Read through the blog here, or skip to our Q4 2025 Market Update Video below

Key Takeaways

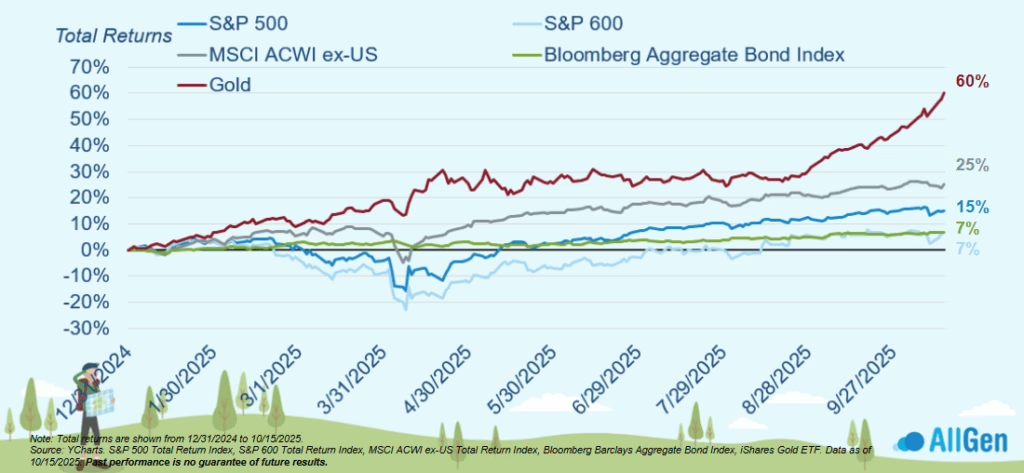

- Markets broadly strengthened in 2025 despite high valuations and global uncertainty. Equities, bonds, and commodities all posted strong gains through mid-October.

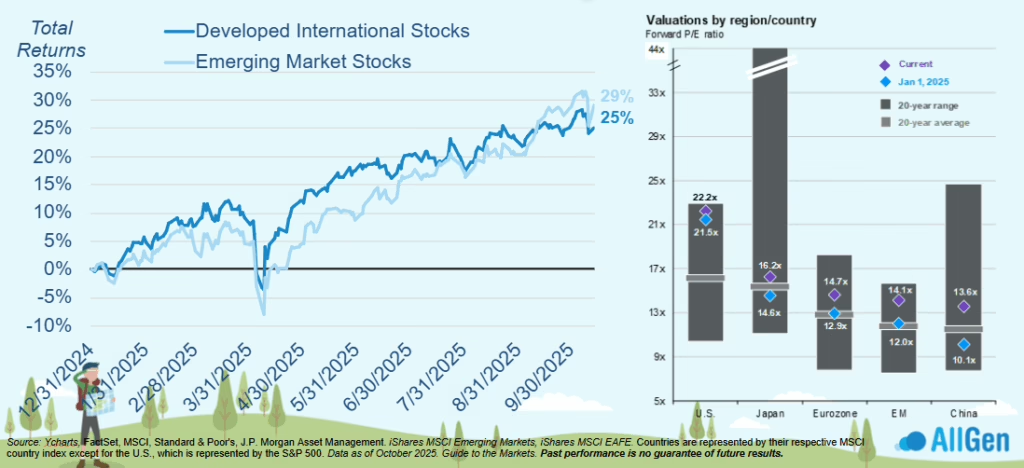

- International and alternative assets are taking leadership beyond the S&P 500. Emerging and developed international markets have benefited from relative valuation discounts and a weaker U.S. dollar. Gold has broken out into a new potential secular uptrend, up 60% for the year, supported by global policy uncertainty and central bank demand.

