By Paul Roldan, CFP®

You’ve done the hard part: accumulating your retirement savings. Maybe you’ve recently transitioned out of an employee stock ownership plan (ESOP), sold a business, received an inheritance, or are ready to use your 401(k). Now you’re facing a new challenge: turning that nest egg into lasting, reliable income. Whether your assets are sitting in retirement accounts, investments, or cash, the question remains—do you have a plan to make them last?

Or perhaps you’ve saved your whole life, building your retirement accounts, and now you’re on the brink of retirement and you’re not quite sure how to switch from “savings” mode into prudent spending. While it may sound like a “nice problem to have,” abruptly being in control of a vast amount of cash can be daunting. You don’t have to worry about setting aside money for savings anymore, but you do have to think about how to make it last—possibly for decades.

Having a plan is paramount in this regard. Without one, even the biggest retirement savings account can be depleted in a hurry. Here are some considerations to keep in mind.

From Saving to Spending

In your working days, all your attention was focused on the job at hand. This included contributing to your employer’s 401(k) plan or growing ESOP shares. Now the time has come to start reaping the benefits of those plans—but that can come with challenges of its own.

Now entering retirement, you need to adjust the way you think about finances. Consider your needs in retirement in the context of preserving wealth. This involves an appraisal of your monthly budget, tax implications, market volatility, and economic conditions.

Many people tend to underestimate the length of their retirement. They may also be unclear about how cost-of-living increases and healthcare needs can quietly evaporate their fixed savings. In fact, recent data published by TIAA Institute suggests that nearly one in five retirees have trouble making ends meet during any given month. Their studies also found that roughly half of U.S. adults were poorly informed about average life expectancy, a lack of information that could prove to be perilous in retirement.

Avoiding Common Retirement Savings Mistakes

Many newly retired people—or those nearing the milestone—make innocent but costly errors with their retirement savings. These common but controllable errors can eat away at your account funds with little warning. Some of the most common mistakes include the following:

Withdrawing Too Much Too Soon

Taking out a big chunk of your savings at the outset increases your risk of running out of funds sooner. Have a measured plan for responsible withdrawals.

Misunderstanding Required Minimum Distributions (RMDs)

Traditional IRA and 401(k) account holders are required to withdraw a monthly minimum from these accounts after a certain age (typically age 73 as of the publication of this article). These withdrawals are called requirement minimum distributions (RMDs). If you fail to make RMDs in retirement, you may face penalties.

Not Diversifying Your Portfolio

Spreading your retirement savings capital across different investment types, sectors, and sizes is how you mitigate risk. Putting all your money in one place may make you feel more in control, but it’s actually a riskier move.

Making Tax-Inefficient Withdrawals

If you have multiple types of retirement savings accounts, take withdrawals strategically to optimize your tax exposure. This includes sequencing withdrawals from 401(k)s, traditional IRAs, Roth IRAs, non-qualified taxable accounts and Social Security to balance your tax obligation.

How to Make Retirement Savings Last

Fortunately, there are a few simple approaches that can help you extend the lifespan of your retirement savings.

Create an Income Plan

Evaluate your yearly spending needs and expenses. When possible, tailor your spending to your scheduled withdrawal rates, understanding the tax implications of different types of income streams. Look into ways to optimize your tax picture, while considering a part-time job or investments that issue dividends.

Diversify Your Portfolio

Allocate your assets across several types of investments. Align your investments with your financial goals, life expectancy, and risk tolerance limits.

Partner With a Wealth Manager

Managing retirement savings on your own can feel overwhelming, especially when every decision from how much to withdraw each year to which account to tap first can impact the longevity of your nest egg. That is where a wealth manager adds tremendous value.

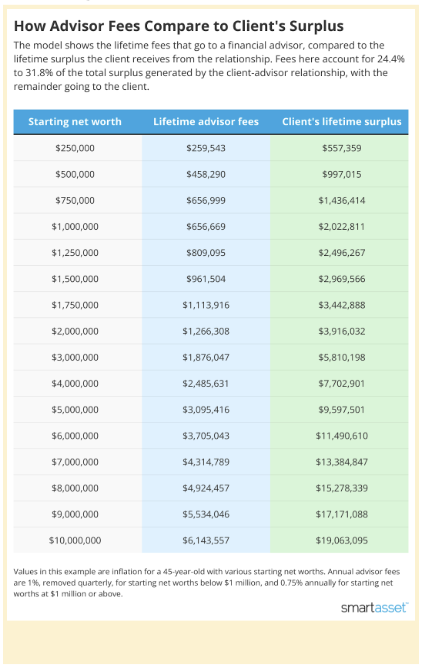

In fact, research shows that working with a financial advisor does not just provide peace of mind—it can significantly increase your overall financial outcome. A recent model by SmartAsset demonstrated that even after accounting for lifetime advisory fees, clients still came out far ahead. For example, someone with a $1 million starting net worth could pay roughly $656,000 in advisor fees over their lifetime but still walk away with a $2 million surplus, meaning a net gain of over $1.3 million after fees. That is the power of professional guidance.

How is that possible? A skilled advisor can:

- Help you avoid costly mistakes like poorly timed withdrawals or tax-inefficient decisions

- Optimize your income strategy across taxable and tax-deferred accounts

- Manage risk through proper asset allocation and diversification

- Anticipate future expenses like healthcare and long-term care

- Guide behavior during volatile markets to help prevent panic-driven decisions

The goal is not just to grow your money. It is to preserve and extend it in a way that supports your lifestyle and legacy for years to come. When the stakes are this high, having a professional in your corner can be one of the most valuable investments you make in retirement.

A Helping Hand in Managing Retirement Savings

At AllGen Financial Advisors, we work with a broad range of clients to manage their savings, build solid portfolios, and gain financial literacy. When you contact us to talk about retirement, we explore all options for making your money last and even continue growing.

To schedule a complimentary meeting, call (407) 210-3888 or email advisors@allgenfinancial.com.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.