1st Qtr Review

Strength in the Dollar

The U.S. dollar index has been on a rapid ascent, rising over 20% since last June, as seen in the chart below. In fact, it has recently broken into 12 year highs. The reason for the strength lies in the fact that the U.S. has ended its quantitative easing while other major economic regions have restarted or continued to buy bonds through quantitative easing, namely Europe and Japan. A strong dollar can impact markets in various ways. Let’s look at how a strong dollar effects international and domestic markets.

Strong Dollar’s Impact on International Markets

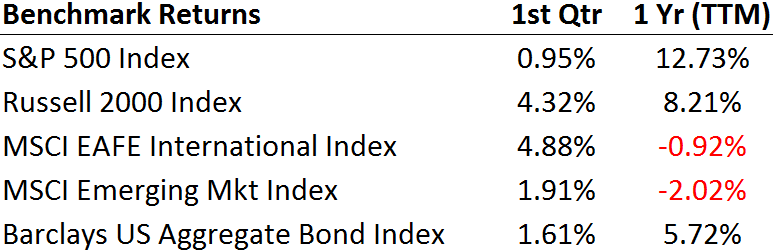

International markets usually benefit when their currency becomes weaker to the dollar because their products in their countries become cheaper for U.S. consumers which usually causes more demand for their products. For example, a company in the U.S. may switch suppliers if it becomes cheaper abroad because of the increased purchasing power of the dollar in foreign countries. Or, a family may be more likely to take a trip to Europe in this environment because it would be cheaper in dollar-terms. Because of this new boost in demand as well as some increased stimulus measures in Europe and Japan via Quantitative Easing, some international markets have lead the way this year in market gains. As you can see (chart on left) that Japan is up around 10% and Europe is up about 4.5% for the first quarter while the U.S. was flat. However a weaker foreign currency or stronger dollar is not always a positive for international markets. If a country’s currency drops too fast it could cause fear that the country’s financial viability is in question. This could cause money from the foreign countries with weaker currencies to move their money to the stronger currency. For example if a European moved their money to the U.S. (from Euro to Dollar) a year ago, he/she would be up over 20% compared to leaving his/her money in their home currency. In the same scenario, if a Brazilian moved his/her money to the U.S. (from Real to Dollar), he/she would be up over 30% compared to leaving the money in their home currency. A large population moving their assets out of their respective country could be detrimental to the home country.

Strong Dollar’s Impact on Domestic Stocks

A gradual rise in the dollar has historically been a positive for the U.S., but a sharp rise like we’ve recently seen can cause multinational corporations in the U.S. to struggle because their international sales are worth less in dollar terms, and because their products become more expensive for international consumers. However, small and mid-caps that tend to do most of their business in the U.S. usually benefit from a strong dollar because they can import materials at cheaper costs and thereby increasing their margins. Similar to International stocks, small and mid-cap stock sectors have outperformed to start the year. On the other hand, large multinational companies were flat to slightly negative for the first part of the year. Going forward though we believe the dollar will not continue to increase at the rate it has recently, which should help the larger multinational companies since a lot of the negative impact of the strong dollar is already factored into today’s stock prices.

Federal Reserve No Longer “Patient”

