Maximizing Financial Freedom Funding

How do you choose which investment accounts are best for you?

Before you start, make sure you have laid a solid foundation according to the previous steps in the path to financial freedom:

- Paid off all consumer debt

- Have adequate emergency reserves

- Acquired the appropriate insurance coverage(s)

- Have estate planning documents in place

You can reference our Building a Foundation course in AllGen Academy for a refresher. (Become an AllGen Insider to get free access if you haven’t already.)

Once you have a solid foundation, consider your needs for financial freedom funding. The vehicles you use will depend on:

- Your current financial goals

- What accounts are available to you (i.e. employer sponsored retirement plans)

- Your income level

Keep reading this blog or skip to our maximizing financial freedom funding video below from AllGen Academy.

Step 1: Determine Annual Amount

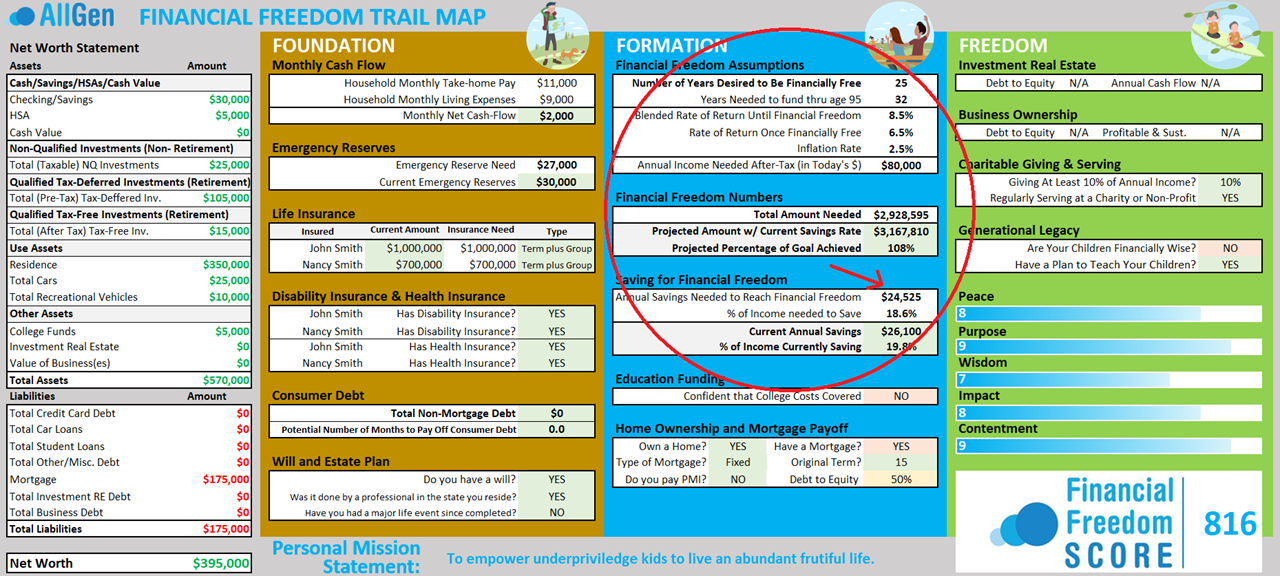

Determine how much you need to save each year to reach financial freedom in your desired time frame. You can arrive at this number using the Time Value of Money Calculator (covered at the beginning of this chapter) or referencing your Trail Map.

Step 2: Find Your Marginal Tax Rate

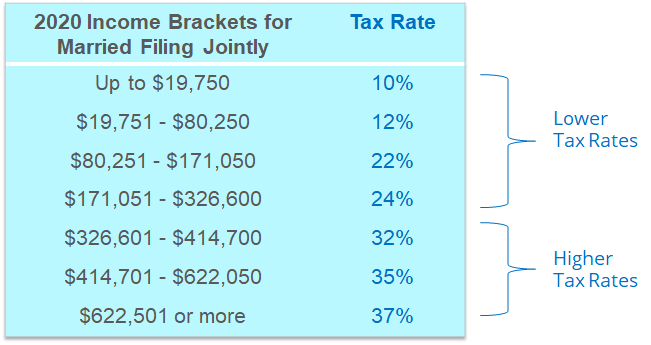

Next, find out which tax bracket you’re in based on your taxable income. You can find this towards the bottom of Form 1040 on your tax return. Your current tax bracket will determine the type and order of retirement savings vehicles to use.

We’re using 2020 tax brackets for illustration but please note that tax laws change so make sure to reference the most current tax brackets.

