3rd Quarter 2016 Market Commentary – 07/12/2016

The Long and Short of It:

[full_width]

- The so-called “Brexit” continues to cause uncertainties as the market tries to reconcile what a post-UK European Union looks like

- Corporate earnings continue to be a drag on the market but there is hope for improvement

- U.S. Gov’t bond yields to hit historic lows causing the potential for a bond bubble

[/full_width]

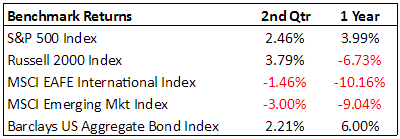

2nd Quarter Review

US stock markets continued to fight their way higher last quarter, but international stocks took a big hit towards the end of the quarter – highlighted by the “Brexit” (UK’s vote to exit the European Union). The uncertainties of Europe and a weak May US jobs report has caused US Government bonds to continue to climb in a flight to safety. In this quarter’s market commentary, we will discuss the ramifications of Brexit, the current earnings recession, and the interest rate outlook.

Brexit

The news of the UK’s vote to exit the European Union (EU) came as a shock to the market. In the days leading up to the vote, the market rallied in its incorrect assumption that the UK would vote to remain. When the unexpected news came out that the UK voted to exit the EU, the European markets were blindsided. The MSCI UK index dropped over 20%, the MSCI Germany index dropped by about 12%, and the MSCI France Index dropped by about 13% – all in a 2-day period. The S&P 500 initially lost about 5% in the first two days, but recovered all of the losses over the next week.

We believe the Brexit will not have a major effect on the US economy. According to the International Monetary Fund, exports to the UK from the US represent only about 0.25% of US GDP. Also, while the US dollar jumped on the news, it is still flat compared to a year ago. Therefore, US multinational companies will not be hurt from a competitive pricing point-of-view. We also don’t believe there will be a negative effect across most emerging market economies in Asia and Latin America. In fact, stock markets of countries like India, Brazil, and Indonesia are up since the news of Brexit.

While we do not see a major impact to the US and to emerging markets like Latin America and Asia, we do believe there will be a negative effect in the UK and Europe over the next 2 years. The largest fear from our perspective is that the UK vote has now opened the door for other countries to leave. France, Sweden, Hungary, the Netherlands, and Greece are some of the countries that could potentially follow UK out of the EU. While the UK vote has caused European markets to drop and surely other countries leaving the EU would cause high levels of volatility as well, it’s not the “end of the world.” Good things could come out of this in the long-term.

For example, the British Pound has dropped from the news of the Brexit, which will make UK’s exports, services, and tourism cheaper for those outside of the UK. Over time this could make the UK more competitive. While, the UK may not have as favorable of trade terms with the EU, it will most likely grow and create good trading relations outside of the EU. As for the EU, since the UK voted to leave and other countries may follow, you may see the EU reform for the better. European markets have been hit hard recently and will probably experience pressure in the intermediate-term; this can be a catalyst for positive change in the long-term. As for clients of Allgen, it’s important to know that we have been underweighted in Europe and International markets since 2008.

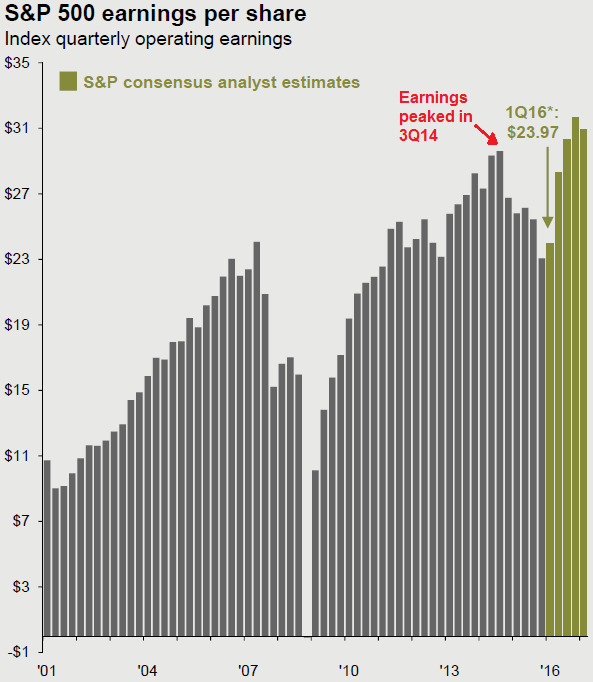

Earnings Recession Persists

Source: Compustat, FactSet, Standard & Poor’s, J.P. Morgan Asset Management; Guide to the Markets – U.S. Data are as of June 30, 2016 EPS levels are based on operating earnings per share. *1Q16 earnings estimates are Standard & Poor’s consensus analyst expectations, based on actual earnings for 98% of Standard & Poor’s companies that have reported and earnings estimates for the remaining 2% of companies

