Read through this post on how taxes impact retirement planning and Financial Freedom or skip to the AllGen Academy taxes video below.

Taxes

Though taxes may not be a fun topic to discuss, they can significantly impact your Financial Freedom plan. Not accounting for taxes in your plan could cause you to be underprepared for your desired lifestyle in retirement.

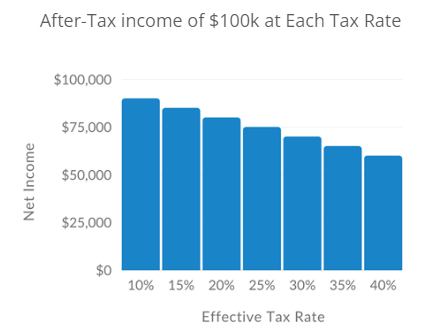

Find out what your income is ‘net of taxes’. Depending on your tax bracket, you could be grossing a high income but keeping much less.

For example, if you earn $100,000 and are in the 15% tax bracket, your net income is $85,000. If your tax bracket is 20%, your net income will only be $80,000.

Higher taxes = less net income

It’s important to remember this dynamic as you project what you’ll need in Financial Freedom. The income you expect to receive most likely won’t be the amount you actually have to live on once you pay taxes on that income.

Major Types of Taxes

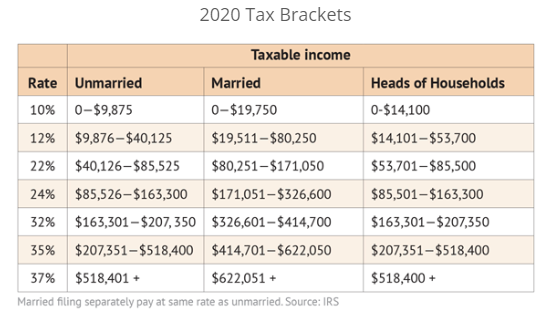

- Federal income tax – a tax the federal government assesses on your income based on a progressive tax rate system (higher income earners are taxed at higher rates). Federal income taxes can either be withheld from your paycheck or paid in quarterly installments. Some key terms to know:

- Marginal tax rate – the tax rate applied on the next dollar you earn

- Effective tax rate – the overall tax rate you pay on your income

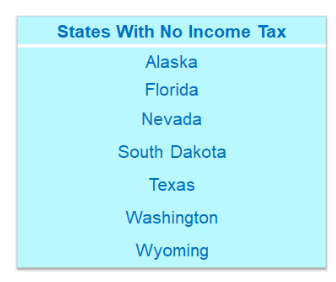

- State and local income tax (SALT) – a tax levied by state and local authorities such as state income, property, and sales tax. Depending on where you live, some states and localities don’t assess income taxes. This may influence where you live either now or in the Financial Freedom stage. If you live in a state that does collect income taxes, you may get a deduction for it on your federal tax return.

- Payroll taxes – taxes deducted from earnings on your paycheck.

- Social Security – withheld to fund retirement, survivor, and disability benefits (6.2% up to income threshold)

- Medicare – withheld to cover health care costs in retirement (1.45% plus an additional 0.9% over certain income threshold)

- Self-Employment – tax paid quarterly by self-employed persons (15.3% of net income)

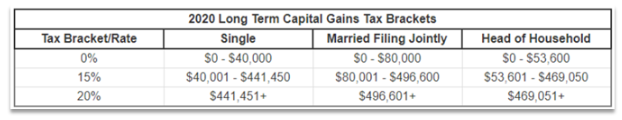

- Capital Gains tax – assessed on profits earned from the sale of assets.

Capital Gains = Sale Price – Cost Basis (the price that asset was purchased for)

-

- Capital gains tax is only triggered when an asset is sold (realized), not yearly appreciation

- Two types of capital gains:

- Short Term – profit on assets held for one year or less are taxed at ordinary income tax rates

- Long Term – profit on assets held for more than one year are taxed at preferential tax brackets (0% – 20% depending on your normal tax bracket). Lower-income earners may not have to pay any capital gains tax if they are under a certain income threshold.

Tax Deductions, Exclusions, and Credits

In relation to the types of taxes outlined above, here are some common ways to reduce the amount you ultimately have to pay in taxes.

- Deduction – a tax deduction is an amount subtracted from your income before tax is calculated. Most taxpayers take a standard deduction which is a set amount that can be subtracted from gross income each year. Some taxpayers choose itemized deductions when they have many tax-deductible items to account for.

- Exclusion – the amount is exempt from being reported as income. Life insurance proceeds, child support, and welfare benefits are some examples of tax exclusions.

- Credit – the amount of tax credit is directly applied towards tax liability. Tax credits lower the amount of tax owed dollar-for-dollar (versus a deduction which reduces the sum that taxes are calculated from)

Important Considerations

Here are some key things to keep in mind regarding taxes and how they impact your plan:

- Tax rates are subject to change in the future

- The higher the income, the more taxes you might pay

- Make financial decisions based on ‘net of tax’ numbers, not gross

- Explore strategies to reduce your tax bill

Most financial transactions have a tax effect. Consider how taxes will impact your ability to save and your lifestyle in Financial Freedom.

For more information on how taxes impact how much you’ll need to save for retirement, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.