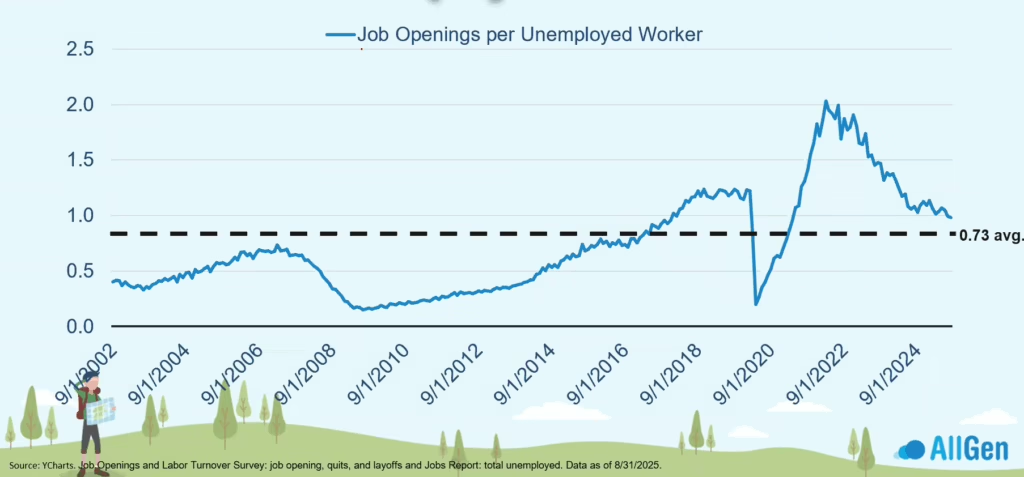

- The economy shows continued resilience with stable consumption. Consumer spending remains solid and job openings continue to exceed long-term averages.

1. Returns for 2025

So far this year, most investments have done well. Gold has been the big winner, up about 60%. International stocks gained around 25%, while the S&P 500 went up 15%. Bonds and smaller company stocks also did well with about 7% gains, though not as impressive, reflecting a strong but uneven global growth.