Step 3: Choose A Strategy Based On Your Tax Bracket

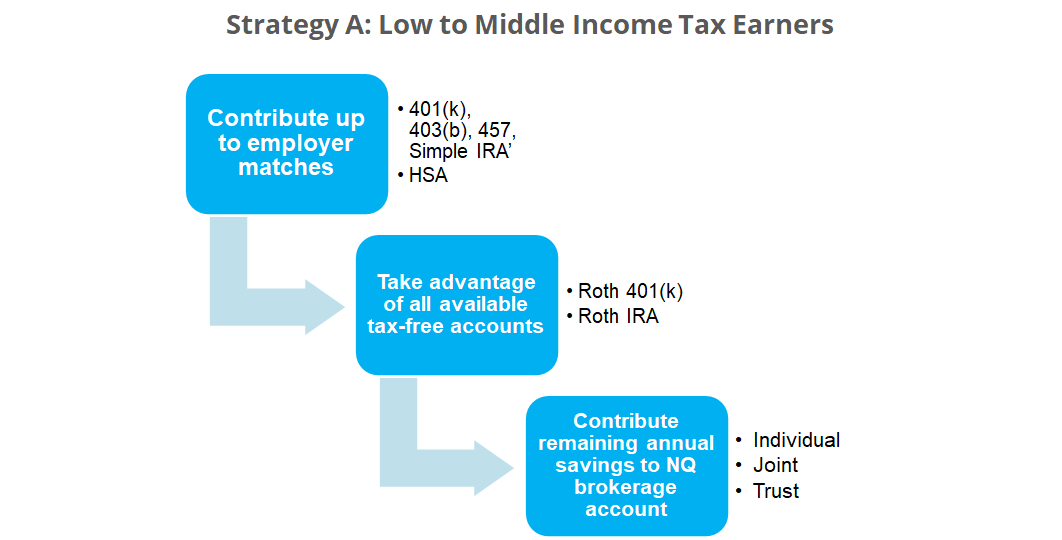

Strategy A – Low to Middle Income Tax Brackets (24% marginal tax rate or below as of 2020)

1. Contribute up to employer match in retirement account

- Take advantage of ‘free money’

- If there is Roth 401(k) option then contribute up to the match in Roth

- Employer matching funds will go in pre-tax side of 401(k)

2. Contribute up to employer match in Health Savings Account

3. If employer offers Roth 401(k), contribute up to the maximum

- 2020 401(k) contribution limit is $19,500 ($6,500 extra if 50 or older)

4. Max out Roth IRA if eligible

- 2020 income limit is $124,000 for single and $196,000 for married (plus phase out window)

- Maximum contribution limit is $6,000 (extra $1,000 if 50 or older)

5. Contribute remaining portion of annual savings needed to nonqualified (NQ) brokerage account

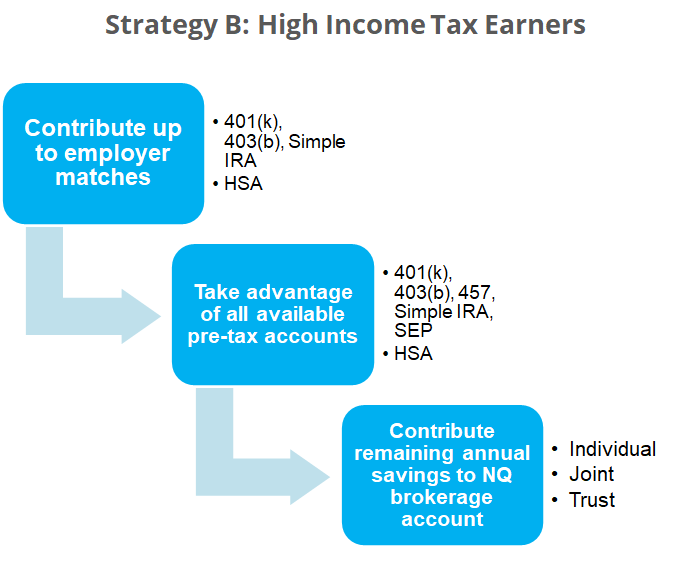

Strategy B – High Income Tax Brackets (32% marginal tax bracket or higher as of 2020)

1. Contribute up to employer match in retirement account

- Take advantage of ‘free money’

- Stick to pre-tax contributions even when there is a Roth 401(k) option

2. Contribute up to employer match in Health Savings Account (HSA)

3. Max out remaining pre-tax employer retirement accounts including HSA

4. Contribute remaining portion of annual savings needed into nonqualified (NQ) brokerage account

- Invest tax savings from pre-tax contributions in addition to regular NQ savings

These high level strategies provide a starting point for you to plan a savings strategy. How you accumulate savings for financial freedom depends on various factors. Understand your options and choose the maximization strategy that is best suited for your unique situation.

For more information on maximizing financial freedom funding, what our video from AllGen Academy below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.