In case you haven’t noticed, the stock market has been relatively flat for the last 2 years. The Dow Jones Global Aggressive Index (a diversified all stock portfolio of domestic and international stocks) returned over the last 2 years -0.03% (06/30/14 – 06/30/16). We believe one of the biggest reasons for this 2-year slump is because operating earnings (an important measure of profitability) of companies have been declining during that time. Investors usually invest in a stock that they believe will earn a greater profit in the future.

As you can see in the chart to the left, operating earnings of the companies in the S&P 500 peaked in the 3rd quarter of 2014 and have trended lower since. Historically when operating earnings are not growing stock markets do not perform well. While two of the top concerns of business owners: increased government regulation and healthcare costs don’t seem to be improving, there are two factors that may help in the coming quarters. The stabilization of the price of oil and the US dollar could help earnings bounce back over the next year. Losses from the energy sector have been a huge drag on the overall earnings of the S&P 500. The price of oil has started to stabilize over the last 6 months.

Assuming this trend continues, energy companies may start to be a contributor instead of a detractor of earnings in the next few quarters. Also from May of 2014 until March of 2015 the Dollar Index rose nearly 25%. A steady rising Dollar can be a good thing, but when it spikes that high that fast it causes US multinational companies to suffer since their products are now much more expensive to the rest of the world. Since March of 2015 until now the Dollar is slightly down. Assuming the dollar continues to cool and does not spike higher again it should provide for better conditions for US multinational companies. Due to these and other factors the S&P consensus analyst estimates are for operating earnings to increase in the coming quarters. This would be a welcome sign for the stock market.

Interest Rate and Bond Outlook

The Federal Reserve began the year expecting to raise interest rates a ¼ of a point at least 4 times in 2016; a clip which would have meant that the Federal Reserve’s short term rate would end the year at 1.5% (currently at 0.5%). However, weakness in the global economy, a weak May jobs report, and fears of Brexit have caused the Fed to put interest rate hikes on hold. The fed funds futures (an indicator of future interest rates) is predicting that interest rate will stay at 0.5% for the remainder of the year. A few economists have even tossed out the possibility of negative interest rates.

At the same time nearly a third of the world bond interest rates are negative-yielding. The combination of a low interest rate policy in the US combined with negative interest rates in Europe and Japan has caused US Govt. Bond prices to catapult higher. In fact, interest rates on the 10-year Treasury Bond just recently hit an all-time low. Keeping in mind that bond prices and interest rates are inversely related, while yields have hit an all-time low bond prices have hit an all-time high.

This has caused us to be prepared for a potential bond bubble. It’s very difficult to gauge when a bubble will pop, but we would rather err on the side of caution. While Long-term treasuries are up over 18% this year it would be a very high risk position to hold on to them at this point as the chances of them falling significantly are high. In general, we have reduced bonds as a percentage of our clients’ portfolios and we hold bonds with a shorter duration to the index which should protect us if the bond bubble pops.

Source: (http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html)

Going Forward

While the Brexit has caused some short-term volatility, which could lead to further uncertainties, the US and emerging markets like Latin America and Asia have not experienced any major impact from this event. Our portfolios have been underweighted International stocks for years because of their weak economies. Markets have been flat for nearly 2 years, and we believe this has been in large part due to an earnings recession; however, since the price of oil and the dollar have stabilized this could be a catalyst to future earnings growth.

Finally, we mentioned that interest rates are at all-time lows which has caused a potential bond bubble. In order to protect our clients, we have reduced our overall percentage of bond holdings and we have shortened the duration. We constantly monitor market factors and adjust accordingly as our proactive money management style seeks to take advantage of pricing anomalies while managing risk and protecting our clients’ hard earned money. We appreciate your trust and confidence in us!

Written by: Jason Martin, CFP®, CMT, Chief Investment Officer Allgen Financial Services, Inc.; Paul Roldan, Chief Executive Officer; Christina Shaffer, Operation Specialist

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. Allgen Financial Services, Inc. (Allgen) is an investment advisor registered with the SEC. Allgen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by Allgen. It is not intended to be a solicitation or offer to sell investment advisory services to residents of any state in which Allgen is not currently authorized to do so. The Disclosure Brochure, Form ADV Part II, which details the business practices, services offered, and related fees of Allgen, is available upon request.