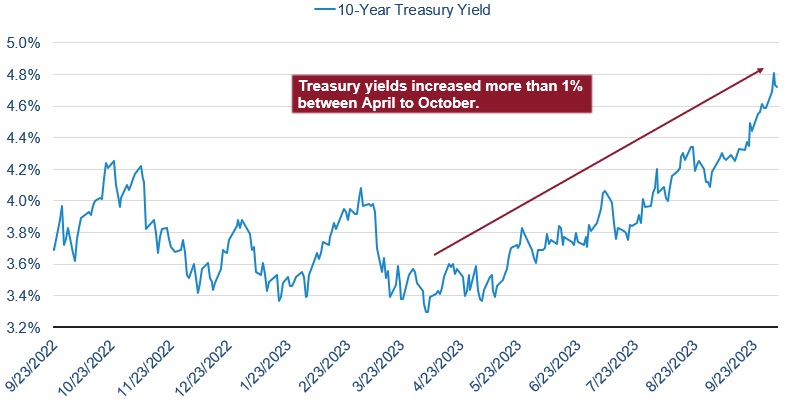

Markets are hearing the Federal Reserve’s “higher for longer” message loud and clear. From April’s low, the 10-year Treasury yield rose more than 1.0% from 3.30% to 4.69%. The whipsaw in yields is contributing to widening credit spreads and negative bond market returns year to date. I suppose the old adage hasn’t changed – when the Federal Reserve hikes rates things tend to break. 2023 could end up being the third straight year of negative returns in the bond market.

The 10-year Treasury yield climbs as the Federal Reserve signals “higher for longer”

Source: YCharts. 10-Year Treasury Yield. Daily data as of 10/6/2023.

But there’s still hope; higher yields are presenting opportunities we haven’t seen in the bond market in over a decade. Let’s look at why yields are climbing higher, what to expect going forward, and the opportunities we are taking advantage of for our clients in their portfolios.

Why Are Long-Term Treasury Bond Yields Rising?

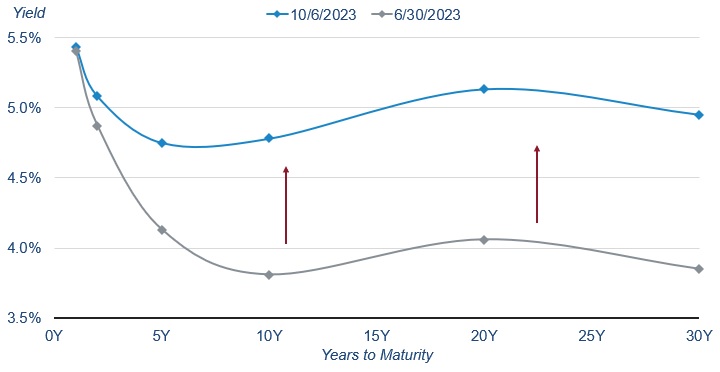

The market’s expectations for Federal Reserve rate cuts are being pushed back, causing long-term yields to rise. Below is a chart of the Treasury yield curve, which is a curve formed from the yield investors can receive for each maturity. The shape of the curve tends to relate to the expectations for the path of the Fed funds rate (the rate the Federal Reserve uses to set monetary policy), inflation, and growth expectations. When the market expects the Federal Reserve to hold rates steady, then the Treasury yield curve tends to flatten, as you can see in the chart below with long-term yields rising more than short-term yields.

Long-term Treasury yields rose more than short-term Treasury yields recently

Source: YCharts. Treasury Yield Curve. Data as of 10/6/2023 and 6/30/2023.

Treasury Yields Rising in Response to Fed Rate Hikes

Given the uncertainty around the path for the Fed funds rate, investors are demanding compensation for investing in longer-term Treasuries. 2023 has been a wild year for Treasury yields – they initially dropped due to the mid-size banking crisis, but now yields are rising dramatically as the Federal Reserve signaled that rates would be “higher for longer” over inflation concerns. Keep in mind that the relationship between yields and the prices for bonds move inversely – when yields rise, prices fall and vice versa. So, longer-term Treasury prices have dropped as yields rose over the last few weeks. It is no wonder that investors are finally demanding higher compensation in the form of higher yields for this level of uncertainty around the Federal Reserve’s policy, growth, and inflation.

