Key Takeaways:

- Your 401(k) or other company retirement plan should be invested based on your unique circumstances like your time horizon and risk profile – not what your friends or co-workers are invested in.

- Consider investing in a target date fund because it is like having professional investment management for your 401(k) with low fees.

- If you prefer to go the do-it-yourself route, then use a diversified proportion of stocks to bonds that is appropriate for your time horizon and the level of risk you are willing/able to take.

401(k)s, 403(b)s, and other company retirement plans are where many people start to amass wealth. As such, one of the first questions we are asked by a new client is, “How should I invest my company retirement plan?” The answer: invest in an allocation that is appropriate for you and your unique circumstances, not necessarily what your co-workers or friends invest in. This could mean using a target date fund based on your year of retirement or allocating between stocks and bonds based on your investment time horizon and risk appetite. Before we unpack these two strategies any further, we want to quickly cover the do’s and don’ts of company retirement plan investing.

The Do’s and Don’ts of 401(k) Investing

At different points in life, we have all probably committed some of the don’ts (but hopefully also some of the do’s!) when it comes to 401(k) investing.

The following are the do’s for your 401(k):

- Do consider investing in a target date fund – it can help simplify the investment management of your company retirement plan.

- Do invest according to your time horizon and risk tolerance – this can take the form of a target date fund or a certain ratio of stocks to bonds, but more on that later.

- Do diversify properly – if you go the do-it-yourself route instead of a target date fund, then make sure you hold funds that provide proper diversification – we will explain what proper diversification means below.

The following are the don’ts for your 401(k):

- Don’t try to time the market – time in the market is better than timing the market. Remember, timing the market involves two decisions that you must time correctly: selling out of the market and buying back into the market.

- Don’t stay in cash or cash-like investments – your 401(k) is a retirement plan that should be invested in things like stocks and bonds with an objective for growth, especially if you have a long time horizon. You need your account to grow beyond just your contributions to help fund your retirement. Otherwise, you might get to retirement and find you don’t have enough. Likewise, holding nothing but cash or cash alternatives in a retirement account can reduce, or even eliminate, any potential tax advantages.

- Don’t just invest in what your friends or co-workers are investing in – investments should be customized to your specific circumstances, like your time horizon and risk appetite.

The First Strategy: Target Date Funds

The first strategy to consider for investing the money in your 401(k) is to invest in a target date mutual fund. Target date funds are run by investment professionals that allocate your dollars among different asset classes, such as stocks and bonds, and usually adjust the weightings as you near retirement. In other words, target date funds are like having an investment manager who manages your 401(k) and de-risks your portfolio as retirement nears.

What Does the Target Date in a Target Date Fund Mean?

A target date fund labeled “2020” would normally be used for someone planning to retire near the year 2020 and should be invested conservatively with a higher weighting of bonds. On the flip side, a target date fund labeled “2040” would normally be used for someone planning to retire in the year 2040 and should be invested aggressively with a higher weighting of stocks.

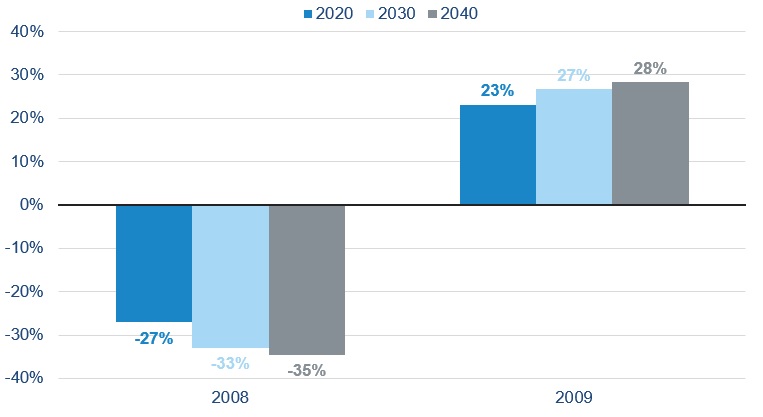

Below we chart returns for a variety of target date funds during one of the largest pullbacks in stock market history: 2008, and the subsequent rebound in 2009. The funds used have target retirement dates of 2020, 2030, and 2040. Notice that the volatility of the 2020 fund is lower than the 2040 fund – depending on the target date, the fund changes the weightings between stocks and bonds. Funds holding more stocks, like the 2040 fund, generally see higher returns and larger drawdowns than funds holding more bonds, like the 2020 fund.

