At Allgen we define the Financial Freedom stage as the point when you have accumulated enough assets and/or income streams to maintain your lifestyle without having to depend on a paycheck from work. While the Formation (accumulation) stage focuses on the growth of assets, the Freedom (preservation) stage focuses on ensuring the assets last your lifetime while preserving your lifestyle. Wealth preservation is as important (and perhaps even more) as wealth accumulation because it happens at a time when most individuals will rely on the assets/income streams for lifestyle maintenance rather than actively working to produce income. Whether by 1) choice, 2) forced (downsized), or need (physical mental limitations/tiredness), the preservation stage requires a high degree of attention as we leave the “power” position of income production through work to passive portfolio/income stream dependence. As such, here are some important considerations when entering or living in the Freedom stage of the financial cycle.

What is the Mix of my assets versus fixed income?

This question is important because the answer impacts the strategy of distribution during the Freedom stage. A higher level of fixed income streams puts less stress on the investment portfolio. Conversely, a lower level of fixed income requires the investment portfolio to maintain levels while producing income from liquidation and/or earnings. A rule of thumb states that a distribution rate from an investment portfolio ranging from 3-5% highly increases the odds of this portfolio lasting a lifetime. Yet, sometimes the asset/income stream mix requires a higher distribution rate. As such, it is important to run “stress tests” on portfolios during the Freedom stage in order to assess the probabilities of success and better grasp the most appropriate balance between risk and preservation. While there are many stress tests available to clients, many financial advisors use multiple probability simulators to determine future success rates of varying investment portfolios with fixed income streams. Once determined, appropriate actions can then be taken to increase the “odds of success” during the Freedom stage, determined by the maintenance of your lifestyle during this stage.

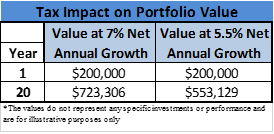

What role do Taxes play in my finances?

Aside from not wanting to pay too much, taxes should be considered at all stages of investing but especially during the preservation stage. Taxes can have several negative effects on investment portfolio including: 1) Reducing investable income; and 2) Reducing real returns. The latter is of greater consequence during the preservation stage. Consider a portfolio the produces a gross return of 7%.

What Coordination strategy optimizes my Freedom assets/income?

Several decisions can impact the longevity of a portfolio during the Freedom stage. Among these are the distribution choices for pensions as well as the social security income selections. Questions that should be answered during this preservation stage include but are not limited to: 1) Should I delay receipt of my social security income; 2) Should I claim single life, joint life, or period certain when it comes to my pension; 3) should I choose an income stream or a lump sum distribution for my pension, etc.? The answers to these questions can vary depending on the makeup of the family (i.e. married, single, non-married but cohabitating, etc.) Each of these scenarios can lead to different conclusions in terms of how to optimize your Freedom income/portfolio. Additionally, the mix of assets vs income streams needs to be considered in determining the optimal choice to make when entering the Freedom Stage.

What Risks can impact my portfolio preservation during the Freedom stage?

Risk management is an area that we promote in all stages of your financial life. In the preservation stage this is even more critically important as there is less room for error. A few of the risk considerations are: 1) portfolio volatility; 2) death of spouse/partner; and 3) Disability (i.e. need for Long Term Care. While we hope for the best at Allgen, these happenings occur in life and should be accounted for in any Freedom plan. Not accounting for them can lead to accelerated depletion of assets and therefore added stress during the preservation stage. According to Genworth’s 15th annual Cost of Care Survey, the annual median cost of care in the U.S. can range from $18,720 to $100,375 per year1 depending on the type of care wanted or required. These costs continue to increase with an aging population, creating more demand. As such, it is important to consider what the goals and tools required would be if this were needed in conjunction with the rest of the asset and income stream picture.

Summary

As you enter the Financial Freedom stage, it is critical to consider the above to ensure optimizing the long-term picture during the preservation stage of your portfolio. These considerations will highly increase your odds of “success” during the Freedom stage and enable you to then move on to planning for a successful legacy and impact living. As always, we invite you to speak with us about your particular situation and see how we can help you optimize your Freedom Stage portfolio.

1 15th annual Genworth Cost of Care Survey

Written by Paul Roldan with Allgen Financial Advisors, Inc.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.