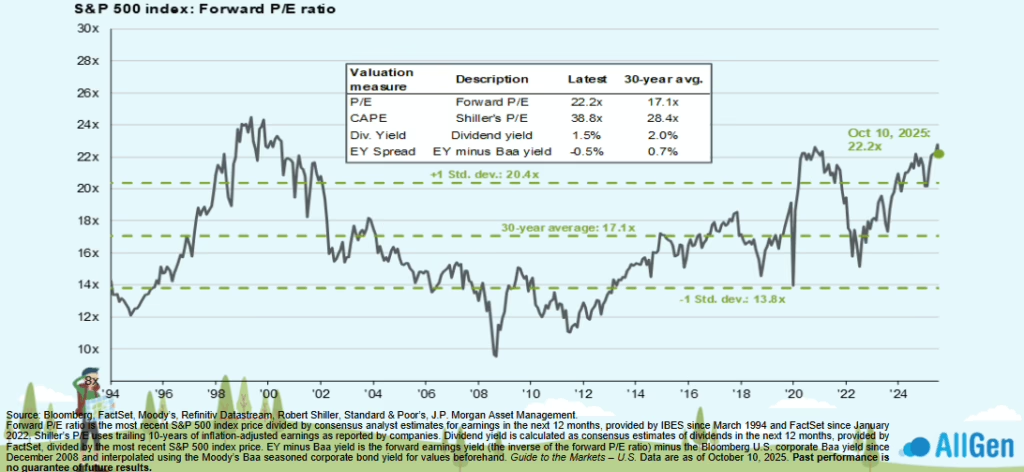

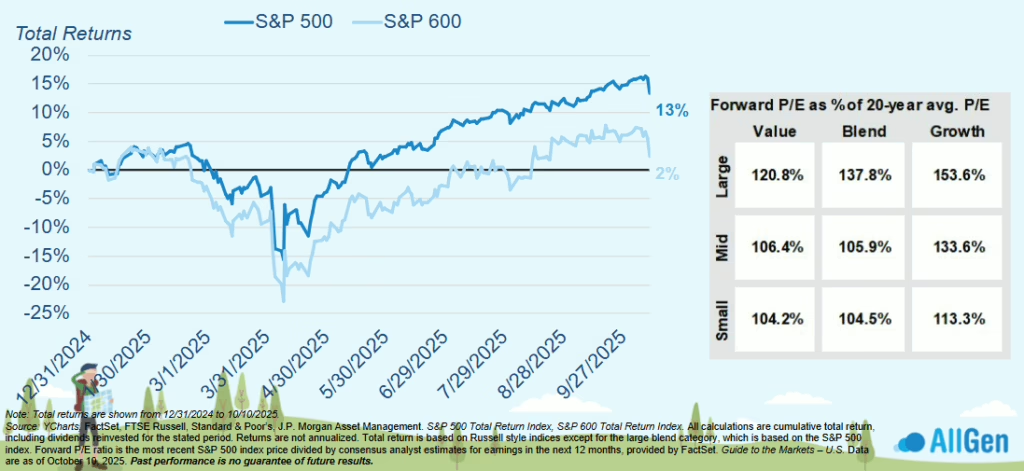

2. Stock Valuations Are Stretched

Equity prices are high compared to what we’ve seen in the past, as measured by forward P/E ratios and Shiller’s cyclically adjusted metrics. They’re about as expensive as they were before stocks dropped in 2021, but still cheaper than during the dot-com bubble in the late 1990s. Yes, the market looks pricey, but history shows that trying to predict when prices will fall just because things seem expensive usually doesn’t work well.

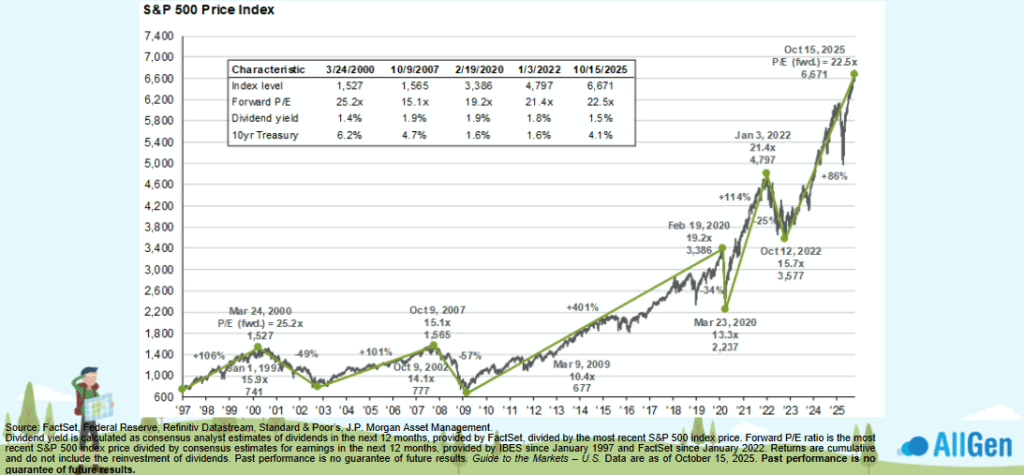

3. The Market Is Up 86% From the October 2022 Low

The stock market has gone up about 86% since late 2022. That’s actually less than we’ve seen in previous big market runs. Looking at history, some bull markets have seen gains anywhere from 100% to 400%. Sure, there are always short-term risks to watch out for that we will cover, but the long-term upward trend is still holding strong.

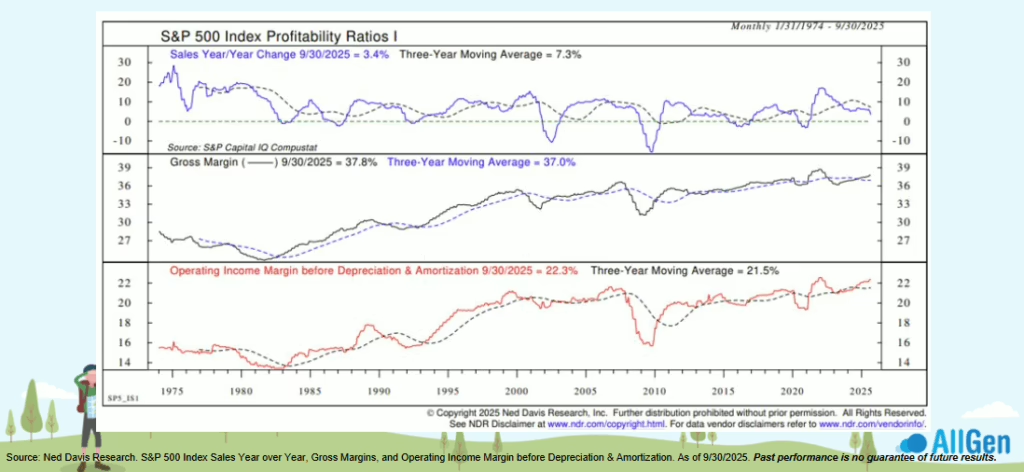

4. The Stock Market Cares More About Profit Margins Than Sales

Corporate profit margins remain above 3-year moving averages despite economic headwinds, indicating efficiency and productivity gains. Advances in automation and AI adoption generally translates to less of a need for hiring and have likely contributed to maintaining profitability even as input costs rise.