The returns and drawdowns are larger the farther out your retirement date is

Source: YCharts. Vanguard Target Retirement Funds: 2020, 2030, and 2040. Annual total return for 2008 and 2009. Past performance does not guarantee future performance.

Target date funds have come a long way since they first came out in 1994. They used to have much higher fees but now are offered at a relatively low cost due to the rise of passive index funds. Target date funds, albeit nothing fancy, are worth considering.

The Second Strategy: The Do-It-Yourself Route for 401(k) Investments

The second strategy to consider for investing the money in your 401(k) is the do-it-yourself route: to invest in the percentage of stocks and bonds that is appropriate for your circumstances (keep in mind that this ratio will likely change over time). To determine the correct ratio of stocks to bonds, we typically start where a target date fund starts – your expected retirement date. Your expected retirement date can be used to determine your time horizon. For instance, someone that is currently 45 years old and is planning to retire at age 60 would have a 15-year time horizon until retirement. Yet, managing your company’s retirement account isn’t just until you retire, you need to determine the allocation of stocks to bonds that is appropriate for while you are in retirement – keep that in mind while investing your 401(k) dollars.

Factoring Your Risk Profile Into Your 401(k) Investment Strategy

Your ability and willingness to take risk need to be factored into your 401k investment strategy and it will likely change as you near or are in retirement. Your ability to take risk is dictated by your financial circumstances. For instance, a longer time horizon and higher wealth would be circumstances of your financial life that usually translates to a higher ability to take risk (and vice versa). As for willingness – well, that’s generally psychological and behavioral. Consider whether you tend to, or want to, sell out of the market when it is down due to fear. Someone who sells when the market is down has a lower willingness to take risk.

401(k) Portfolio Allocations by Risk Profile

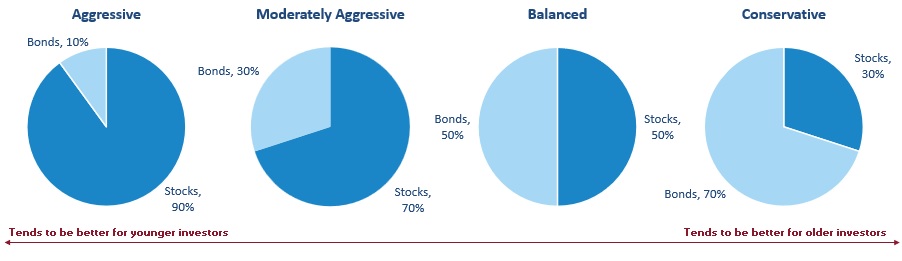

Below we break down typical portfolio allocations for a 401(k) and the corresponding risk profile (dictated by investment time horizon and willingness/ability to take risk as discussed above). Reading from left to right, the chart shows:

- An aggressive allocation: 90% stocks, 10% bonds

- A moderately aggressive allocation: 70% stocks, 30% bonds

- A balanced allocation: 50% stocks, 50% bonds

- A conservative allocation: 30% stocks, 70% bonds

Generally speaking, more aggressive portfolio allocations tend to be more appropriate for younger investors with longer time horizons as they have time to make up for larger losses that may occur in a given year. More conservative allocations tend to be more appropriate for older investors as they have less time to make up for larger losses and may have to lock in the large losses to raise cash for distributions in retirement.

The allocation between stocks and bonds should correspond to your risk profile

Source: Different allocations of stocks and bonds and their corresponding risk profile. For illustrative purposes only.

