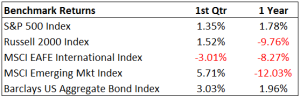

2nd Quarter Market Commentary 2016

The Long and Short of It:

The price of oil continues to make headlines causing some to think that the stock market’s performance is at the mercy of oil’s performance. We do not believe that to be the case for U.S. markets.

- Value stocks have started performing better than growth stocks, which should fare well for Allgen’s style of money management.

- The Federal Reserve has lower expectations for the amount of interest rate hikes this year, which has recently helped the bond and stock market.

1st Quarter Review

Looking at the quarter end numbers alone, you would think it was a flat quarter with not much market movement. Nothing could be further from the truth! Markets around the world started off in a free fall. In fact, the U.S. market recorded the worst first 10 trading days on record. Markets continued to fall, dragging a lot of indices into bear markets until Feb. 11th. From that point on markets bounced, recapturing all the prior losses to end the quarter mostly positive. It was a wild ride to say the least. This quarter’s market action hammered home the point that we continually make: always stay calm and don’t make financial decisions based on emotion. Those who sold in early February after the big drop not only locked in significant losses, but also missed out on the huge bounce that followed. In this quarter’s market commentary we cover the relationship between oil and the stock market, the market’s shift from growth to value stocks, and the Federal Reserve’s interest rate policy and its impact on the markets.

“The only people to get hurt on a roller coaster are the ones who jump off” -Dave Ramsey

The Relationship of Oil and the Stock Market

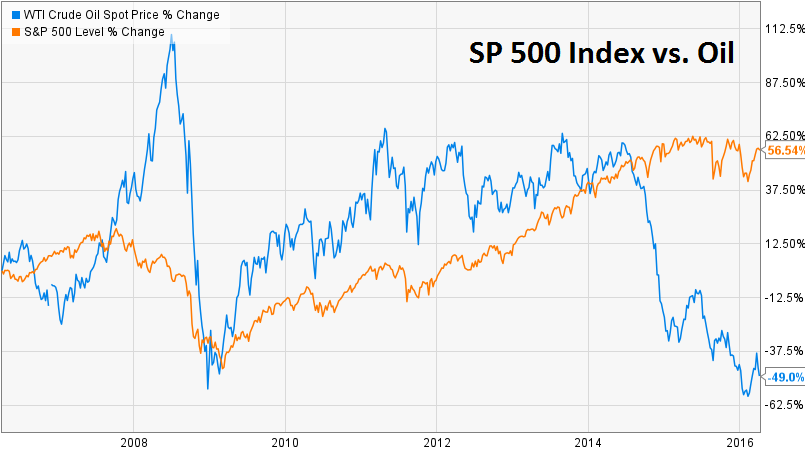

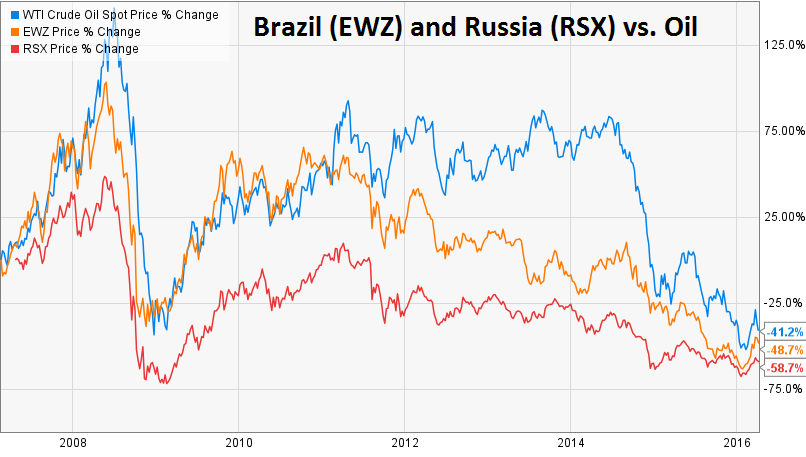

Recently, financial headlines and media outlets have related the move in oil as the reason for the stock market’s drop. For example, recent headlines have read something like this: “The Stock Market Fell as Oil Dropped Again” or “Oil Prices Bounce and the Stock Market Follows.” While the correlation between the stock market and oil has been high recently, historically that has not been the case for the U.S. stock markets. The U.S. economy is a consumption based economy. Therefore, oil exports and commodity exports in general are not a major portion of the U.S. GDP. We’ve made the point in the past that lower oil prices are actually a good thing for consumption based countries like the U.S., China, and India. If you spend less at the pump, then you have more money left to spend on other things. While low oil prices can be good for consumption based economies, it is bad for countries whose economies depend on oil revenues like Brazil, Russia, Saudi Arabia, Venezuela, etc. This is evident in the charts below.