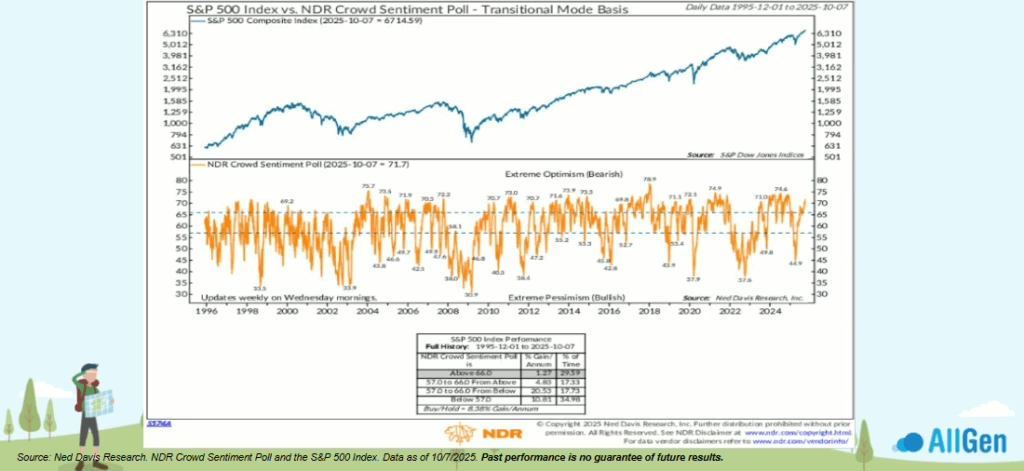

5. Sentiment Is Bearish for Stocks

Investor sentiment indicators are showing relatively high optimism, a condition that has historically preceded periods of lower returns. Elevated optimism typically reflects reduced cash reserves and limited new buying power. This sentiment backdrop warrants some caution, even as long-term trends remain favorable.

6. Small Cap Has Underperformed Year-to-Date but Have the Most Attractive Valuations

Large-cap stocks have continued to outperform smaller companies, but valuation spreads have widened. Small- and mid-cap equities now trade near long-term averages, making them relatively inexpensive compared to large-cap growth sectors. This valuation gap may create opportunities for future mean reversion in performance.

7. Emerging Market Stocks Had a Better Quarter Than International Developed Markets

Emerging markets jumped ahead of developed international stock performance in Q3, advancing approximately 29% year-to-date vs. 25% for developed international stocks, which is still nothing to sneeze at though, since it has exceeded U.S. returns. Why are international stocks doing so well? A falling dollar, an exodus of capital from the U.S. due to high policy uncertainty and deficits, and lower starting valuations have all provided support for the performance of international stocks to overtake domestic stocks year to date.

8. The Dollar Has Broken Down Over the Short Term but Longer Term the Dollar Is Still Holding On

The U.S. dollar declined sharply in 2025 but remains within a broader long-term uptrend that began after the financial crisis. Current technical levels suggest short-term weakness within an intact multi-year trend. A sustained dollar decline would typically favor international investments and commodities.

9. Historical Trends in Gold

Gold prices surged more than 60% in 2025, continuing a pattern of cyclical strength during periods of global uncertainty. Historical uptrends in gold have lasted 10–20 years and delivered significant compounded gains. While a short-term pullback would be normal, the longer-term outlook remains constructive given macroeconomic tailwinds.

10. Gold Broke Out Relative to the S&P 500, Potentially Forming a New Secular Trend

Gold has recently outperformed the S&P 500, signaling a potential new secular phase in which gold outperforms stocks. Historical precedents show that gold’s outperformance often coincides with inflationary or policy-driven market stress. This relative strength supports maintaining exposure to gold as a portfolio diversifier.

