Read through this post on mutual funds and ETFs or skip to the AllGen Academy mutual funds video below.

Mutual Funds and Exchange Traded Funds

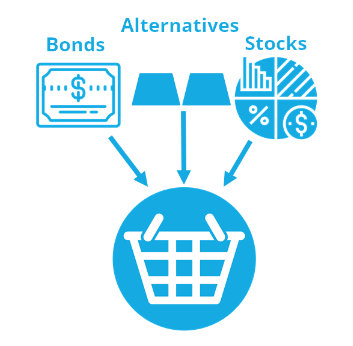

Funds were created to help the average investor own stocks, bonds, and other investments without having to pick individual investments.

Funds are essentially a basket of investments that are mutually funded by a pool of investors. An investor in a mutual fund owns a portion of all the companies or holdings in that fund.

A mutual fund manager chooses the investments and quantities to hold in the fund. Mutual funds can specialize in just one asset class or combine multiple types and classes in a single fund.

By investing in mutual funds, investors can own nearly all asset classes without having to purchase those assets directly. Funds enable average investors to spread risk across many different investments and further diversify their portfolios depending on the composition of the funds they invest in.

Types of Funds

- Mutual Fund – trades once a day at close (4 pm EST); does not trade during the day

- Exchange Traded Fund (ETF) – trades throughout the day during market hours like a stock

There are usually management fees charged by funds to cover operating costs and other expenses. ETFs tend to have less activity with investments being bought and sold within the fund so they often charge lower fees than mutual funds. However, higher fees may not necessarily be a bad thing if the investment outperforms a lower-fee option. We’ll cover active versus passive investments in greater detail later on.

Conclusion

Mutual funds and ETFs are another asset class that can help to make up a well-diversified portfolio and also can help the average investor to diversify and therefore spread risk over many different investments instead of putting all of their investment eggs in one basket. Contact us with any questions on investment management.

For more information on mutual funds & ETFs, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.