What Is Diversification?

Diversification is the practice of spreading money across different types of investments to reduce risk and maximize your investments.

You’ve likely heard the phrase, “Don’t put all your eggs in one basket.” This illustrates the concept of diversifying your portfolio: offsetting the risk of negative performance from one investment with positive performance from other investments.

Keep reading this blog or skip to our diversification video below from AllGen Academy.

How Do I Diversify My Portfolio?

Diversification is achieved through asset allocation; balancing risk versus reward by investing in different asset classes according to your:

- Individual goals

- Risk tolerance

- Time horizon

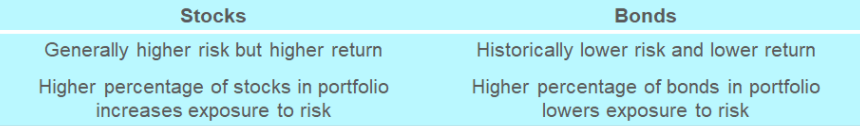

- The key to diversification is to invest in non-correlated assets that don’t behave in tandem with each other. Stocks and bonds are usually non-correlated: often when the price of stocks go down, bond prices go up and vice versa.

When you mix stocks and bonds and rebalance over time, you can produce a decent return from your portfolio while taking on less risk.

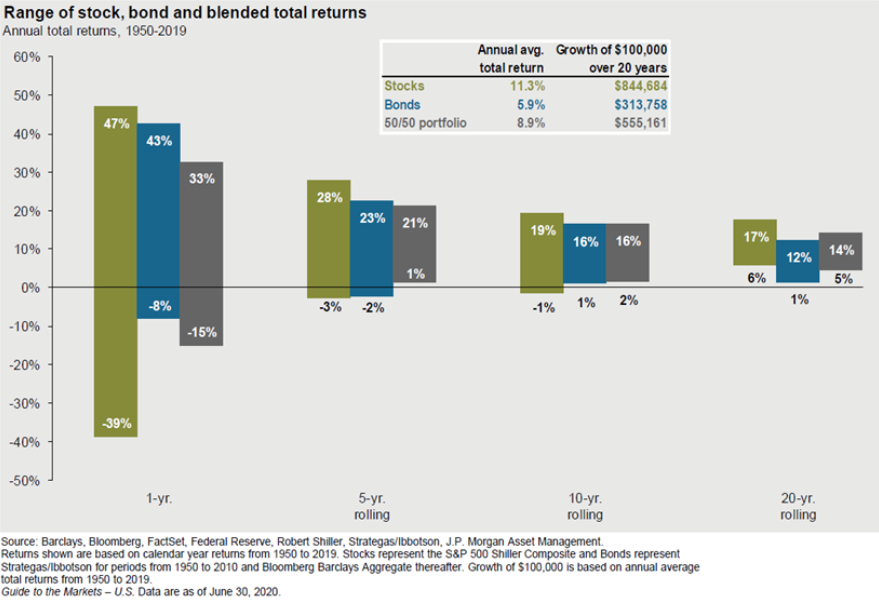

Blended 50/50 Stocks and Bonds Portfolio Example

To illustrate, the following chart features a blended 50/50 portfolio (half invested in stocks and half in bonds). This portfolio yielded decent returns over the long term with reduced risk. There were no losing returns over all 5-year rolling periods while averaging 8.9% annually over the almost 70 year time frame, just slightly lower than an all-stock portfolio that carried significantly more volatility and risk.

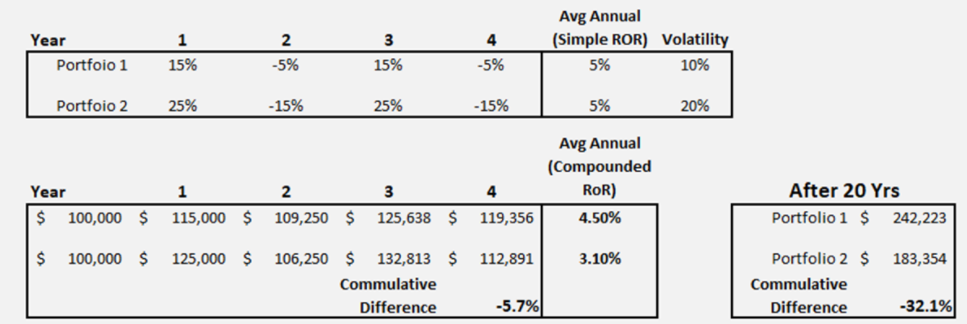

Why Is Volatility a Problem in My Portfolio?

Volatility is the range of percentage changes in price in a given year. More volatility creates more risk in your portfolio.

In the chart below, Portfolio 2 is twice as volatile as Portfolio 1 (20% versus 10%). That volatility causes it to underperform Portfolio 1 by -5.7% after 4 years and a whopping -32.1% after 20 years. Volatility can make a big impact in your earnings over time.

Diversified Portfolios Reduce Risk

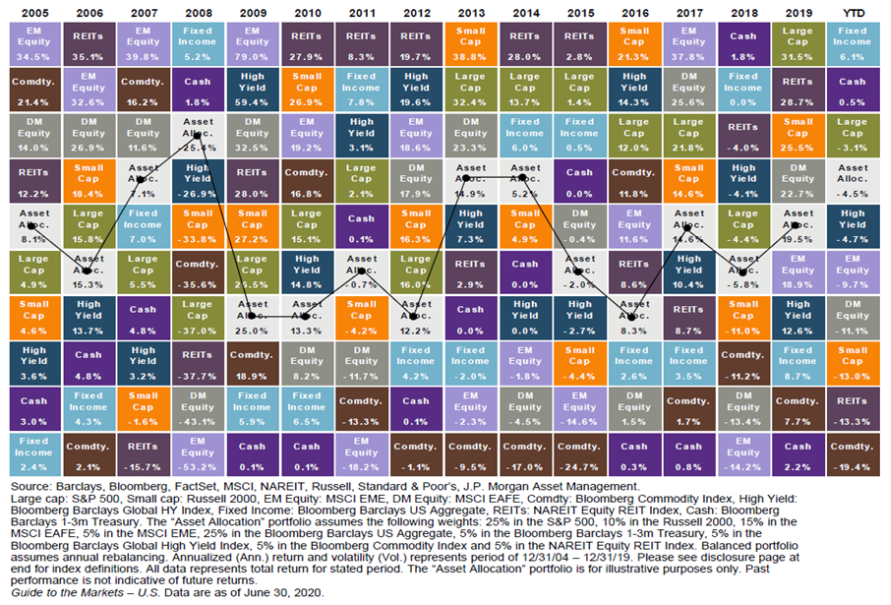

To further diversify your portfolio, it’s important to not only hold stocks and bonds of one type, sector, or region. There’s no telling which asset classes will outperform others in a given year so it’s prudent to spread your money across multiple asset classes.

This chart shows the variation in performance across different asset classes over a 15 year time period. Some years an asset class may be up, in other years it was down. The light grey box represents a diversified portfolio. It never significantly outperformed, but didn’t extremely underperform either.

Diversification helps tame extreme volatility and makes investing less risky and more tolerable for many investors while still producing decent returns over the long run.

For more information on diversification, watch our video from AllGen Academy below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.