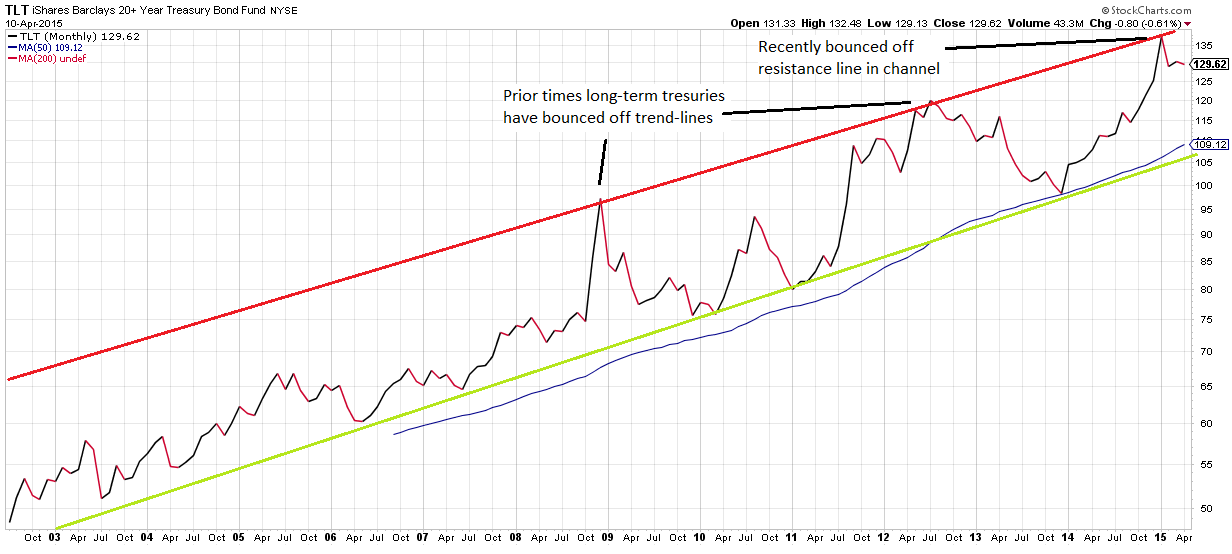

I’m often amused by how much the investment world focuses on the Federal Open Market Committee’s (FOMC) verbiage in their meetings. The most recent significant change in the Fed’s talk is that they have removed the word “patient” as it pertains to the time frame of eventually increasing interest rates. Removal of the word “patient” opens the window for the FOMC to raise rates. We believe the most likely initial rate hike will be sometime between July and October. In typical ambiguous fashion the FOMC also lowered their Fed rate forecast for future rates more in line with Fed-funds futures rate, which is priced by the futures market. The reason for the caution the Fed sited was the recent slowdown in the U.S. economy and the deflationary trends overseas. This is in line with our prediction that when the Fed does start to raise rates it will be slow and gradual. The recent retreat in the price of long term Treasury Bonds may confirm the theory of a pending fed rate hike. As you can see in the chart on the right the TLT (a fund made up of Long term Treasuries) has bounced off its long term resistance trend line (red line) and started heading lower over the last couple of months. While we have already adjusted our client’s portfolios anticipating future weakness in bonds we will continue to monitor market factors and adjust accordingly.

Going Forward

Recent strength in the dollar has impacted markets around the world. International markets have benefited from increased demand in their products since they are now much cheaper compared to U.S. products than they were a year ago. Small and Mid-Cap stocks in the U.S. have benefited from reduced cost of materials they import, thereby increasing margins. Large multinational U.S. companies have been hurt since their products are more expensive to foreign buyers. In anticipation of a stronger dollar we rebalanced portfolios last October to hold more small and mid-cap stocks while reducing large cap stocks. At the same time last year, anticipating future weakness in bonds from a future interest rate hike, we reduced our bond exposure. While we expect a rate hike in the latter part of this year we believe future hikes will be slow and gradual which should not cause bond prices to go into an extreme descent in their prices. We constantly monitor market factors and adjust accordingly as our dynamic money management style takes a proactive approach to strategically rebalancing portfolios, attempting to take advantage of pricing anomalies. We continue to manage risk first in all of our investments, while seeking to outpace our clients’ respective benchmark over the long-term net of our fees.

Written by:

Jason Martin, CFP®, CMT, Chief Investment Officer Allgen Financial Services, Inc.;

Paul Roldan, Chief Executive Officer; Chris Damiano, Operation Specialist

Important Disclosures: Blogs, Collateral & Web Site Content: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. Allgen Financial Services, Inc. (Allgen) is an investment advisor registered with the SEC. Allgen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by Allgen. It is not intended to be a solicitation or offer to sell investment advisory services to residents of any state in which Allgen is not currently authorized to do so. The Disclosure Brochure, Form ADV Part II, which details the business practices, services offered, and related fees of Allgen, is available upon request.