The Composition of Stocks and Bonds in Your 401(k) Matters

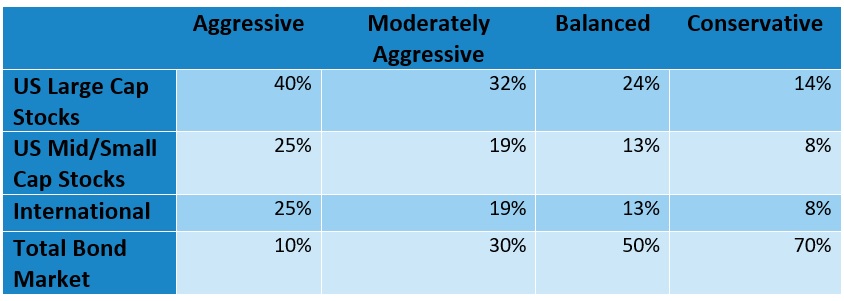

The makeup of what you hold for your stock and bond exposure also matters. You don’t want to hold a stock fund that is only one sector, like a technology fund, in your 401(k). Holding only one sector in your 401(k) is akin to making a sector bet and forgoing diversification between different industries. It might work for you over one or two years, but it is not a diversified portfolio that can withstand a myriad of economic environments. Consider investing in a broad-based large-cap stock index, mid-/small-cap stock index, and international stock index. As for bonds, we typically like total bond market index funds, which are funds that invest in bonds with an average maturity anywhere from 5 – 10 years and hold “core” bonds such as Treasuries, mortgage-backed securities, and investment-grade corporate bonds. It is generally best to stay away from allocating a large portion of your fixed income (or bond) holdings towards a niche bond fund such as a high-yield or ultra-short bond fund.

Diversification and 401(k) Investing

The goal here is to create an allocation that is properly diversified – meaning one investment goes up when the other investment goes down. This creates a smoother ride for you as your investments grow and gives you more rebalancing opportunities to sell investments that are up and buy investments that are down. Below are some example allocations (for illustrative purposes only) based on risk profiles to show how you can diversify a portfolio across market caps, geographical regions, and asset classes.

Example weightings for diversified portfolios depending on risk profile

Source: Different allocation percentages across asset/sub-asset classes for general risk profile. For illustrative purposes only.

Choosing 401(k) Funds

After determining an allocation you wish to have, now it’s time to choose your funds. We would encourage you to choose index funds over actively managed funds when possible. For example, when choosing a US large-cap fund, you may consider a fund that tracks the S&P 500 or a fund that says, “US Large Cap index.” A similar technique should be used for the other areas of the market such as for mid/small cap stocks (S&P 400 or 600), international stocks (MSCI ACWI ex US), and bonds (Bloomberg Barclays Aggregate Bond Index). If there aren’t index options, then you’ll want to research the funds that have the best long-term returns. Be careful not to be too enticed by the fund’s performance over the last 1-year, because short-term outperformance could possibly lead to a pullback in that area over the next year as it reverts to the mean.

Rebalancing Your 401(k)

Once you choose your funds you should rebalance and set your current 401k allocation to it, as well as your future contributions (if you are still contributing). This is usually a two-step process. You will also need to turn the automatic rebalancing feature on within your 401(k). An automatic rebalance can usually be applied quarterly, semi-annually, or annually (we generally prefer quarterly). Its purpose is to bring your portfolio back into alignment with your target percentages for each fund and help reduce risk over time. If you don’t rebalance, your portfolio could become overweight in the area that has performed the best, but this area is also most exposed to a big drop.

Target Date Funds Versus Do-It-Yourself 401(k) Allocations

As you can see the do-it-yourself approach can require a lot of work and skill – especially when paired with the need to monitor your allocation and potentially make tweaks. This is why a target date fund is usually an easier way to go. On top of that, there have been many studies, most notably the recent DALBAR Quantitative Analysis of Investor Behavior study, that have shown that do-it-yourself investors tend to underperform the market, as it is easy to be driven by emotions. This often translates to investors switching between funds or trying to time the market – frequently buying high and selling low (the opposite of what you are supposed to do). In a target date fund, the fund manager does all the work for you, while you get time back to continue doing what you enjoy and do best!

Speak to Your Financial Advisor

Consider investing in a target date fund that aligns with your retirement date. If you would prefer not to use a target date fund, then speak with your advisor about what ratio of stocks to bonds is best for your 401(k) given your unique circumstances. Generally speaking, do not try to time the market, do not invest in cash/cash-like investments, and do not invest in the latest hot trend a co-worker told you about by the water cooler. Avoid get-rich-quick schemes. Investing for retirement is a tortoise game, not a hare game – slow and steady wins the race!

Sign Up for Insights on Maximizing Your 401(k)

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.