70% of all homeowners have a mortgage. Which means 30% do not.1 If you aspire to be in the latter camp, below are some ideas to accelerate that outcome. At Allgen, we would love for you to have your home paid in full by the time you retire and even sooner, if possible. Yet we understand that many factors in life pull at the purse strings, such as having an emergency fund, paying off student loans, and saving for retirement. So how do we eliminate the mortgage, and does it make sense to do so?

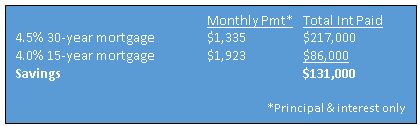

The idea of paying off my home in 15 years is great, but doesn’t it make my payment higher?

Looks like 15-year is the smartest option. Why not do that?

Financially you can save a lot by choosing the 15-year, however there are other considerations. Location drives housing prices. Depending on where you live, pricing may require a 30-year mortgage just to get into a reasonable home. $260,000 goes much farther in Florida than it does in New York. Maybe a dual-income household can afford the 15-year payment now, but might switch to a single-income household in the future (becoming a caretaker, starting a business, etc.).

How to eliminate the 30-year mortgage on a 15-year schedule?

If you already purchased a home with a 30-year mortgage and don’t want to refinance, then you can accelerate your pay off date another way. Determine what the payment would be on a 15-year schedule and send that rather than the 30-year payment. Here is a calculator to help you find your number: https://www.dinkytown.net/java/mortgage-calculator.html. Sending in extra monthly or lump sum payments helps. A $30,000 lump sum payment within the first 5 years of a 30-year $260,000 loan, results in a ~$60,000 reduction in interest paid over the life of the loan! Just making 1-2 extra payments per year can shave 1-7 years, depending on interest, loan amount, etc. Any extra reduces the years and interest paid.

How much should I use for down payment?

Ideally put down enough to avoid Primary Mortgage Insurance (PMI). PMI is an insurance cost that the lender charges so that they are covered in case you default on the loan. The cost is about .5 to 1% of the loan (on the higher end for 30-yr loans). On a $260,000 loan, PMI would be ~$108 for a 15-year and ~$216/mo for a 30-year. PMI is not deductible. Yet another reason to opt for the 15-year mortgage.

How to avoid PMI? Put down at least 20%. (20% of $260,000 = $52,000). While it is ideal to put down at least 20%, it is not the end of the world if that doesn’t happen. Once your loan to value proportion reaches 80% (meaning you have 20% equity in your home), PMI can typically be removed. Contact your lender to see what you need to do to have it removed as each lender has different parameters for determining this.

Down payment also affects your loan balance. The more you put down, the lower your loan. How much of a loan can you afford? A good rule of thumb: (principal + interest) < 28% of NET take home pay.

I’ve already been in my home many years. Should I pay it off?

Paying off your home or accelerating mortgage payments should only be considered after making sure that your financial future is secure. Once the below finances are in place, mortgage elimination may be your next goal.

• Emergency fund is fully funded

• Consumer debts eliminated (credit cards, student loans)

• Retirement savings – enough is being saved to meet needs

• College Savings – enough is being saved to meet needs

But I don’t want to miss out on deducting the interest?

1. Some argue that paying interest is good as you can save on taxes by deducting the interest. The problem with this argument is that while you might save some money in taxes, you end up paying more in interest. For example:

Interest paid $10,000

Potential Tax savings $3,500 (35% tax bracket)

Total Interest paid $6,500

In this example $10,000 in interest is paid to potentially save $3,500 in taxes. This is bad math for your wallet.

2. You must itemize in order to use the deduction. With the new tax law increasing the standard deduction (individuals to $12,000 and couples to $24,000), there will be far fewer people itemizing. The nonpartisan Tax Policy Center expects itemized filers to drop from 30% down to 10%3.

Summary

Your house and your mortgage are typically your biggest asset and liability. Making the right financial decisions with both of these can make a huge impact on one’s future! The decision of when to pay off a mortgage should be determined by personal circumstances. We understand there is not a one size fits all when strategizing about mortgage elimination and so we invite you to connect with us to help you decide which options may be best for your family.

1 https://www.joshuakennon.com/nearly-1-out-of-3-homeowners-have-no-mortgage/

2 Consumer Financial Protection Bureau, “ Average Loan Amount, 1-4 family dwelling, 2017.”

3 https://www.aarp.org/money/taxes/info-2018/new-standard-deduction-fd.html

Written by Teresa Talton, CFP® Professional with Allgen Financial Advisors, Inc.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.