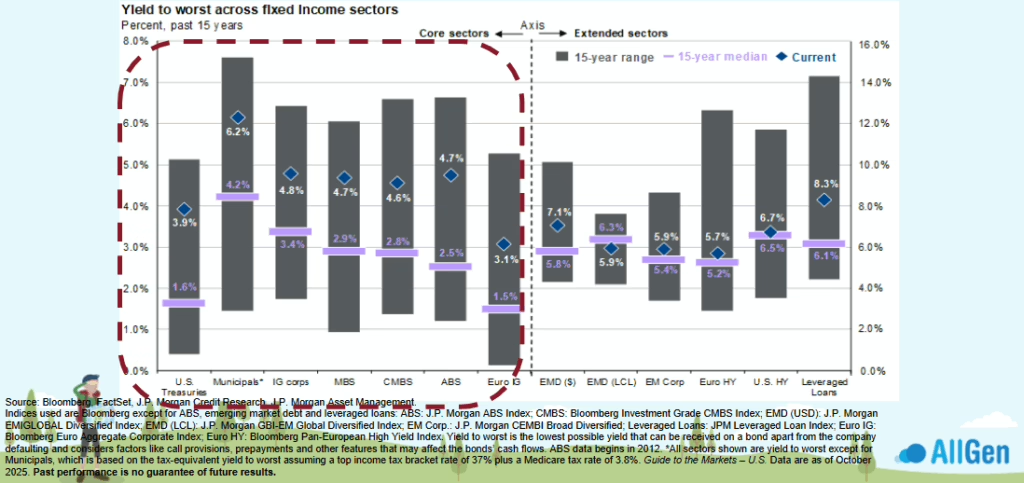

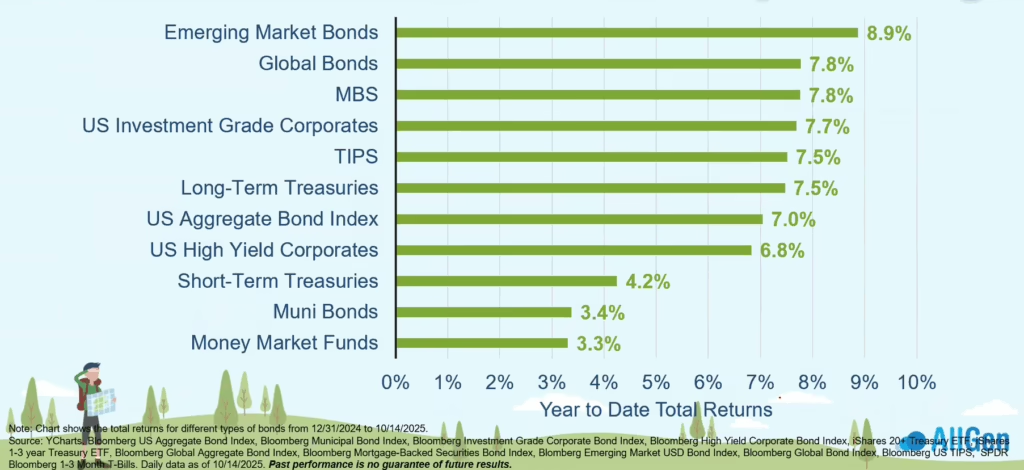

11. Bonds Still Look Attractive

Bond yields remain above historical averages across nearly all sectors, offering strong income opportunities. U.S. Treasuries, municipals, and agency mortgage-backed securities stand out as both stable and having attractive yields. These assets provide valuable diversification and downside protection during periods of equity volatility.

