Become an #AllGenInsider!

Stay updated with financial insights and unlock free access to our Building A Foundation ecourse. The time-tested principles in this course have helped many become financially free.

Find Your Path to Financial Freedom

Foundation

Figure out where you are, to see where you can go. We’ll work together to make sense of your financial statements and develop a risk management strategy. Then, we’ll develop a plan to get rid of consumer debt for life, so you can truly build wealth.

Formation

Plan, plan, plan.

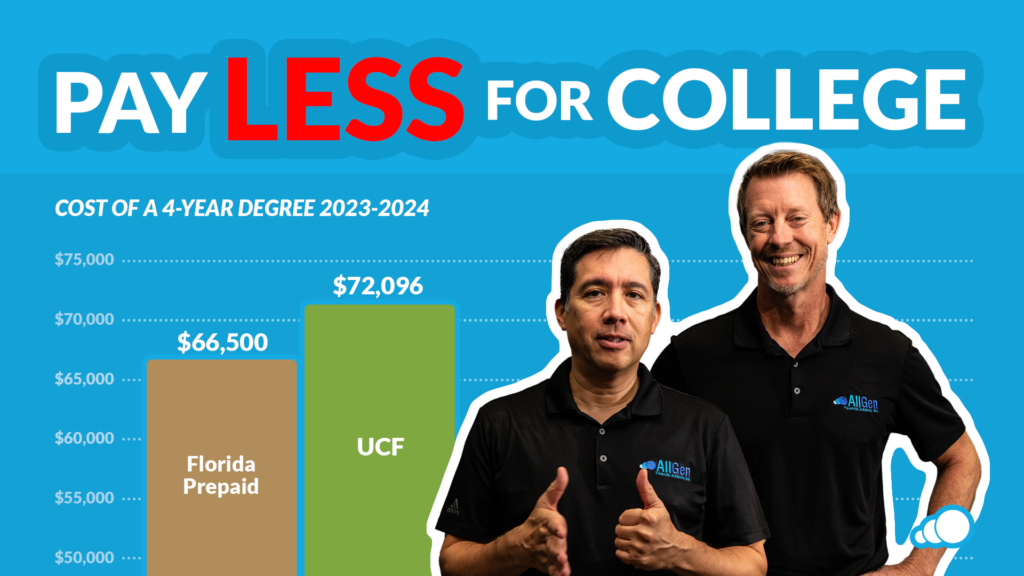

We maximize your investments to get you on track for retirement and college tuition for your kids. We’ll even look at your mortgage and see if it makes sense to pay it off sooner than later.

Meet the Team

Liz Castro

Client Service Associate

Robert Cortes

Financial Advisor

Ana Fernandez, CFP®

Financial Advisor

Kristyn Fultz

Client Support Specialist

Kathryn Hite, CFP®

Financial Advisor

Jason Martin, CFP®, CMT

CIO & Co-Founder

Paul Mazon

Financial Advisor

Axel Otero

Financial Advisor

Jamie Parlak

Client Service Associate

Paola Rojas

Director of Operations

Paul Roldán, CFP®

CEO & Co-Founder

Charles Seaman, FPQP®️

Client Service Associate

Christina Shaffer, CFA®

Director of Fixed Income

Ryan Staton, CFP®

Director of Trading

Manuel Turushina, FPQP®

Client Service Associate

Karen Vergara

Financial Advisor

Looking to join the team? Great news, we are hiring!