Read through this post on how longevity impacts retirement planning and Financial Freedom or skip to the AllGen Academy accumulated assets video below.

The final and probably most common component of Financial Freedom is accumulated assets, the lump sum that you have saved to fund your lifestyle and expenses in retirement.

There are many vehicles and ways in which to save retirement assets. Some are tax-advantaged such as 401(k), 403(b)s, IRAs, Roth IRAs, and other retirement plans. Other vehicles may not have the same tax advantages but may offer more flexibility and allow you to save bigger chunks. We’ll discuss these different investment vehicles in the next chapter.

Although you may expect some sort of reliable income source in retirement, they are becoming less and less certain. A growing responsibility falls on current and future generations of retirees to accumulate enough assets so they won’t have to be as dependent on income sources. The good news is that you have more flexibility and control over your assets than with reliable income sources.

In general, the amount you will need to accumulate is inversely correlated with the number of income streams available to you in Financial Freedom. How much you will actually accumulate depends on some additional factors:

- Savings (how much you save)

- Time horizon (how many years do you have to save)

- Investment returns (how much growth you earn with your savings)

All of these factors impact how much you will have in accumulated assets at retirement. Each is important yet they all work together to grow your assets. Let’s cover each one in more detail.

Savings

As the saying goes, it’s not about how much you earn but how much you save. Investment returns can make a difference in how much you end up with but it’s equally important to be disciplined in saving money consistently over time.

Regardless of which vehicle you use to save in, the goal is to save a steady portion of your income for the long term. One approach is to build it into your budget and plan your monthly expenses around your retirement savings, making it a priority.

Unfortunately, the United States has one of the lowest savings rates among developed nations. A general rule of thumb is to save 15-20% of your income. This may sound like a lot but if you build a solid foundation and eliminate consumer debt, you’ll have more room in your monthly cash flow to save for retirement. Instead of paying someone else, you can pay your future self. The dollar amount of your savings, timing, and frequency all impact how much you can accumulate over the long term.

Time Horizon

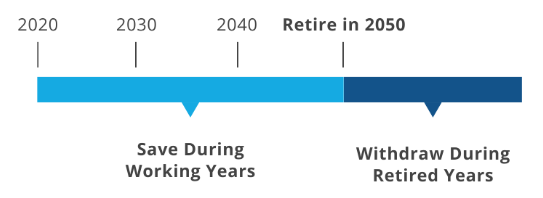

Because of the effects of compounding, the sooner you start saving, the better. Starting earlier in life will allow time to work in your favor so that even modest savings can turn into a potentially large nest egg.

Saving smaller contributions early on is better than waiting until you can afford to save larger contributions later in life. Saving consistently over a long time horizon will give you the best chance of accumulating a substantial amount of assets to fund financial freedom.

Investment Returns

Lastly, how your savings are invested determines how much they will grow over time. Simply putting money into a low-yielding savings account is not enough to grow your assets. They must be invested so that your money can be ‘put to work’ and earn returns.

It’s important to invest your savings according to your risk tolerance as markets do rise and fall. However, investments generally grow over the long term, increasing the overall value of your invested assets.

For more information on how taxes impact how much you’ll need to save for retirement, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.