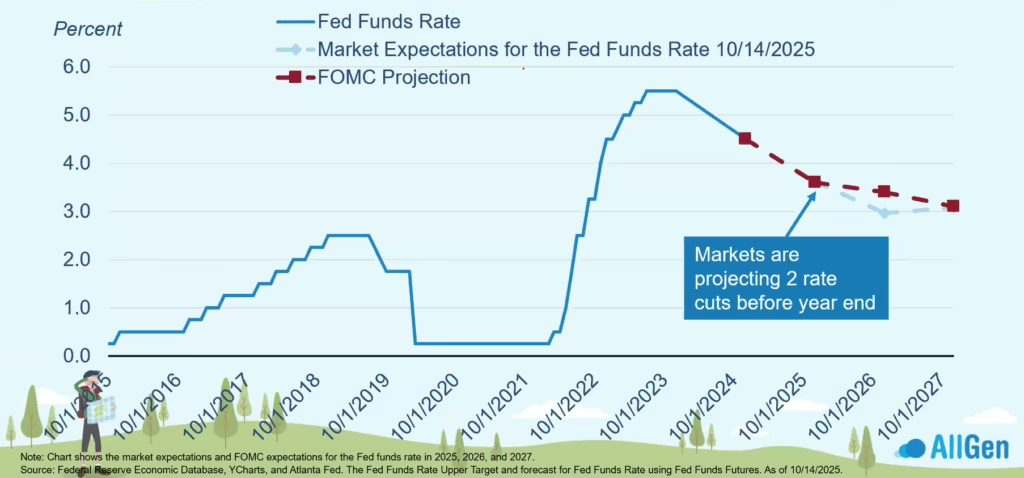

12. Markets Are Pricing in More Rate Cuts in 2026 Than the Fed Is

Markets are anticipating two additional rate cuts before year-end and further easing in 2026, meaning more rate cuts in 2026 than the Federal Reserve is currently forecasting. The divergence between market and Federal Reserve forecasts reflects ongoing uncertainty around the labor market and inflation – the Fed’s dual mandate from Congress.

13. It’s Been a Great Year for Fixed Income Returns With Riskier Areas of the Market Outperforming

Total returns across bond categories have been broadly positive, with riskier areas of the market like emerging market bonds, and global bonds leading gains. The combination of higher yields and capital appreciation has produced mid- to high-single-digit returns year-to-date. Bonds continue to serve as an effective stabilizer in diversified portfolios.

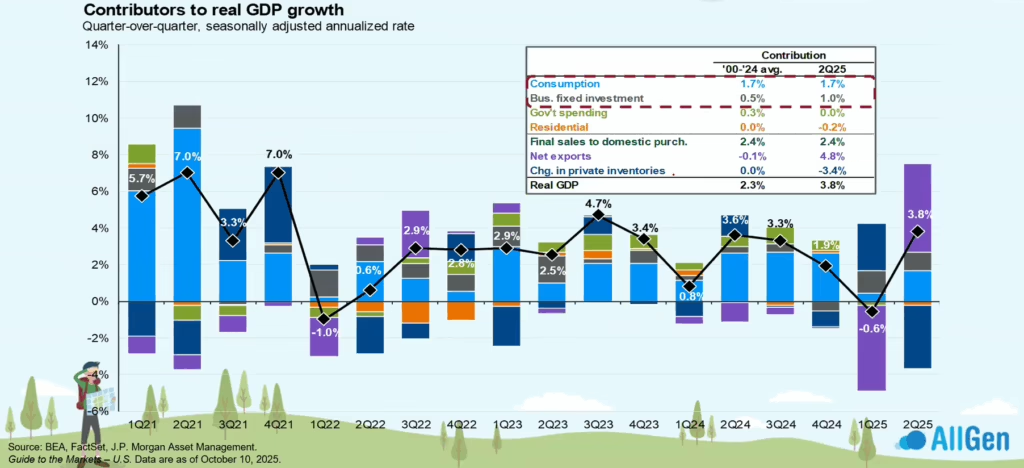

14. Consumption Drives 68% of the U.S. Economy

Consumer spending accounts for roughly two-thirds of U.S. GDP and remains stable at long-term averages. Meanwhile, businesses are investing more in things like factories and equipment, thanks to more manufacturing happening here at home and increased infrastructure projects. Together, these trends indicate ongoing economic resilience.

15. Job Openings Have Declined to Roughly 1 Opening Per Unemployed Worker

The job market has cooled off a bit, but there are still more job openings per unemployed person than the typical long-term average of 0.73. This cooldown means wages aren’t rising as quickly and many employees are choosing to stay put vs. switching jobs. Overall, the job market is still healthy enough to keep people spending money and the economy stable.