You can see the lack of correlation of oil prices vs. the U.S. stock market in the left chart. In contrast, the right chart shows the direct correlation of Oil prices vs. Oil export-dependent countries such as Brazil and Russia. Why is this important to you? As we noticed this trend occurring years ago, we reduced our holdings and stayed away from commodities and commodity-based countries, while focusing on investments that should benefit from lower oil prices.

The Market’s Shift from Growth to Value

In our last market commentary, we discussed that value stocks have outperformed growth stocks over the last 50 years. We also pointed out that in recent years, especially in 2015, growth stocks outperformed value stocks. We made it the point that we believed the market would go back to its historical trend of value outperforming growth. So far in Q1 of 2016 that prediction has come to fruition as large, mid, and small cap value indices are beating their growth counterparts. While clearly no one knows the future, we anticipate value stocks will continue to outperform in the intermediate future. A large portion of growth stocks have become overvalued, while many value stocks have become more favorably priced. This is especially true with small and mid-cap stocks. While our Allgen portfolios are well diversified, holding both value and growth stocks, we tend to favor value and will usually overweight that area due to those stocks having a better long-term historical performance with lower risk.

Federal Reserve Interest Rate Policy Update

The Federal Reserve began the year expecting to raise interest rates a quarter point at least 4 times; a clip which would have meant that the Federal Reserve’s short term rate would end the year at 1.5%. However, weakness in the global economy has caused the Federal Reserve to adjust its stance. They are now stating that it is more likely that we will only have 2 interest rate hikes, which means the Federal Reserve’s short term rate would end the year at 1.0%. Federal Reserve funds futures, a more accurate indicator historically, is currently pointing to only one interest rate hike later this year. A few economists have even tossed out the possibility of negative interest rates. Both the stock market and bond market have reacted positively to the anticipation of fewer and slower interest rate hikes. Bonds tend to underperform when interest rates are going up since bond prices and interest rates have an inverse relationship. So the anticipation of less interest rate hikes is a welcome sign for bond investors. From the stock market’s point of view, when interest rates are going up quickly it makes it more expensive for people to borrow, which tends to slow down the economy (think less borrowing to buy homes, cars, or businesses not borrowing to expand operations, etc.). Therefore, if interest rates are not increasing as quickly, then the economy is better positioned to grow. A faster growing economy is typically good for the stock market. Historically, the U.S. stock markets have performed better during a slow-rising interest rate environment versus a fast-rising interest rate environment. However, it would be a bad sign if the Federal Reserve doesn’t raise rates at all this year or if they consider a negative interest rate policy. This would indicate that the Federal Reserve is losing confidence in the growth of our economy which would probably not be good for stock markets. In this scenario, safe haven bonds like the U.S. government bonds would most likely outperform as investors seek safety.

Source: (http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html)

Going Forward – Fasten Your Seatbelt and Enjoy the Ride

The start of this year was not for the faint of heart, and we anticipate that markets may potentially have more bouts of volatility going forward due to elections and the weakness of the global economy. Despite the crazy start, stocks and bonds are up. While the drop in oil can be a negative for some commodity export-based economies, cheap oil has historically been a net positive for consumption-based economies like the U.S. Allgen’s style of money management favors value stocks because of their long term returns vs. risk. Recently, value stocks have been outperforming growth, which is favorable for our clients. Finally, the Federal Reserve has lowered expectations for multiple interest rate hikes this year, helping the markets rebound. We continue to encourage investors to keep emotions in check when volatility comes. When in doubt, feel free to call us as we will be sure to encourage, console, and even sometimes “walk you off the ledge.” Our investment philosophy manages risk in order to avoid major losses while striving to outperform over a full market cycle. This lower risk style allows you to stay the course and makes it easier to avoid “jumping off the roller coaster” so that you can enjoy life’s journey while avoiding painful mistakes. We appreciate your trust and confidence in us!

Written by: Jason Martin, CFP®, CMT, Chief Investment Officer Allgen Financial Advisors, Inc.; Paul Roldan, Chief Executive Officer; Christina Shaffer, Operation Specialist

Important Disclosures: Blogs, Collateral & Web Site Content: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. Allgen Financial Services, Inc. (Allgen) is an investment advisor registered with the SEC. Allgen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by Allgen. It is not intended to be a solicitation or offer to sell investment advisory services to residents of any state in which Allgen is not currently authorized to do so. The Disclosure Brochure, Form ADV Part II, which details the business practices, services offered, and related fees of Allgen, is available upon request.