Watch the Labor Market and Inflation for Clues on Where Fed Rates Will Go

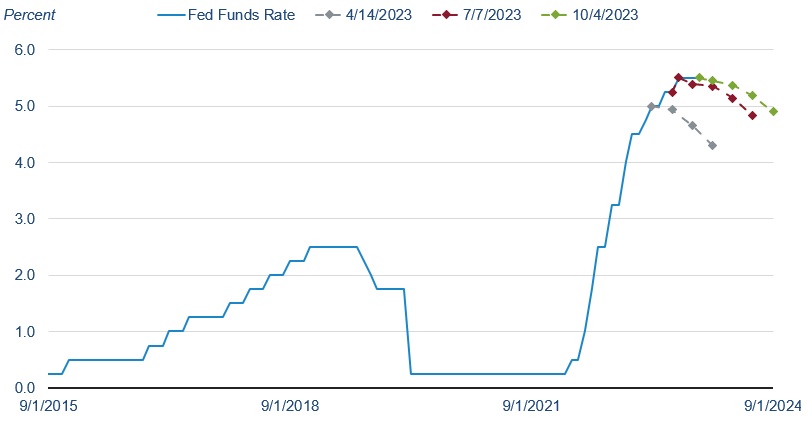

The direction of rates is highly dependent on the market’s expectations for Federal Reserve policy. Federal Reserve policy is commonly expressed through the Fed funds rate and is dictated by the Federal Reserve’s mandate to target 2% year-over-year inflation and full employment in the economy. Markets were pricing in rate cuts before year-end only a few months ago, as many leading economic indicators pointed to a recession. Admittedly, so were we! Now, things have shifted and, with them, our outlook.

Market expectations for the Fed funds rate have shifted up

Note: This chart shows the Fed Funds rate and market expectations for the Fed funds rate on 4/14/2023, 7/7/2023, and 10/4/2023. Source: Federal Reserve Economic Database, YCharts, Atlanta Fed, and CMEGroup. The Fed Funds Rate Upper Target and forecast for Fed Funds Rate using Fed Funds Futures. As of 10/4/2023.

The broad US economy is stronger than many previously thought.

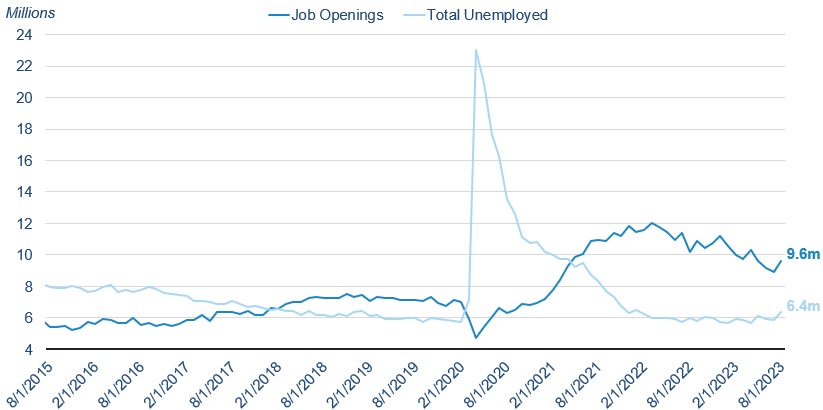

The economy seems to be averting a broad-based recession in the near term as jobs added to the economy continue at a healthy rate, the GDP remains higher than expected, and financial conditions remain loose. Expectations for real GDP in 2023 and 2024 have risen and job openings (more of a leading indicator than jobs added) are still elevated above pre-pandemic levels. As of August, there are still more job openings than unemployed people looking for jobs, creating a shortage of 3.2 million workers.

There is a shortage of 3.2 million workers relative to job openings

Source: YCharts. Job Openings and Labor Turnover Survey: number of job openings and Bureau of Labor Statistics: Total Unemployed. Monthly data as of 8/31/2023.

Demographics of the Labor Market

To understand whether this is likely to be a short-term issue or a long-term issue, we can examine the demographics of the labor market. We have more baby boomers aging out of the workforce than we do younger entrants into the workforce, starting their careers. To fill this deficit in new entrants to the workforce, we could rely on immigration as we have done in the past. There are still quite a few people who would gladly move to the US legally, work, and pay taxes. Yet, the current sentiment towards immigration within Congress is not supportive enough to fill this void through immigration. The result: demographics that are supportive of a tighter labor market, supportive of wage inflation, and supportive of the Fed keeping short-term rates higher for longer. We see the chances of a rate hike more likely than a rate cut over the next 6 months.

Inflation and the Service-Based Economy

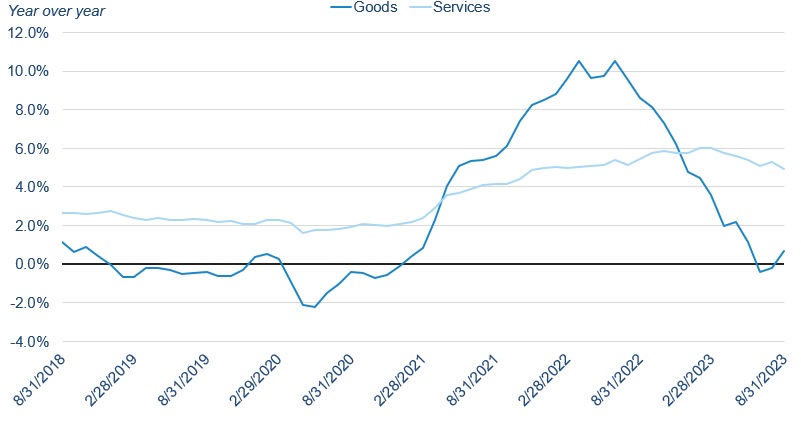

Likewise, inflation still isn’t at the Fed’s target. We are not stating this to downplay the progress seen in inflation as it has come down – thanks in part to inflation on the goods side of the economy declining meaningfully. Yet, the services side of the economy (which makes up more than 70% of the US economy) is still seeing higher inflation numbers than economists consider ideal and the Federal Reserve targets. The chart below shows the year-over-year inflation rate for goods and services using the Fed’s preferred inflation measure: personal consumption expenditures (PCE).