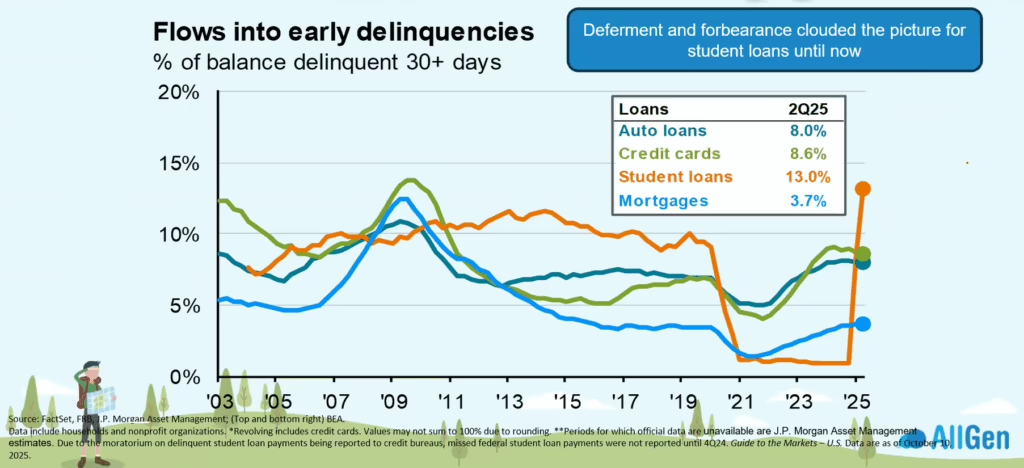

16. Flows Into Early Delinquencies Is Stabilized for Credit Cards, Autos, and Mortgages

Household debt delinquencies have risen modestly since 2022 but appear to be stabilizing. Credit card and auto loan delinquencies have begun to decline slightly, while mortgage delinquencies remain low. The resumption of student loan payments has increased defaults in that category, but overall consumer credit health remains manageable.

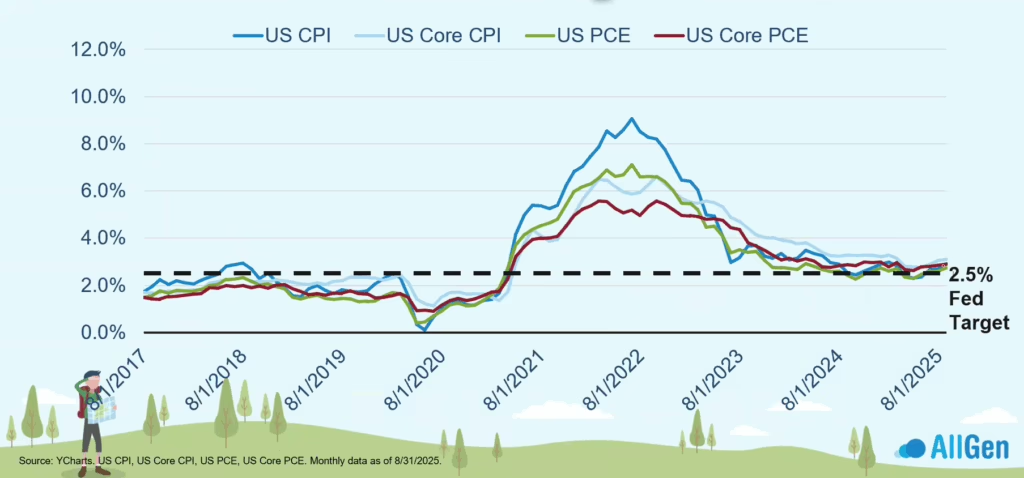

17. Inflation Is Remaining Sticky Above the 2% Fed Reserve Target

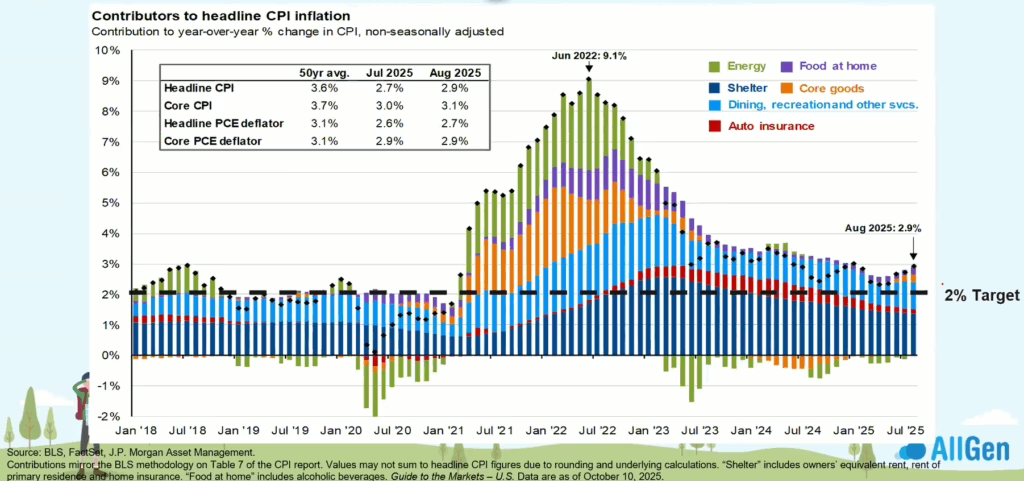

Inflation has stabilized near 2.5%–3%, modestly above the Federal Reserve’s long-term target. Core inflation, particularly in services, continues to exert upward pressure on prices. While the trajectory has flattened, the persistence of elevated inflation suggests that prices may remain above pre-pandemic norms for some time.

18. Services Inflation Is Growing, Pushing Inflation Higher

We are watching a few areas when it comes to the underlying drivers of inflation: services (dining, recreation, travel, and other areas), core goods, and shelter. Starting with the last point, shelter inflation has come down, but not as much as we would like to see – this is predominantly reflecting home prices and rent prices. Core goods are likely bumping up slightly due to tariffs, but the bump up is so small that it isn’t materially impacting inflation. Finally, the best for last, services inflation. Services inflation has increased more than we expected recently. It reflects the ongoing willingness for consumers to pay for travel, leisure/recreation, and dining out.

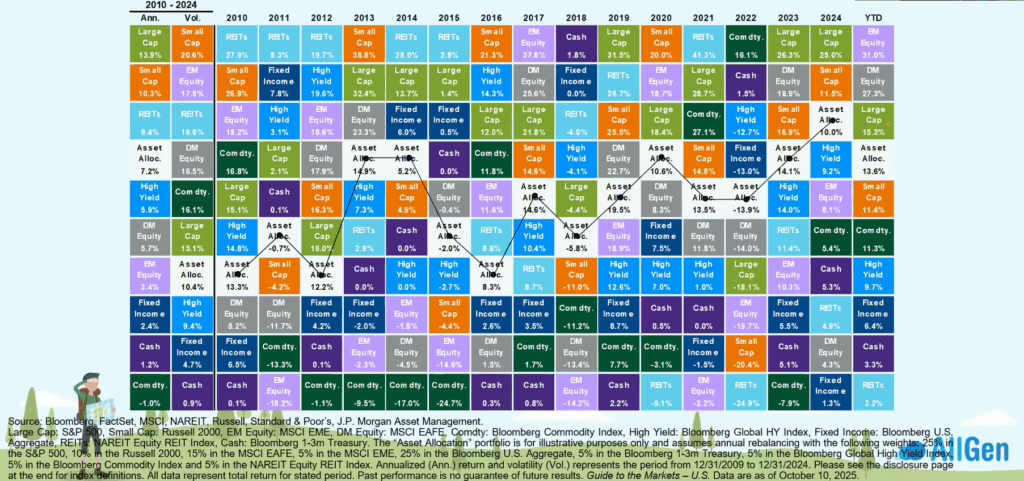

19. Diversification Is Key to a Portfolio That Can Withstand the Test of Time

Long-term asset rotation data demonstrate that leadership among asset classes shifts frequently. While U.S. large-cap stocks have dominated much of the past decade, 2025 saw international and emerging markets outperform. Maintaining a diversified portfolio across geographies and asset classes remains essential for managing risk and capturing opportunities.

Summary

The S&P 500 is no longer the only game in town. Gold has led performance, supported by policy uncertainty and a weaker dollar. International equities are outperforming the S&P 500 as investors look outside the U.S. for investment opportunities. Bond yields remain attractive and prices are supported by the Federal Reserve cutting rates. Yet, we cannot underscore the importance of diversification enough – policy uncertainty is elevated and the S&P 500 is vulnerable to negative news, albeit compressed margins, tariffs, or something else entirely.

Contact Your Financial Advisor

A well-diversified, disciplined strategy that manages risk first is what we strive to build for our clients. Contact your advisor to learn more about how AllGen can help manage risk in your portfolio!

For more information, watch the full October 2025 Market Update video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.