Service-based inflation is still higher than the Federal Reserve would prefer

Source: Bureau of Economic Analysis. Personal Consumption Expenditures for Goods and Services. Monthly data as of 8/31/2023.

Consumer Spending and Housing Costs

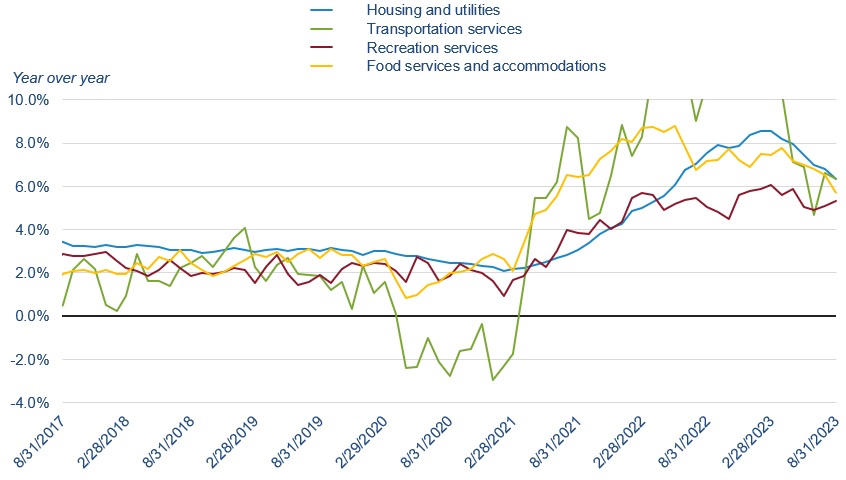

Inflation within the services side of the economy includes things like housing and utilities, transportation services (flights, public transportation, etc.), recreation, food services, and accommodations. We expect inflation for these areas of the economy to have a harder time coming down. The consumer’s finances are still in a relatively healthy state and consumers are enjoying spending on travel (flights, accommodations, etc.), recreational activities, and restaurants – all of which are still at higher inflation rates than the pre-pandemic norm. Housing costs have also remained elevated as existing home inventory is still low and as insurance costs rise in many areas due to natural disasters. This is largely the reason why you may still hear some Fed officials advocating for another 0.25% rate hike.

Key areas of the service side inflation in the economy may be sticky (truncated)

Source: Bureau of Economic Analysis. Personal Consumption on Services: Housing and utilities, Transportation Services, Recreation Services, and Food services and accommodations. Monthly data as of 8/31/2023.

Given the strong labor market, economic growth, and sticky inflation, we expect the Fed to keep rates high – with the chances of a rate hike more likely than a rate cut over the next 6 months. Of course, the mid-size banking sector could have liquidity issues again, and it seems as though the stock market is pricing that probability with the recent rise in yields, but that is not our base case given the facilities the Federal Reserve has in place.

Wrapping It Up: Our Positioning of Investment Portfolios

We expect economic growth to remain near 2%, service side inflation to keep overall inflation elevated, and the Federal Reserve to maintain its restrictive policy stance with risks skewed towards more rate hikes than rate cuts. This outlook for the economy and Federal Reserve policy matters because it impacts how we position our clients’ portfolios. We are seeing great opportunities in yields that we haven’t seen in years, but price volatility is currently high within the bond market. Therefore, we are balancing taking advantage of the higher yields for our clients while attempting to avoid significant price declines.

Managing Risk in Investments

We are investing in both the short and the long end of the Treasury yield curve to hedge bets and manage risk. Investors can earn higher yields by holding short-term bonds out to 3 years without taking on much risk – so, we find that area of the Treasury yield curve attractive and do hold short-term bonds in our clients’ portfolios. Yet, we also want to safeguard against crises, recessions, geopolitical risks, and whenever the Fed does eventually cut rates.

As mentioned earlier, our base case is for economic growth to remain around 2% over the next 6 months, but there are risks to this view. The recent return of student loan repayments could negatively impact consumer spending and economic growth. Likewise, higher rates should eventually slow down borrowing and economic growth – it’s just hard to pinpoint the exact date that will happen. There’s also a risk that the recent Hamas attack on Israel could cause investors to rush into Treasuries, pushing prices up and yields down. These are risks that we account for by holding long-term Treasury bonds that tend to perform well when growth slows and geopolitical tensions rise. The goal is to position our fixed income portfolios for the long run and to not make significant changes in reaction to market movements when it’s likely too late, which requires somewhat of a hedging of bets, for a lack of better terms.

Contact Your Financial Advisor

During times of heightened volatility, we like to revisit our clients’ financial plans and goals to make sure everything is still on track. We are always here for our clients in any way possible. You can’t control the markets, but you can control your financial plan. Please reach out to your advisor with any questions.

For more information, watch the full Rising Interest Rates video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.